Why Sharesight is the best portfolio tracker for financial advisors

No matter what kind of financial advice practice you belong to, you are likely faced with a number of challenges on a daily basis. From fragmented systems and ever-changing regulatory requirements to balancing admin work with client engagement, there is a lot of pressure on the modern financial advisor.

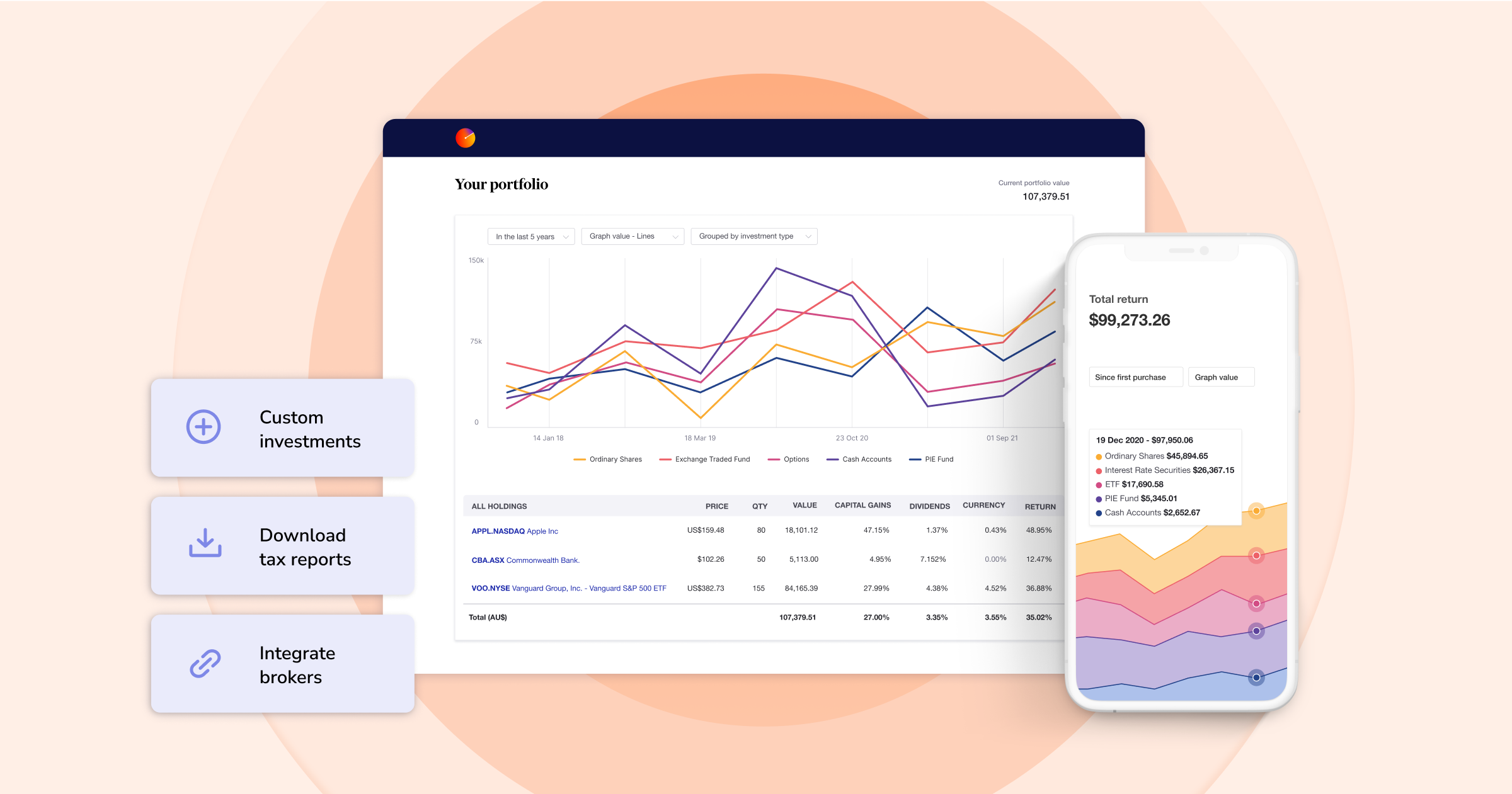

This is where Sharesight comes in. Built for the needs of financial advisors and their clients, Sharesight is an online portfolio tracker with real-time price and performance tracking for over 750,000 stocks, ETFs and managed funds, plus the ability to track a range of other assets. By implementing a portfolio tracking software like Sharesight into your tech stack, you can track all your clients’ investment portfolios in one place, automating your practice and reducing tedious admin work — giving you more time to focus on building relationships and producing better outcomes for your clients.

In this article, we’ll discuss the 5 C’s of Sharesight — client demand, complete visibility, comprehensive reporting, client access and cost effectiveness — and how these factors can help transform your financial advice practice.

Client demand

Here at Sharesight, the bulk of our user base is self-directed investors using the retail version of our product. These users tend to be experienced investors who use Sharesight because they understand the tracking and reporting limitations of online brokers and watchlists. Where this is relevant to financial advisors is that retail users have the ability to share their portfolio with anyone they like, including their financial advisor.

Consider the admin burden that most people face when hiring a financial advisor. Transferring assets, paperwork, logins, custodial forms and much more. With Sharesight, investors can share access to their portfolio with their advisor in just a few clicks of a button for no additional cost – giving you real-time access to their portfolio, including the ability to see their investment holdings, plus performance data inclusive of capital gains, dividends and distributions, brokerage fees and foreign currency fluctuations.

Complete visibility

As an advisor, it’s crucial to have the right solution to track your clients’ wealth. From stocks, ETFs and managed funds to cash, real estate and precious metals… there are countless asset classes your current and prospective clients may be invested in, and you need an efficient solution to see all of that data in one place.

By using the business edition of Sharesight’s portfolio tracker, you can do just that. Whether you have one client or hundreds of clients, you can easily track portfolios for the same client, or a family. You can also see all of your client portfolios at a glance, giving you complete visibility into the wealth you’re tracking.

Comprehensive reporting

When you’re managing multiple client portfolios, tax planning is a year-round responsibility, and done effectively, it can be a huge differentiating factor in helping your clients reach their financial goals. Sharesight gives you (and your clients) access to a comprehensive suite of reports that help make tax planning more efficient and less time-consuming, with clear insights into gains, losses, taxable income and upcoming cash flow.

For example, the unrealised CGT report can be used to see unrealised gains and losses across a client’s portfolio, allowing you to identify opportunities to offset gains and losses throughout the year and model different tax-loss selling scenarios, empowering you to be proactive and help your clients achieve a better tax position. Sharesight’s future income report can also be used to project upcoming dividends and distributions in a client’s portfolio, helping you plan ahead for your client’s cash flow needs. These are just a few examples of reports that can assist you with tax planning, but there are also a number of other reports designed to help you evaluate the performance of your clients’ portfolios, track diversity and asset allocation, see the impact of foreign currency investments, identify a portfolio’s risk profile, and much more.

Client access

As the world becomes increasingly digital, we’re all surrounded by a vast, ever-expanding flow of information at our fingertips. The result of this is that clients are demanding more transparency than ever from their financial advisor. Not only this, but for today’s client (and certainly the clients of the future), tech adoption is no longer a differentiating factor but a baseline expectation of their financial advisor.

By tracking your clients’ investments in Sharesight, you have the ability to create client logins and choose your clients’ level of access (read-only, read and write or admin). Addressing clients’ needs for transparency and automation, this sharing feature allows you to invite clients to log into Sharesight and keep track of their portfolio’s performance, check trades and even run reports. By giving clients the power to see their assets at a glance, you also benefit from the ability to facilitate better conversations, with less time spent discussing the state of the portfolio and more time spent discussing strategy and the direction of the portfolio going forward.

Cost-effective

Platforms and wraps are certainly appropriate for some clients. But portfolio admin alone should not be the determining factor in choosing to put client assets on a wrap. In the past there wasn’t a choice — an advisor couldn’t risk tracking client holdings on a spreadsheet. Unfortunately for clients, this meant paying asset management fees for a portfolio reporting service.

By tracking client assets in Sharesight, you can record unlimited trades without worrying about assets under management or portfolio size. Whether a portfolio is made up of 100 penny stocks or $100 million in Berkshire Hathaway, you still pay the same price.

When you track a portfolio on Sharesight, you also have access to our ever-growing ecosystem of connected apps. We automatically record trading data from over 200 global brokers and push data to apps like Xero, helping you ensure accuracy, reduce admin work and free up time to spend on professional development, relationship-building and other income-producing activities for your practice.

Start your free trial today

Sharesight is the ultimate tool to help you manage and report on client investment portfolios. By providing you and your and clients with powerful stock market data tools and advanced performance reports, Sharesight can save you hours of manual administration while adding value for clients and improving the quality of your conversations.

Try it for yourself with a 30-day risk-free trial – no billing details are required and you have the ability to upgrade, downgrade or cancel at any time.

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.