What your broker tells you vs what they actually mean

Most Australian stock brokers, especially the online outfits run by the big banks, care about one thing: getting you to trade more. They’re not particularly interested in the "[picks and shovels](https://www.investopedia.com/terms/p/pick-and-shovel-play.asp)" aspect of investing, such as helping Australian investors complete their tax returns.

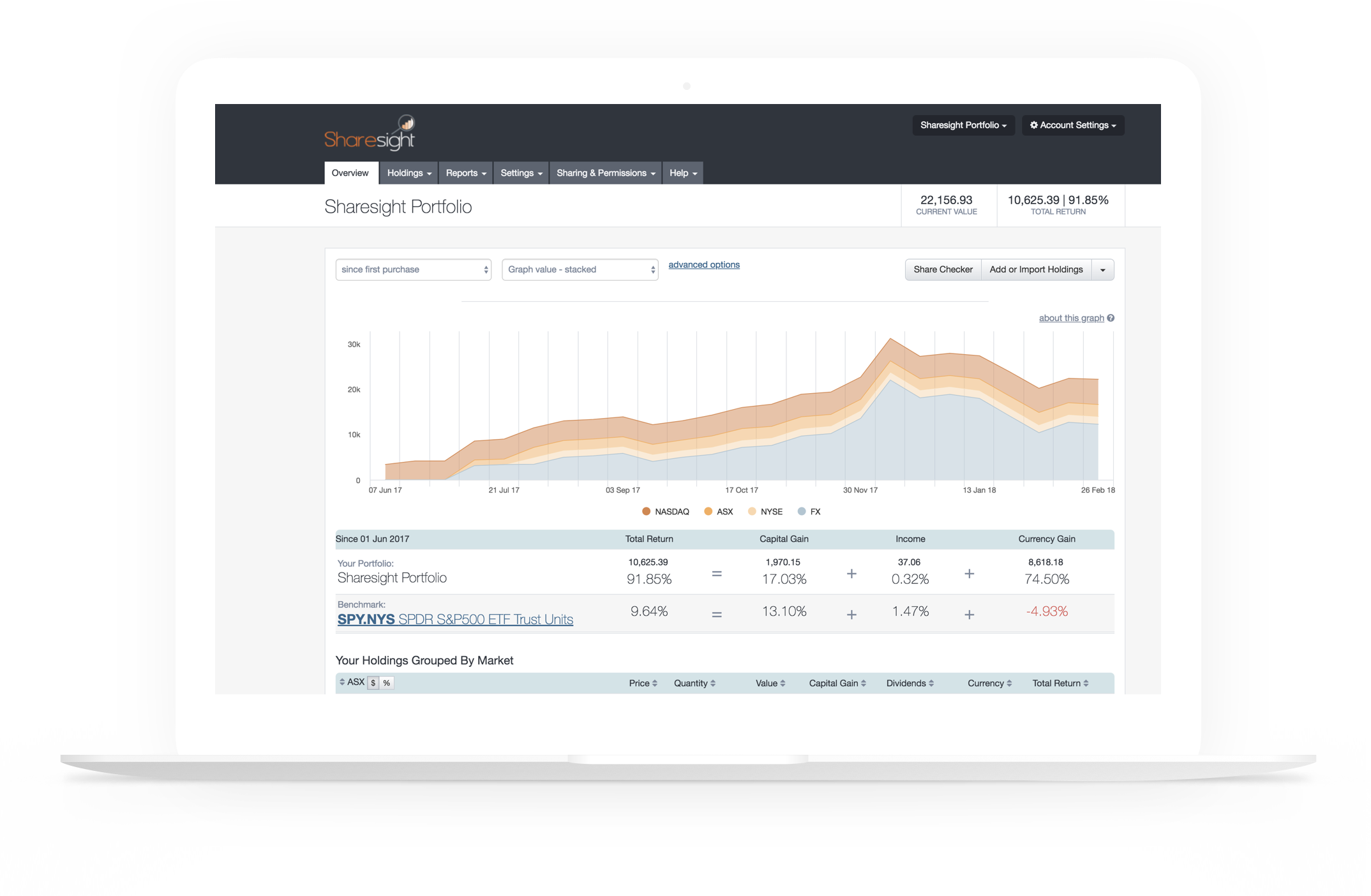

Fortunately, that’s exactly what Sharesight was built to do.

Right around this time of year I look forward to a bit of comic relief in my inbox. That is, the annual "how broker X is making tax time easy" email and marketing campaign.

If you define "easy" as downloading spreadsheets, sourcing three different registry websites for unit balances and dividends (god help you if you reinvest dividends), and checking PDFs for distribution data, then you’re in luck. Tax time will be a piece of cake for you!

What your broker tells you vs what they actually mean

There are a number of common phrases in these broker emails, here’s what they really mean:

| Broker Says | Broker Means |

|---|---|

| Be a Smart Investor at Tax Time | Savvy investors use tax time to their advantage, especially if they’re sitting on capital losses. Unfortunately, we don’t provide you with tax reports and if we do send you something notional it will be for the trades you’ve made with us, and not anyone else. |

| Update your Personal Details | We’ve posted you a bunch of stuff, hopefully you haven’t moved house. Would you like a home loan? |

| Download your Trades | Incredibly, the only way to view your transaction history is by downloading raw data into Microsoft Excel and parsing the actual share trades from the other junk (like the fees we charge you). |

| Review your Trade Confirmation Emails | We don’t make it easy to download all of these, much less a summary. Hopefully you’ve created an email filter so you find 12 months’ worth of trading history and then print each one for your accountant. Consider buying premium Adobe so you can collate PDF files. |

| Check your Dividends | Even though Aussie investors love dividends because of our incredible franking policy, we have no insight into your dividends whatsoever. You need to create an account on the three different registry websites and download your dividend history. This will probably cost you $40 per registry if you need historical data. |

| Update your Tax File Number (TFN) | The ATO is cracking down on the entire industry so it’s best you stay on top of your tax. Also, we’re now responsible for sharing capital gain and loss data with the tax office as well so it will pay to be organised! |

| Understand your Portfolio Performance | We’ll show you green numbers if you’ve made money and red numbers if you’ve lost money. If you see green, you probably owe some tax. We don’t provide information on investment duration, cost bases, or dividends. Also you can’t benchmark your portfolio against the market. |

Sharesight actually makes it easy at tax time

Unlike most brokers, Sharesight actually makes it easy for investors at tax time. With Sharesight you can:

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Automatically track your daily price & currency fluctuations, as well as handle corporate actions such as dividends and share splits

-

Run powerful tax reports built for investors, including capital gains tax (Australia and Canada), unrealised capital gains (Australia), and taxable income (All regions)

-

Easily import trades from the brokers that have partnered with Sharesight

The best way to understand what Sharesight is all about is to sign up and try Sharesight for yourself. We’re confident that you’ll agree that it’s the best portfolio tracker for investors.

FURTHER READING

Sharesight product updates – February 2026

This month's key focus was on the rollout of the new Investments tab to all users, along with various enhancements across web and mobile.

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.