Who’s to blame for the financial meltdown?

As an investor in the share markets, I’m keen to discover why such a serious meltdown has occurred in the world’s financial markets and I want to gauge whether the US government’s rescue package will work. Dr Gareth Morgan has had a lot to say recently about the financial meltdown and, as he is well-qualified to assess the situation, I have been reading his views with interest. Maybe it’s just me, but I soon found myself getting some pretty contradictory messages.

Dr Morgan advised that an increasing predilection by the world’s central banks to "save the world" whenever the going gets tough can singularly (my emphasis) be blamed. He then opined that “what‘s behind the current crisis is an orgy of debt - an unrestrained appetite for lending and borrowing, no matter the risk of the transaction”.

This seems like a bank problem to me and it made me wonder whether there might be a dual rather a singular source of blame. But Dr Morgan explained that a message has been sent to the effect that, in the event that an institution over-stepped the mark, it was odds-on that the Central bank would step in. This points the finger at the Central banks with the implication that they have made financial institutions irresponsible by their apparent willingness to bail them out. However in the next breath Dr Morgan suggested that the Central bank might have done no more than aiding and abetting the suicide of the financial sector. This seems to redirect the finger at financial institutions.

The suggestion that financial institutions indulged in an ‘orgy of debt’ because they believed the central bank would bail them out does not sit well with me. I do not for a moment believe that staff in any financial institution anywhere in the world have done shonky deals on the basis that if they go wrong that would be ok because the Central bank would bail them out. That point aside, financial institutions want to succeed not suffer the ignominy of a collapse or a bail out.

The multitude of finance companies that have failed in NZ after indulging in an ‘orgy of debt’ certainly had no expectation of a bailout by our Reserve Bank or the Government. On the other hand, management at the ANZ undoubtedly realise that ANZ is too significant in NZ for the Government to allow it to fail. Despite this there is no suggestion ANZ has indulged in an ‘orgy of debt’.

There is little point in trying to assign blame unless it is part of a process to identify the source of the problem so that it can be fixed. To my mind the primary, if not singular, source of the problem is the lending institutions themselves, not the Central banks. And they have been aided and abetted not by the Central banks as Dr. Morgan suggests, but by the derivatives market.

Derivatives are highly risky instruments with no underlying asset to support them. They started with securitisation (the selling of parcels of loans) and moved on to include credit default swaps (a type of credit risk insurance). These instruments were relatively straight forward initially but variations on them (derivatives) were developed over time allowing them to be used as a tools for financial speculation. At this point things got absurdly complex and the rot set in.

Transparency went out the window along with trust. The linkages back to the security of the original asset were broken and this created great uncertainty about the value of the assets the financial institutions are holding. In some cases this value is less than the value of the financial institution’s loans which, in the minds of many, is a pretty good definition of insolvency. No one is too sure which financial institutions are insolvent (apart from the ones that have already fallen over!) and this has made financial institutions wary about dealing with each other. Interbank trading is a crucial part of the financial system so it is not surprising that this has triggered a catastrophic chain of events.

So I think to fix the problem we have to start with financial institutions and find ways to monitor and control the derivatives market. This is what the US Treasury is planning to do and they have to be applauded for that. But whether they are going about this task in the best way is another question entirely.

One last thought. Maybe the real culprits are not the financial institutions, or the central banks or the derivatives market. Maybe we need to blame the borrowers. If they had not borrowed excessively in the first place none of this would have happened. Or would it?

We at Sharesight would be interested in your views. What do you think? What are the implications for the Australasian share markets?

This information is not a recommendation nor a statement of opinion. You should consult an independent financial adviser before making any decisions with respect to your shares in relation to the information that is presented in this article.

My investment portfolio used to be gold bangles

For International Women’s Day, Morningstar's Shani Jayamanne explores the ways that women have taken back financial control.

Simplify property tax & investment tracking with TaxTank + Sharesight

Simplify property tax management with the Sharesight + TaxTank integration—track CGT, investment income, and tax data in one seamless, automated platform.

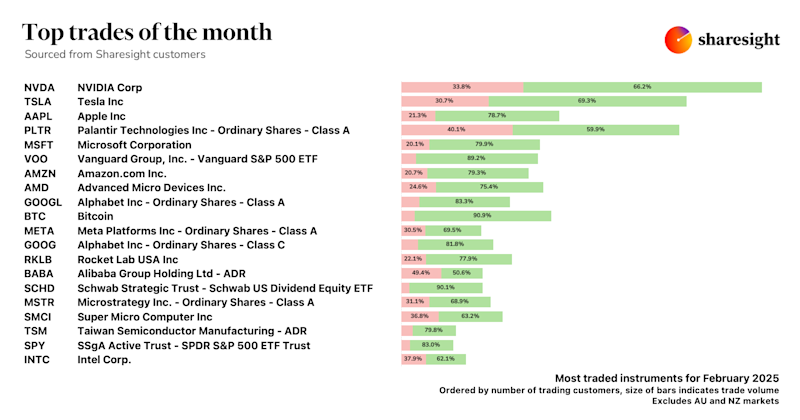

Top trades by global Sharesight users — February 2025

Welcome to the February 2025 edition of Sharesight’s trading snapshot for global investors, where we reveal the top 20 trades by Sharesight users worldwide.