Simplify your

dividend tracking

Track dividends and distributions from over 700,000 global shares, ETFs and managed funds, going back up to 20 years.

Sign up for free

Automatically track all your dividends

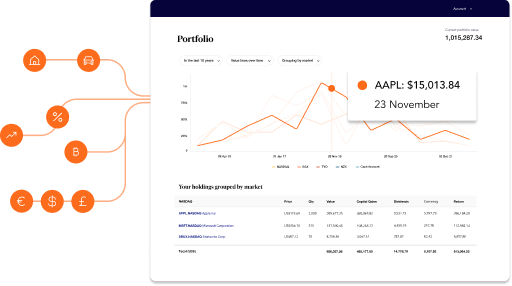

Track your dividend income

See all your dividends and distributions, across multiple brokers and more than 60 exchanges.

See your dividend yield

Calculate the impact that dividends are having on your portfolio performance.

Make tax time a breeze

Save time and money this tax season with all your dividend data living in one place.

We work with all your favourite brokers and apps

Sharesight integrates with hundreds of brokers and finance apps, including Sharesies, Hatch and Jarden Direct.

View our partners

"It does everything that I need and it does it automatically."

See your entire

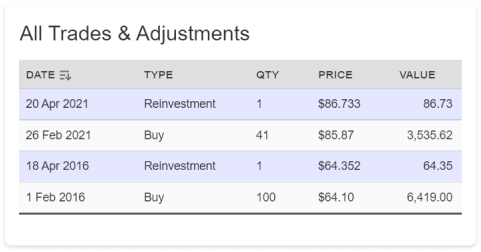

dividend history

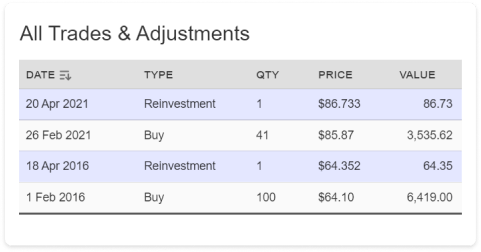

Import your historical trades, then sit back and watch as your dividend income is automatically tracked – going back up to 20 years.

Understand

your dividend yield

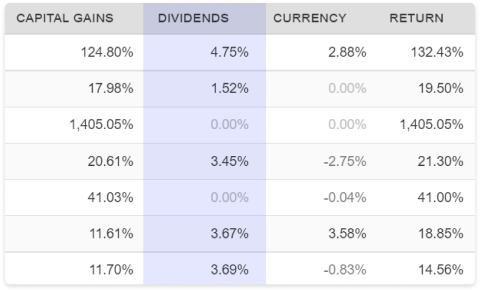

See the impact of dividends on your portfolio performance, both at the portfolio and individual holding level.

Your dividends are factored alongside share price, brokerage fees, and currency fluctuations to give you a true understanding of your total return.

Track reinvested dividends

Easily track your dividend reinvestment plans (DRPs/DRIPs) and their impact on your portfolio performance and return.

Never miss a dividend

See upcoming dividends as soon as they are announced to the market with the actual income predicted based on your current portfolio positions. Plus, you can opt-in to email alerts to be notified as dividends are announced.

Calculate your

dividend income

See all your dividends, distributions and interest payments over any time period, broken-up by local NZ and foreign income.

Export the report to PDF, Excel or Google Sheets, or share secure access with your accountant.

Learn more about dividends

Learn more about how to track dividends using Sharesight.

Read dividend articleBuilt in NZ, for NZ investors

NZ tax status

Set your portfolio tax status to Investor or Trader, and indicate your NZ Resident Withholding Tax Rate.

IRD tax reporting

Easily determine your foreign investment fund (FIF) income and CGT liabilities.

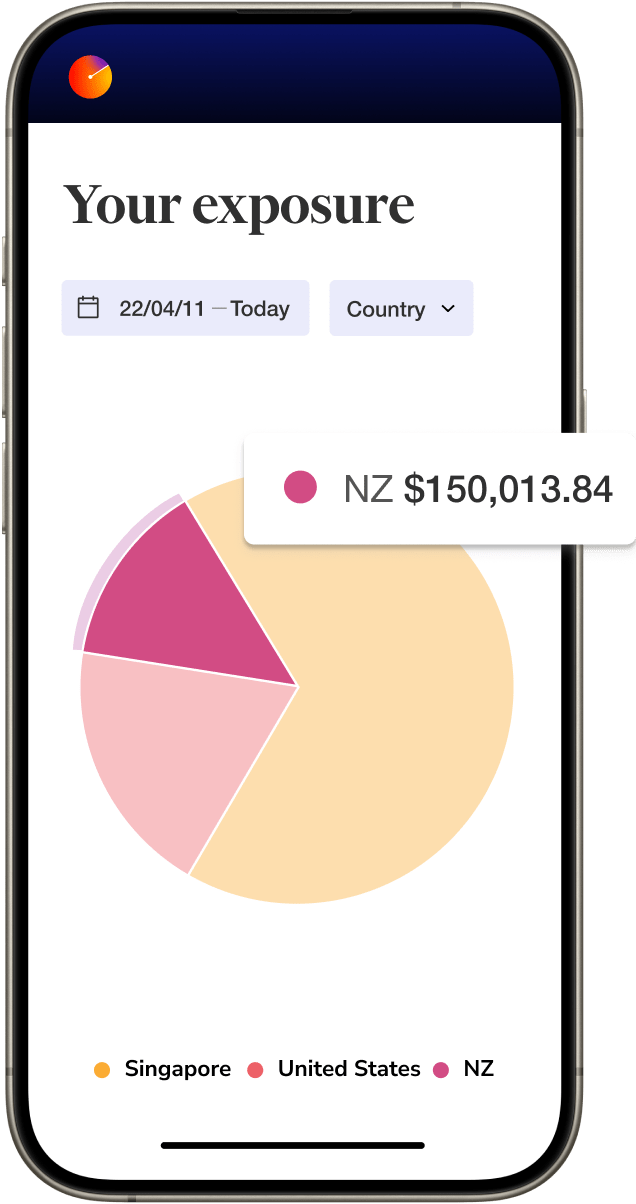

Currency impacts

Set your portfolio base currency to NZD, and automatically calculate currency impacts for any foreign shares.

Don't just take our word for it

Over 400,000+ investors track their investments with Sharesight. Here’s what a few of them have to say:

Dividend tracker FAQ

What is a dividend tracker?

With Sharesight's dividend tracker software, dividend payments are automatically tracked in an investor's portfolio. Investors can view their dividend income and dividend history at any time, see the impact of dividend yield on their returns, and track dividend reinvestment plans (DRPs) in their portfolio. Additional features include the ability to see upcoming dividend income with Sharesight's Future Income Report, and opt-in to dividend alerts about upcoming announced dividends.

How do I track my dividends?

To track your dividends, first you will need to sign up for a Sharesight account. Once you have a Sharesight account, you can start adding trades to your portfolio by automatically forwarding trade confirmation emails from your brokerage account, uploading a spreadsheet file filled with trades, or entering your trades manually.

If you track dividend paying shares in your portfolio, dividends and distributions will be automatically recorded. All you will need to do is confirm the dividend payments in your portfolio. This can be done by clicking into any holding that has an orange icon next to it (which signifies that you have unconfirmed transactions) and clicking 'confirm automatic transaction'. Sharesight will automatically pull dividend income data such as tax credits, exchange rates and foreign source income, however to ensure accuracy it is recommended that you verify these figures using your paper or digital dividend statements.

How to make a dividend portfolio

It's easy to track dividend paying shares along with the rest of your investments in Sharesight. However, if you would like to create a separate portfolio for your dividend shares, this can be done with Sharesight's Investor or Expert plan, which allows users to have multiple portfolios.

Alternatively, you may wish to apply an asset allocation framework to a singular portfolio, which can be done using Sharesight's Custom Groups feature. Available on all Sharesight plans, this feature allows investors to group their investments by 'themes' in their portfolio.

How do I grow a dividend portfolio?

Sharesight has a number of useful features designed to help investors reach their investment goals, including developing a dividend growth portfolio. For example, Sharesight users can easily view the dividend performance of shares in their portfolio by seeing each share's overall dividend contribution on the Portfolio Overview page, or by clicking into individual shares to see how much dividends contributed to the share's net total return.

Sharesight's Auto Dividend Reinvestment feature (available for ASX and NZX shares) is another useful feature that helps investors track their dividend reinvestment plans (DRPs), which is one key measure that many investors take to grow their dividend portfolio. Dividend reinvestments can be tracked for non-ASX and NZX shares as well, simply by manually recording the dividend reinvestment when you add or edit a dividend payment in your portfolio. Investors searching for prospective dividend shares will also benefit from Sharesight's Share Checker tool, which allows investors to quickly view the performance of any share, inclusive of dividends.

What are the benefits of a dividend portfolio tracker?

One of the main benefits of Sharesight's dividend tracker is that it automatically tracks dividend income throughout the year. With all of their dividend information in one place, investors spend less time on tedious portfolio admin (especially at tax time) – leaving them with more time to spend on their investment decisions. Other benefits include the ability to see upcoming dividend income using Sharesight's Future Income Report, which helps investors plan their cash flow, along with the ability to track the impact of dividend reinvestment plans (DRPs).