Yahoo Finance vs. Sharesight – comparing portfolio trackers

If you invest across different asset classes and markets, there are few portfolio trackers that can automate your record-keeping while also giving you a true picture of your portfolio’s returns. Some investors track investments with a spreadsheet, or alternatively, Yahoo Finance – but there’s a better way. Here are some reasons why investors should choose Sharesight over Yahoo Finance.

Get the full picture of your returns

Like most brokers, the problem with Yahoo Finance is that it only displays your capital gains, providing you with an incomplete picture of your returns. To get the full picture of your returns, you need a portfolio tracking software that calculates returns inclusive of the impact of dividends, brokerage fees and foreign currency fluctuations, in addition to capital gains.

Automatically track dividends

Not only is it important to keep track of dividends for tax purposes, but dividends can also have a significant impact on an asset’s returns – making this a crucial performance metric for any investor with dividend-paying stocks. The screenshot below, for example, shows the returns of VDHG shares in an Australian investor’s portfolio, as seen in Sharesight. As you can see, dividends make a substantial contribution to this stock’s returns, contributing 6.73%, alongside 0.37% in capital gains. If you were to ignore the impact of dividends, your return value would only be 0.37%, creating the impression that your returns are much lower than they actually are.

Sharesight automatically tracks dividends and distributions, which are included in performance calculations.

As can be seen from the screenshot below, Yahoo Finance does not include dividends when calculating an asset’s performance. According to Yahoo Finance, this stock’s annualised return is 0.38% (0.37% in Sharesight due to a discrepancy in the timing of intraday pricing updates). As noted above, this is an incomplete picture of this asset’s returns.

Yahoo Finance does not allow investors to automatically track their dividends, meaning investors would need to manually enter dividends as a custom trade to reflect dividend income in their performance calculations.

Track the impact of foreign currency

If you invest across different markets and currencies, you will also find that Yahoo Finance is an inadequate solution for your needs. As mentioned above, Yahoo Finance only includes capital gains when calculating returns – ignoring the impact of foreign exchange fluctuations, which is another crucial performance metric for global investors.

See the screenshot below for example, which displays performance values for a US stock in an Australian investor’s Sharesight portfolio. Currency gain accounts for 6.02% of returns, which combined with a capital gain of -15.75% and dividends worth 0.14%, leads to a total return value of -9.58%. In Yahoo Finance, this value would be -15.75% – an inaccurate reflection of the stock’s true performance.

Sharesight automatically tracks the impact of foreign exchange fluctuations on the performance of assets in an investor’s portfolio.

Benchmark your performance

As an investor, not only is it important to get the full picture of your returns, but it’s also important to be able to put those returns into context with the broader market. One of the best ways to do this is by benchmarking your portfolio against an asset that reflects your investment goals and the composition of your portfolio. For example, an Australian investor with a portfolio consisting primarily of ASX stocks may choose to benchmark their portfolio against an index-tracking ETF like the SPDR S&P ASX 200 Fund (ASX: STW), as seen in the screenshot of Sharesight below.

Sharesight makes it easy to benchmark your portfolio by allowing you to choose the asset that best reflects your portfolio’s composition, and clearly breaking down your returns compared to your benchmark.

By tracking your portfolio against a benchmark, you can easily see where your portfolio matches or diverges from the benchmark. If your portfolio is underperforming compared to the benchmark, for example, this could suggest that your poor performance is due to your own investing decisions, rather than a reflection of market conditions. In this case, you may decide that you would be better off investing your money in the asset you are benchmarking against, rather than continuing to pick individual stocks. These are the kinds of informed decisions you can make by using Sharesight’s benchmarking feature, which allows you to automatically track your portfolio against any of the 240,000+ stocks, ETFs, funds and unit trusts that Sharesight supports.

Investors tracking stocks with Yahoo Finance will notice a small benchmark at the top of their portfolio overview page, however it is not customisable and does not express any actual return values. Investors’ portfolios are simply benchmarked against the S&P 500, whether the investor holds US stocks or not. This means that investors outside of the US – or US investors with a global portfolio – will be unable to get a realistic comparison of their performance with the broader market.

Unlike Sharesight, investors tracking their portfolio with Yahoo Finance are unable to choose a benchmark that reflects their investing goals and/or portfolio composition.

Why investors should use Sharesight instead of Yahoo Finance

Yahoo is a great place to check your old GeoCities email. But when it comes to tracking your investments, you should be using a purpose-built portfolio tracker like Sharesight, which not only tracks your annualised performance, but includes dividend tracking, tax reporting, and a suite of other features specifically designed for self-directed investors. Here’s a side-by-side comparison of Yahoo Finance and Sharesight to show you what we mean:

| Yahoo | Sharesight | |

|---|---|---|

| Performance | Simple return Doesn’t include dividends, brokerage, foreign currency |

Annualised, money-weighted total return Includes dividends, brokerage, foreign currency |

| Performance period | Limited: since yesterday, or since first purchase only | Any time period |

| Dividends | No | Yes – automatically displays the exact dividends based on how many shares you own (these can be edited too) Dividends are rolled back up into your performance calculation |

| DRPs/DRIPs | No | Yes |

| Foreign currency | No – you can change the portfolio’s currency but currency fluctuations for foreign investments aren't tracked | Yes – converts any foreign investments back to the portfolio’s home currency (with forex prices updated every 5 minutes |

| Market coverage | Pretty much everything | Full list of markets tracked by Sharesight |

| Price updates | Mix of real-time/15/20/30 mins | 15 minute delayed pricing for US markets and LSE. 20 minute delayed pricing for AU and NZ, otherwise end of day |

| Number of holdings & portfolios | Unlimited | Track up to 10 holdings for FREE, for more, see our pricing plans |

| Performance & tax reports | No | Yes – performance, diversity, contributions analysis, taxable income, future income, etc. Full list of Sharesight reports |

| Benchmarking | Minimal - all portfolios benchmarked against S&P 500, with no return values | Yes (Benchmark your portfolio against any of the more than 240,000 stocks, funds, ETFs and unit trusts Sharesight supports) |

| Track brokerage costs | No | Yes – Here’s the impact brokerage costs have on your investment return. |

| Cash tracking | Yes | Yes – Cash account tracking that syncs transactions to your portfolio. |

| News | Yahoo | Livewire, Firstlinks, The Motley Fool UK |

| Portfolio sharing | No | Yes – share secure access with anyone, according to the level of access they require: read-only, read-write, admin |

It’s easy to import your Yahoo Finance portfolio to Sharesight

If you’re already using Yahoo Finance to track your investment portfolio, we’ve made it easy to import your data into Sharesight. All you need to do is:

-

Download your portfolio from Yahoo Finance (as a .csv file)

-

Upload it to Sharesight

That’s it. We go into more detail in our guide ‘Easily import your Yahoo Finance portfolio into Sharesight’.

Sign up today and track your investment performance (and more) with Sharesight

Thousands of investors like you are already using Sharesight to track their investment portfolios. What are you waiting for? Sign up and:

-

Track all of your investments in one place, including stocks, mutual/managed funds, property and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed Funds

-

Run powerful reports built for investors, such as performance, portfolio diversity, contribution analysis, multi-period, multi-currency valuation and future income (upcoming dividends)

-

See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account and get started tracking your investment performance (and more) today.

FURTHER READING

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

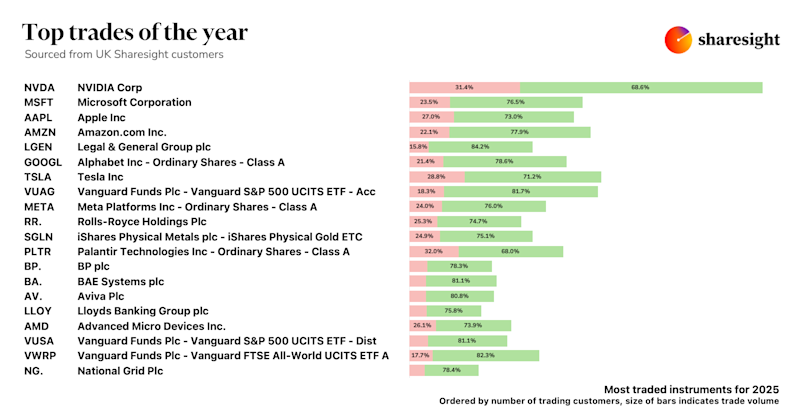

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

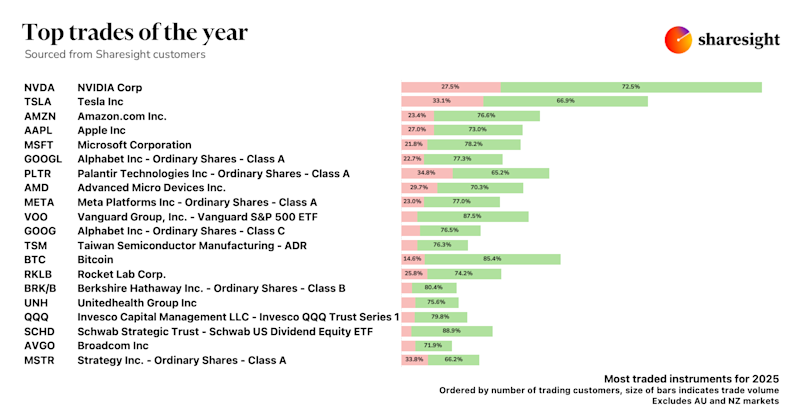

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.