Sharesight for accountants

A portfolio tracker that saves time and money, for you, and your clients. Automate your practice with a 30-day free trial. No credit card needed.

Start your free trial

Research

The 2025 accountants's guide to simplifying tax complexity for investors

The future of tax reporting is here. Download our white paper to discover how automation can transform your workflow by helping you save time, reduce errors and improve client satisfaction.

Fill out form to download

Reduce admin and boost efficiency

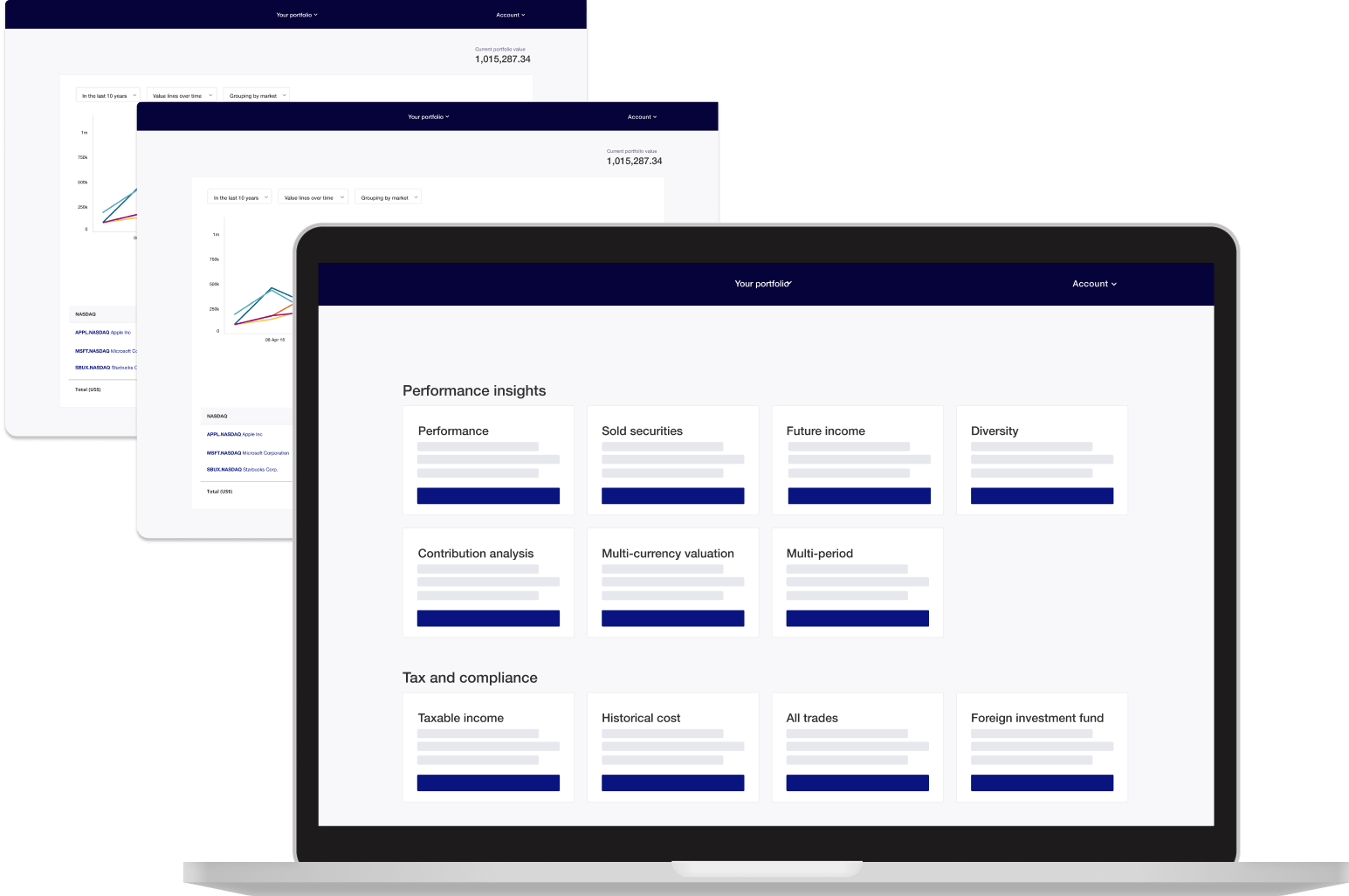

Sharesight combines all the information accountants need to efficiently manage clients investment portfolios at tax time. Tax reporting and asset management tools automate transactional processing and save you hours of manual administration, while comprehensive performance reports provide the insights you need to deepen client relationships.

Intelligent insights

Gain access to real-time advanced tax reporting for taxable income, capital gains tax, multi-currency valuation, and historical cost — with options to share secure access directly with clients.

Everything in one place

Badgering clients for trade confirmations and dividend statements? Staff struggling with stale spreadsheets? Having everything in one place puts an end to file-chasing and ensures everyone’s on the same page.

Cost saving efficiency

Refocus efforts on revenue generating tasks and improving customer experience by reducing tax admin tasks. Take advantage of a SaaS monthly subscription model, with no long-term contract or hidden fees.

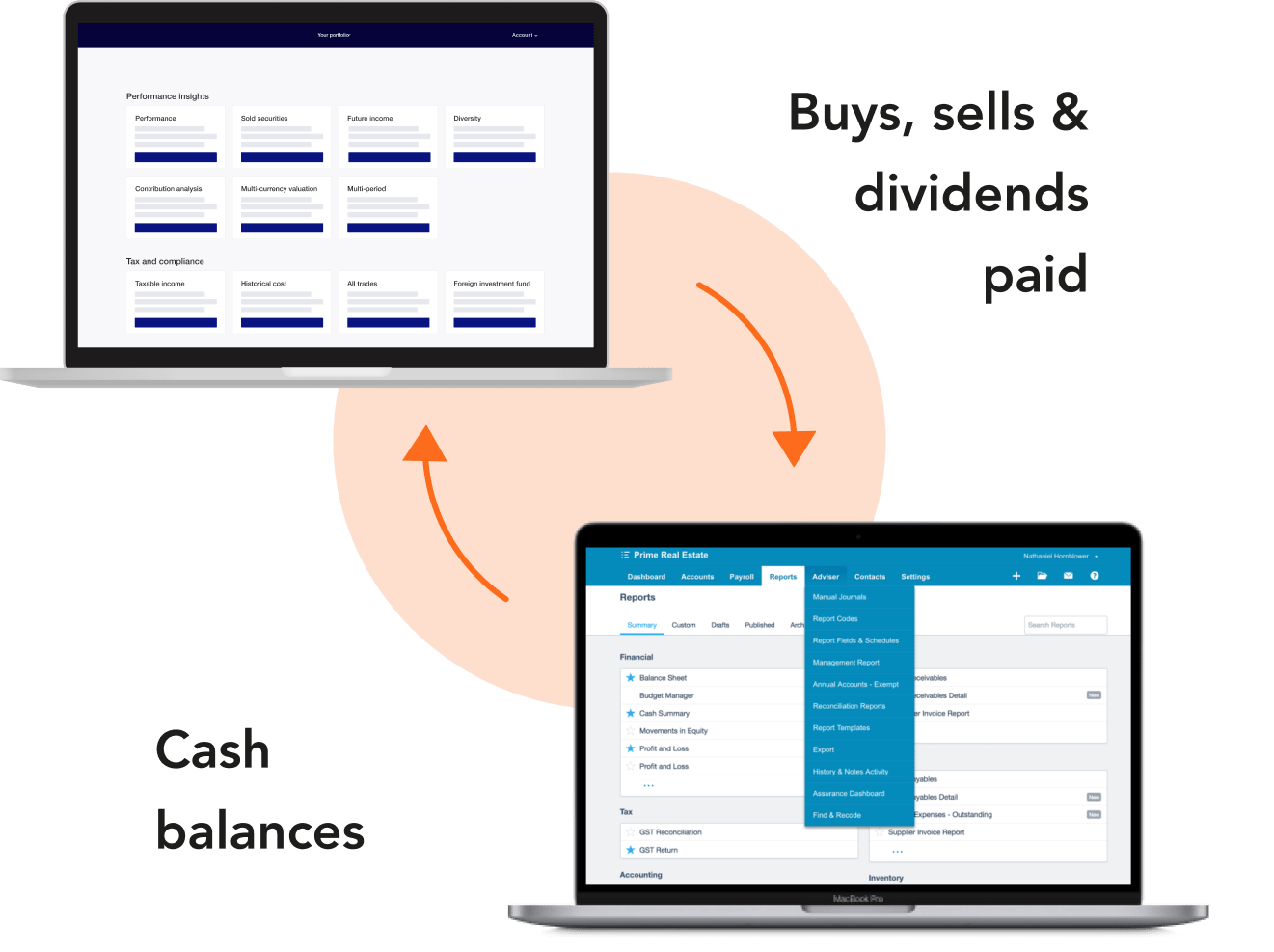

Seamless integration with Xero

Synchronise your clients’ Sharesight portfolio data with Xero, to automatically import details of share purchases, sales, and dividends in real-time. This provides you complete visibility of investment holdings, and allows you to easily reconcile portfolio data against bank statements – without the frustrating paper-chase. Your clients also benefit from Xero data being displayed in Sharesight, with bank balances, term deposits, and cash investments, providing a complete view of their financial position.

Powerful features that change the way you work

Keeping track of your client’s share portfolios used to be a hassle. Sharesight makes it simple. Want automatic trade recording with comprehensive performance reporting, wrapped up in an easy-to-use, fully online system? That’s Sharesight in a nutshell.

Deepen relationships

Extend your service offering with additional portfolio performance features and a connected community of financial wellness and growth tools.

Automatic updates

A well-implemented, automated, online reporting strategy can change the configuration of your firm towards critical thinking and problem solving initiatives.

Simple sharing

Leverage intelligent data insights, and grant access to staff and clients according to the level of access they require: read, read/write, or admin.

Simple pricing, no commitment

Whether you need to track 5 portfolios or 500, you never pay more than €13.50 per portfolio, per month. And the more portfolios you set up, the more affordable it gets.

With Sharesight, there are no hidden fees, no extras that you have to pay for and no contracts. Just one simple price. And you can put us to the test with a free 30-day no-risk trial – no credit card required.

5-19 Portfolios

€13.50

Per portfolio/

month

20-49 Portfolios

€12

Per portfolio/

month

50-99 Portfolios

€10.50

Per portfolio/

month

100+ Portfolios

€9.20

Per portfolio/

month

Sharesight makes managing client portfolios a breeze

Easy sign-up

No billing details or credit card required

No hidden fees or contracts

Upgrade, downgrade or cancel anytime

Start your free trial

Accountants love Sharesight

Chris Wheatley

Scope Accounting

“In terms of productivity, it definitely gives us a faster turnaround time and job throughput, because what could take 3 hours in Excel takes 20 minutes in Sharesight.”

Taryn Port

Sharesight Customer

“Sharesight and Xero are a great combination for clients with investment portfolios. Once set up the integration works really well with income flowing from the portfolio through sharesight to Xero. Will save a lot of time in the second year and onwards.”

Philippa O’Mara

Engine Room Chartered Accountants

“Sharesight saves us 2-3 hours on a mid-sized portfolio, simply removing the need to track down missing dividend statements and create the schedule of income, as well as the calculations involved for foreign shares.”