Track your investments with Sharesight's Performance Report

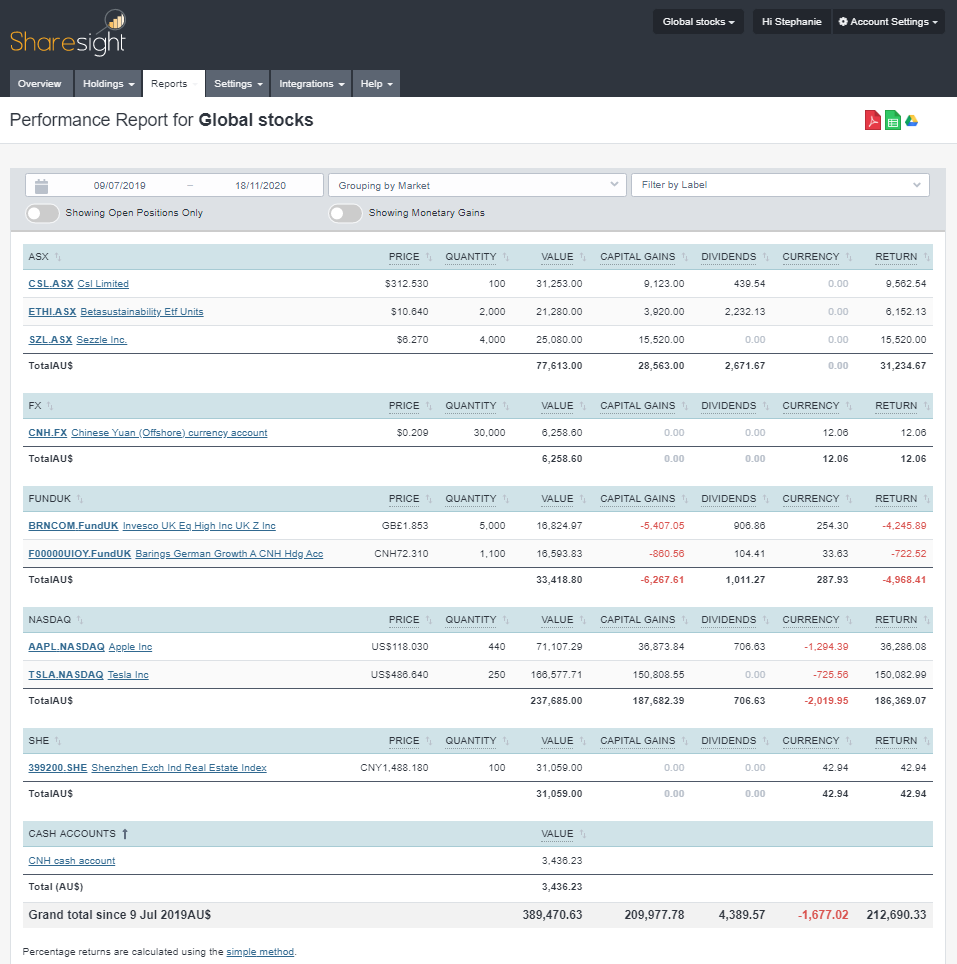

One of Sharesight’s most popular reports, the Performance Report measures a user’s investment performance over any chosen period. Unlike most brokers, Sharesight gives investors the true picture of their returns by taking into account key factors such as the impact of brokerage fees, dividends and capital gains, allowing Sharesight users to make more informed investing decisions.

The Performance Report includes a number of important features, such as custom date ranges, grouping by asset type and the ability to easily export and share the report with an accountant or financial advisor. To learn more about how to make the most out of the Performance Report, keep reading.

Sharesight’s Performance Report

One of the key advantages of Sharesight’s Performance Report is that investors can clearly compare the performance of different assets in their portfolio over the time period of their choice. This is particularly useful for investors with mixed-asset portfolios and global investments who will benefit from seeing the cumulative impact of capital gains, dividends and currency on their returns.

While most brokers simply state the difference between the buy and sell (or current) price, Sharesight considers the above factors to calculate returns on an annualised basis. This is done so that investors can see the complete picture of their investments and understand how an allocation of capital has performed over the time it has been invested.

The Performance Report is ideal for investors with mixed-asset portfolios and global investments.

Key features of the Performance Report

Sharesight’s Performance Report has a number of features allowing investors to customise how their investment performance data is displayed. Here are some of the key features:

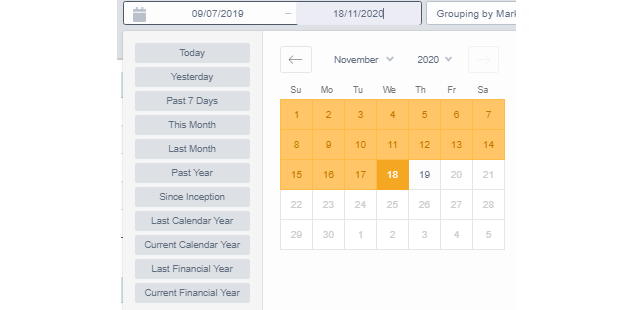

Custom date ranges

Located on the top left-hand corner of the report, users can select the date range of their choice to calculate their portfolio’s returns. For example, an investor may choose to run reports over the last calendar year and the current calendar year to compare their returns and see how they are tracking towards their performance goals. Or if they have sold a stock, they may want to use custom date ranges to compare the performance of their portfolio before and after the sale. There are endless ways to evaluate your performance using the report’s suggested periods or choosing your own custom date range.

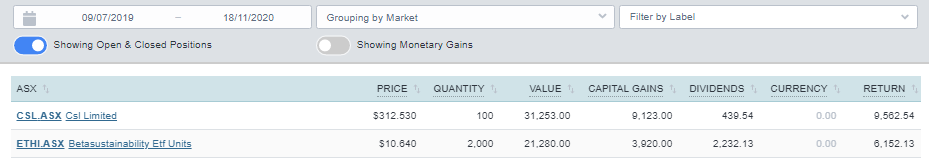

Toggle options

Users have the option to toggle between showing open and closed positions, or just open positions, as well as the option to view returns in monetary or percentage values.

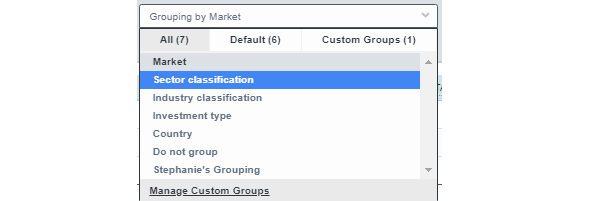

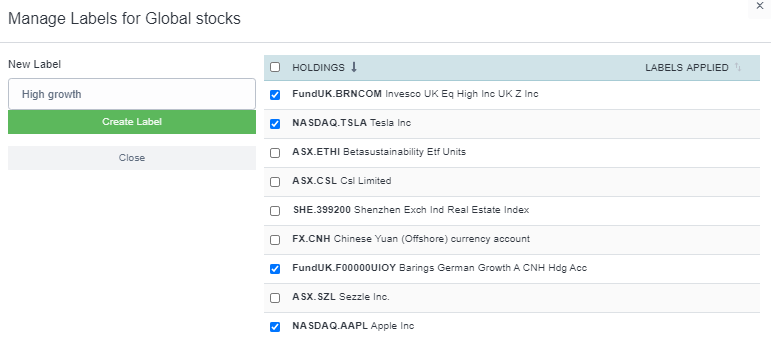

Groupings and filters

The Performance Report allows users to group their holdings based on classifications such as sector, industry, country or even Custom Groups, which is a powerful way to view performance by any grouping an investor specifies..

Users may also choose to filter their results by creating custom labels such as ‘high growth’ or ‘dividend stocks’ to break down the performance by their own custom dimensions in combination with or separate from their own Custom Groups.

File exporting

One of the most convenient features of the Performance Report is the ability to export it in a range of different file formats, such as a PDF, XLSX spreadsheet or Google Sheets file. This is userful if you want to view the report in another format or share it with your accountant/financial advisor.

Start tracking your investment performance with Sharesight

Thousands of investors like you are already using Sharesight to manage their investment portfolios. What are you waiting for? Sign up and:

-

Track all of your investments in one place, including stocks, mutual/managed funds, property and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed Funds

-

Run powerful reports built for investors, such as Performance, Portfolio Diversity, Contribution Analysis and Future Income

-

See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

Sharesight product updates – May 2024

This month's focus was on expanding our broker support and streamlining the customer onboarding journey, as well as additional reporting and holding functions.

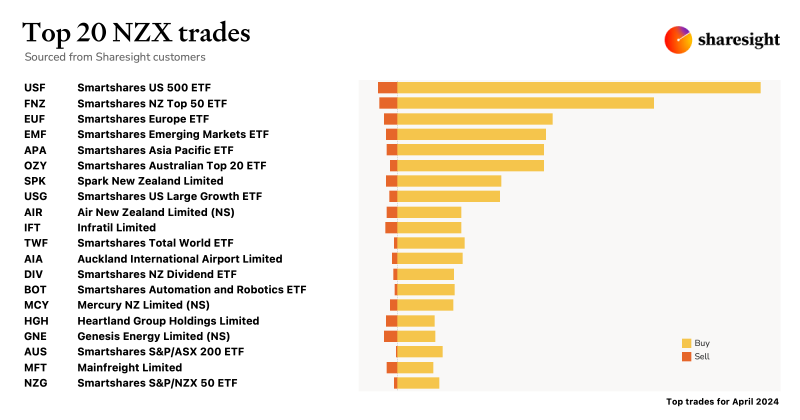

Top 20 NZX trades by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly NZX trading snapshot, where we look at the top 20 trades Sharesight users made on the NZX.

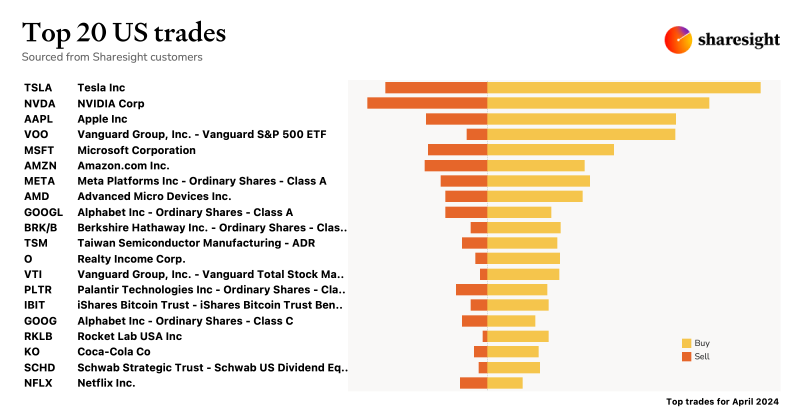

Top 20 trades in US stocks by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly USA trading snapshot, where we look at Sharesight users’ top 20 trades in US stocks.