Latest posts

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.

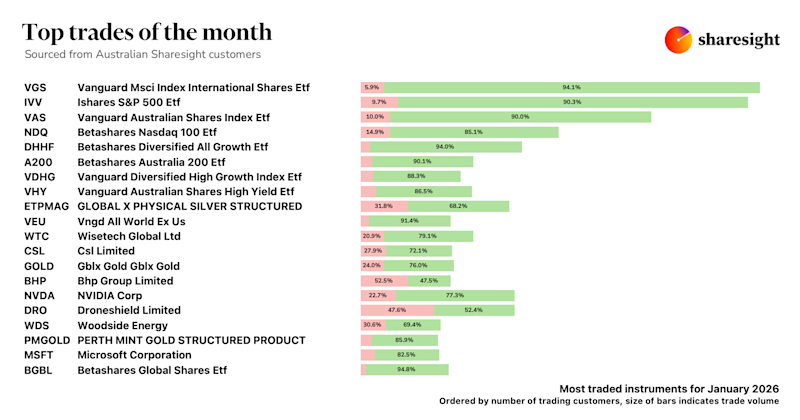

Top trades by Australian Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for Australian investors, where we look at the top 20 trades made by Australian Sharesight users.

Morningstar analyses Australian investors' top trades of 2025

Morningstar breaks down Australian investors’ top trades of 2025 and explores sector trends and global opportunities for 2026.

Turn market volatility into opportunity with Sharesight

Periods of market volatility can distract you from your long-term goals. Learn how Sharesight’s future-focused tools can help you plan ahead with confidence.

Sharesight product updates – January 2026

Our latest updates include Abu Dhabi exchange support, enhanced dividend insights, overview page refinements, mobile app improvements and more.

2026 market outlook: Expert insights on risks, rates and opportunities

We talk to industry experts about their expectations for markets in 2026 — from inflation and interest rates to market opportunities, the AI bubble and more.

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.

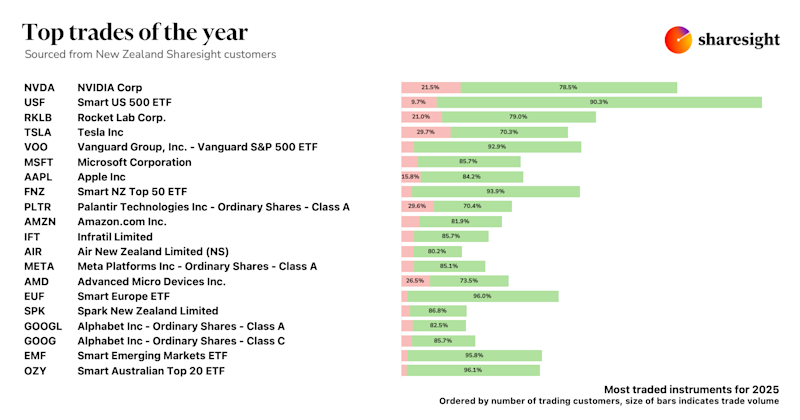

Top trades by New Zealand Sharesight users in 2025

Welcome to the 2025 edition of our New Zealand trading snapshot, where we dive into this year’s top trades by Sharesight users.

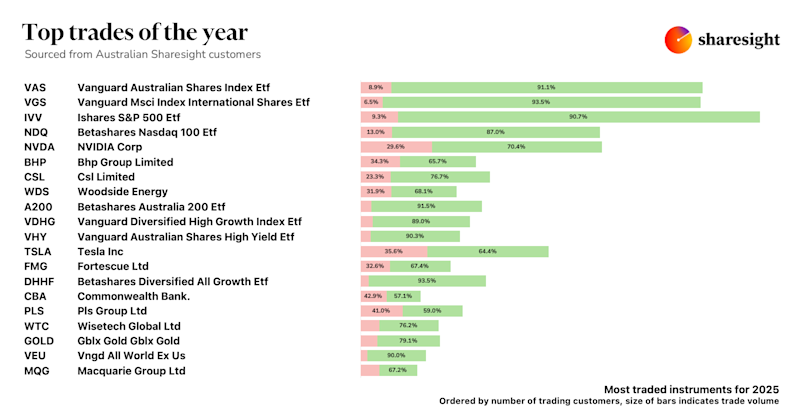

Top trades by Australian Sharesight users in 2025

Welcome to the 2025 edition of our Australian trading snapshot, where we dive into this year’s top trades by Sharesight users.