What’s driving investors: Mind or emotions?

This article is written by Dr Laura Rusu, founder of Diversiview by LENSELL. Part of an ongoing series, you can read the previous segment here.

In this article we look at Australian investors’ preferences in the first quarter of 2022, with an emphasis on the risks and performance of the Top 20 preferred ASX securities. We aim to understand how investors’ choices are placed compared with general attitudes to risk and with the general approach to seeking returns based on performance.

Dataset

Diversiview uses data from Sharesight with regards to the Top 20 ASX trades, sourced from Sharesight customers (See Figure 1 below).

Sharesight has over 150,000 Australian customers who track their investments from many investment platforms and brokers, therefore we take this ranking as a good approximation of the overall behaviour of ASX investors. In the article we will refer to and compare data with the Sharesight Top 20 trades in 2021, to highlight changes in preferences to certain asset types or industry groups, and attitudes to risk.

Figure 1: Top 20 ASX trades in Q1 2022 (1 Jan – 31 Mar) from Sharesight customers

Figure 1: Top 20 ASX trades in Q1 2022 (1 Jan – 31 Mar) from Sharesight customers

Asset classes

During the first quarter of 2022 investors continued to show a preference for ETFs (40% from the Top 20 preferences), to a lesser extent compared with 45% preference for ETFs in 2021. See Figure 2 below.

Also, we can see less focus on industry groups for direct shares in Q1 2022, that is, only 5 preferred groups compared with 8 in 2021.

Figure 2: Asset groups split for top 20 ASX trades for Sharesight users, in Q1 2022 vs 2021

Figure 2: Asset groups split for top 20 ASX trades for Sharesight users, in Q1 2022 vs 2021

From the perspective of investment size, the proportion of mid and low caps vs blue chips stayed pretty much the same, with a slight increase in the interest for mid and low cap securities. See Figure 3 below.

Figure 3: Market capitalisation for top 20 ASX trades for Sharesight users, in Q1 2022 vs 2021

Movements

By looking at the preference lists, one could see notable changes such as securities missing from the Top 20 list altogether in Q1 2022 compared with 2021, including ASIA (7th in 2021), A2M (8th), APT, CSL and APX (10th – 12th), KGN (14th), CBA (15th) and A200 (18th in 2021).

At the same time, new preferred stocks show up in 2022, including CXO, LKE, VEU, MFG, PLS, NIC and MQG. It should be noted that 4 of the new additions are in commodities such as lithium and nickel, likely driven by potential speculative price growth for those materials in the context of the war in Ukraine and global impact of sanctions on Russia.

Z1P had the largest fall in preference, from 2nd place in 2021 to 20th in Q1 2022. Conversely, IVV had the biggest growth, from 19th place in 2021 to 7th in Q1 2022.

Expected return and volatility

We plotted the expected return and volatility, as calculated by Diversiview, for each of the 20 securities. Note: Diversiview calculates the expected return as the geometric average annualised return for the immediate past 3 years. Volatility, as a measure of risk, is the standard deviation of the historical returns from the average return, during the immediate past 3 years.

As can be seen in Figure 4, the Top 20 list in Q1 2002 includes two very volatile securities, namely CXO (Core Lithium, 170% volatility) and PLS (Pilbara Minerals, 157% volatility), and one extremely volatile security, that is LKE (Lake Resources, 514% volatility). They come mid-list, at positions 8, 13 and 10 respectively.

Figure 4: Expected risk & return for the Top 20 ASX trades in Q1 2022, sourced from Sharesight customers

As this is an aggregated list of preferences for 1 Jan – 31 Mar 2022, the single explanation is in investors’ expectation of high growth for lithium stocks in the context of potential big future demand due to global economic shifts caused by war in Europe. This is despite the fact that CXO and LKE reported no revenue and had successive losses for the past 4 years, and PLS reported some revenue and successive losses in the past 4 years (see Figure 5 below sourced from the ASX website on 13/04).

Figure 5: Financials for 3 very volatile securities in the Top 20 preference list (screenshots from ASX website, 13/04/2022).

As the 3 volatile stocks mentioned above are outliers and make a visual analysis quite difficult, in Figure 6 below we show the same risk plot but without CXO, PLS and LKE. We have also removed SYD from the analysis as most trades were sells due to the recent Sydney Airport acquisition.

Figure 6: Top 20 ASX trades, less the identified volatility outliers

The first thing that can be noticed from this graph is that 12 of the 16 securities plotted are grouped in the conservative corner, having an expected return and volatility less than 30%.

Noticeable and difficult to explain, however, is investors’ interest in securities with a negative expected return, e.g. MFG and Z1P. Intriguingly, MFG also comes in mid-list position, that is, 12th out of 20.

At the same time, FMG boasts a very high expected return at the expense of high volatility. Being in position 9 out of 20 in the preference list shows that many investors are either prepared to take that high risk for a high level of expected return, or they are not entirely aware of FMG’s volatility, and they tend to focus mostly on the potential return.

A couple of interesting observations in Figure 6 are:

-

While ETHI has a better expected return than IVV for pretty much the same level of volatility, ETHI comes only 18th in the preference list while IVV is 7th.

-

Some investors preferred to trade securities with very low expected return, close to 0, that is WBC (1.7%) and WPL (1.9%). It can only be explained by their optimism and confidence in a good recovery of those two stocks.

Beta and Sharpe ratio

Another way of looking at the performance of the preferred securities from a risk and return perspective is to look at the Beta for each security and the Sharpe ratio.

As a reminder, Beta is a measure of systematic risk, showing how much more or less volatile a security is compared with the entire market (Diversiview uses the All-Ords index as a representation of the entire market).

The Sharpe ratio helps users understand how much return above the risk-free rate they can get for the level of risk they assume. Note: In Diversiview, the risk-free rate of return is the Australian Bond 10 Year yield, 3.10% as at 20/04/2022. Investors will generally look for a Sharpe ratio greater than 1, that indicates positive return above the risk-free rate.

Figure 7 below shows a plot of the top 20 securities analysed in this article, on Beta and Sharpe ratio dimensions.

Also Note: To be meaningful, it is important that a comparison of the Sharpe ratio and Beta is done within the same industry groups or asset types. Therefore, in Figure 7 different security groups are highlighted in different colours: Materials (orange), ETFs (blue), energy (pink), diversified financials (green) and banks (yellow).

Several things can be noticed by looking at each group:

-

For ETFs, only 3 of them (VAS, NDQ, ETHI) have a Sharpe ratio equal or greater than 1, and a Beta less than 1. The remaining ETFs have a low Beta but they also have a low Sharpe ratio. In other words, while they would be ‘safer’ from a perspective of volatility compared with the entire market, they do not have much expected return above the risk-free rate, for the level of risk taken.

-

Similarly, for materials, 3 of the securities in the list (BHP, NIC and CXO) have a Sharpe ratio greater than 1 and a level of volatility close to or slightly higher than 1. These securities may be preferred by investors who are looking for a good level of return above the risk free rate but are also prepared to see their stocks moving at the same time with the entire market or even quicker.

Figure 7: Beta and Sharpe ratio for the top 20 ASX trades

-

For diversified financials, the situation is mixed, with MQG having a positive Sharpe ratio that is less than 1, and MFG and Z1P having a negative Sharpe ratio and quite high Beta. It is quite impossible to explain why someone would invest when there is no expectation of return and a very high volatility.

-

In energy, WPL is more volatile than the entire market and it has a Sharpe ratio close to 0.

-

In banks, WBC is more volatile than the entire market and it has a negative Sharpe ratio.

Diversification

Since the securities from the Top 20 list are deemed the ‘most popular’, it is possible that some investors would have invested in two or more securities from the list. This begs the question, how diversified are the securities in the Top 20 list, and how diversified would your portfolio be if you invested in several of them?

Figure 8 below shows 46 strong positive correlations between the Top 20 securities in Q1 2022, out of the total of 190 correlations that exist between all the pairs of individual securities.

As can be noticed on the left side of the figure, very strong positive correlations (i.e. greater than 0.75) exist between ETHI, VGS, IVV, NDQ, VEU, VTS, VDHG and VAS. These are all 8 ETFs from the Top 20 ASX trades list, which means that if an investor holds some of these ETFs in their portfolio with the intention of diversification, they will not actually get the diversification they are after.

Very strong positive correlations, for example 0.92 between ETHI and IVV indicates that the share prices for two funds move together in response to different market events, although one is a Global Sustainability Leaders ETF, and the other is a S&P 500 ETF.

Investors need to be aware of these correlation levels and, if holding several ETFs in their portfolio, to make sure that they actually get the level of deep diversification they are looking for.

Figure 8: Strong positive correlations between Top 20 ASX trades in Q1 2022

The takeaway

In conclusion, this article highlights several very important insights:

-

Investors’ behaviour can change a lot in the course of a few months, with preferences changing within the same asset classes as well. This is because financial markets are not abstract – they are made of people who have emotions and react to global news about crises, wars, potential geo-political changes and risk of loss.

-

While there is a lot of data available to support deep investigation and investment research, many investors seem to make only emotional decisions, follow word of mouth or online recommendations that do not make sense from a rational perspective.

-

While 83% of investors only want to take medium, low or no risks at all, this list of Top 20 preferences indicates that many investors may actually take risks higher than they would like.

-

Although investing in ETFs often gives the best diversification, investors need to beware of spreading money between ETFs that may actually be very correlated. Investing in these correlated ETFs will not bring about the intended level of diversification and further investigations are always needed, just the same as when investing in individual stocks.

"Although the study shows that there is less diversity among the most popular trades, we’re beginning to see a more optimistic trend when we consider the overall portfolio composition of our 150,000 Australian investors," says Sharesight’s Chief Customer Officer, Jessica Goodall.

"More investors are taking advantage of the tools available via the Sharesight and Diversiview integration, to better understand the diversity of their portfolios and in some cases, clarify their own attitude to risk."

We hope you found this article informative and useful in your investment journey. If you have any questions, feedback or comments, please contact the author, Dr Laura Rusu, at info@lensell.online.

Optimise your portfolio with Sharesight and Diversiview

If you’re not already using Sharesight and Diversiview, what are you waiting for?

Sign up for a free Sharesight account to get started tracking your portfolio’s performance, and sync your portfolio to a Diversiview account to get deep insights into your portfolio’s diversification and risk profile.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.

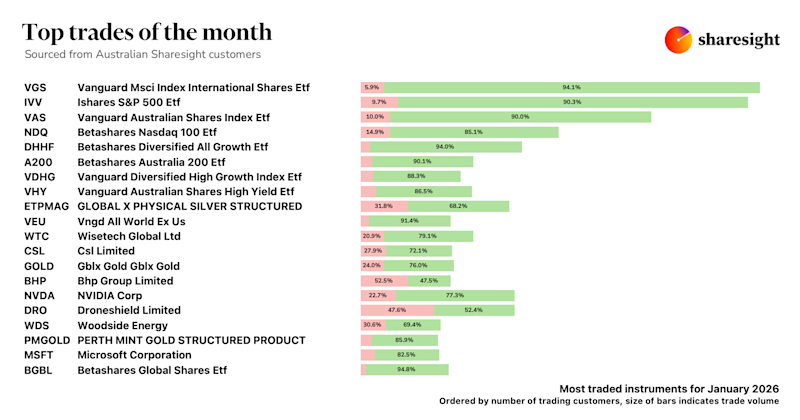

Top trades by Australian Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for Australian investors, where we look at the top 20 trades made by Australian Sharesight users.