When will the share market bounce back and how long will it take?

For those of us with an interest in the share market this is an issue of some importance. We all know that when the markets take a tumble they will rise again, but it would be great to get a handle on how long it will be before we see an upturn and how strong that upturn will be.

Here’s my take on the situation. Caveat: I might change my mind next week!

There is no doubt that there is going to be a major reorganisation of credit globally. The consequences of such a massive change that will embroil the Government (and quasi-government organisations) so extensively in the financial markets, are impossible to predict. However history suggests that anomalies, distortions, loopholes, exploitation and ever increasing complexity and cost will rule.

Despite this gloomy prediction, I also think that while the process of restructuring the world's financial markets is occurring, the productive sector will quickly get back to something approaching normalcy. In other words the players will soon stop obsessing over the score and start concentrating on the game.

Clearly Australia will not escape the impact of the credit crisis or the effects of the recession that is likely to hit most of our trading partners. In view of this it is slightly surprising to me that PM Kevin Rudd has predicted 2% annual GDP growth and that this is supported by similar predictions by the big 4 banks. In fact Westpac is predicting GDP growth of 2.8% over 2008 and 2.2% in 2009.

Whether these predictions prove to be unduly optimistic remains to be seen but there are good reasons to believe we will be less severely affected than most. Unlike many countries we have not had major bank collapses, our financial system has not been hijacked by out-of-control derivatives trading and the Reserve bank has more latitude than most its overseas counterparts to provide further stimulus via interest rate cuts if necessary.

And there is further reason for optimism as well. According to Westpac CEO Gail Kelly who should know if anyone does, Australian banks, in contrast to their counterparts in the US and Britain, have been more conservative in their lending over the past decade. She claims that there has been little or no sub-prime lending by the major banks, and that average loan-to-value ratios are remarkably low.

So back to our share market. What might all this mean? I believe it will be good news. Our economy will be less severely affected than most and this will enhance Australia's reputation as a sound place to invest. This in turn will re-stimulate investment in our share market from both local, and more importantly, offshore investors.

This is not to say it will not be much tougher than it has been over the past 10 years or so. For a start, lack of international demand is likely to depress oil, iron ore and coking coal prices. However this is already fully reflected and more in the share prices of the likes of Rio Tinto and BHP.

For those of us interested in the share market this is surely the key point. The collapse in our share market prices (the S&P/ASX has fallen from 6828 points a year ago to 4018 today) seems out of all proportion given an economy with a sound banking system and forecast growth in GDP that most countries could not contemplate in their wildest dreams.

So how long will it be before common sense prevails and how strong will the bounce back be? I don’t know, but I have certainly persuaded myself not to give up on the Australian share market.

What are your thoughts?

This information is not a recommendation nor a statement of opinion. You should consult an independent financial adviser before making any decisions with respect to your shares in relation to the information that is presented in this article.

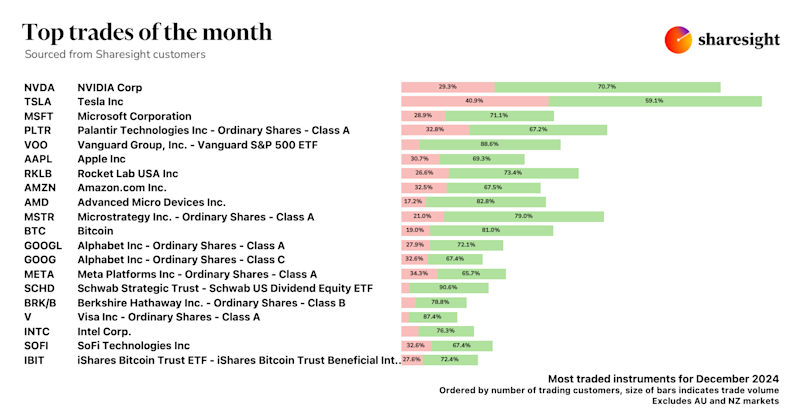

Sharesight users' top trades – December 2024

Welcome to the December 2024 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

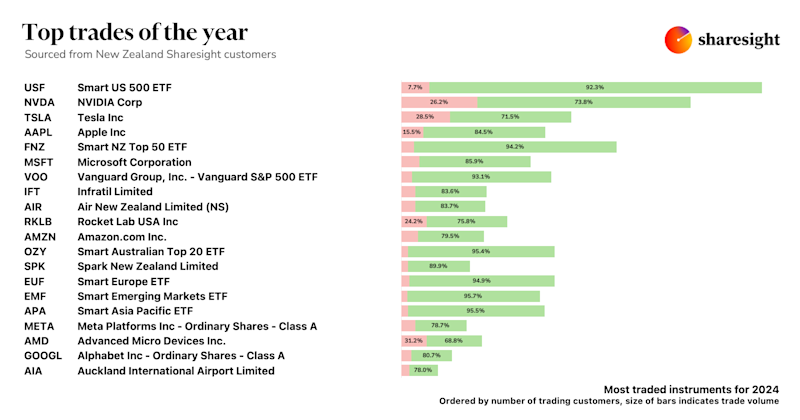

Top trades by New Zealand Sharesight users in 2024

Welcome to the 2024 edition of our New Zealand trading snapshot, where we dive into this year’s top trades by Sharesight users.

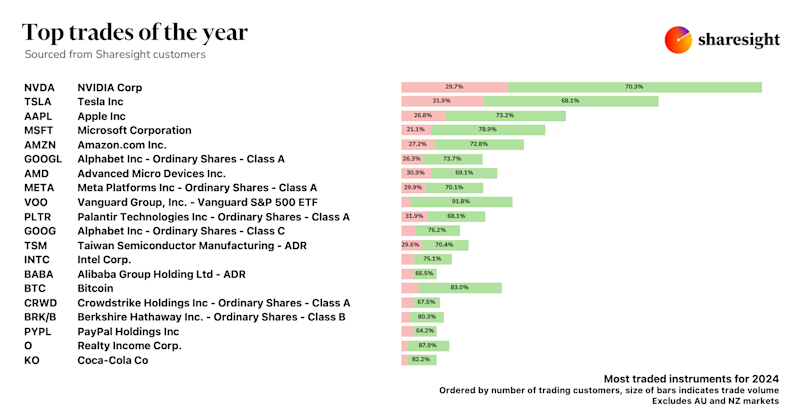

Top trades by global Sharesight users in 2024

Welcome to the 2024 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.