What we learned when recruiting for our fintech

Finding quality people to join start-ups and small tech companies is a challenge. This is especially true in Australia, which is dominated by a few large institutions who seem to be endlessly padding their existing business lines and hiring for “special projects.” Furthermore, the local university system steers students into rigid disciplines. Online businesses don’t typically offer roles that match these disciplines exactly.

We’ve noticed a change recently, however, as we’ve increased our headcount. In Sydney, we’ve hired a Customer Service Manager and an Account Manager. Over in Wellington we’re onboarding a Project Manager next month.

For the two Sydney-based roles we received 150 applications. I was struck by the number, quality, and diversity of CVs – a major step up from when we hired people last year. I took this as an indication that perhaps the Sharesight brand is becoming recognised in the market, but more likely than that: people are now open to joining a fintech company.

Breakdown of applicant industries for two recent job openings at Sharesight

A full 25% of our applicants, including the Account Manager we hired, came from the big banks.

10% came from well-known technology companies.

The remaining applicants came from an array of professional services firms, industrial companies, telecoms, etc.

The background of candidates that we consider is obviously important. Understanding financial services, portfolio management, accounting, etc. are all pluses. But being too tied to these disciplines can also be a negative. Ours is a company where we can’t afford to NOT have our people colour outside the lines of their official job descriptions.

So what do we look for when recruiting for our fintech? We put more stock in the adaptability of candidates and the willingness to learn an entirely new business model. What we’re doing at Sharesight is novel and we need our people to wear many hats and get involved with all phases of our business.

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

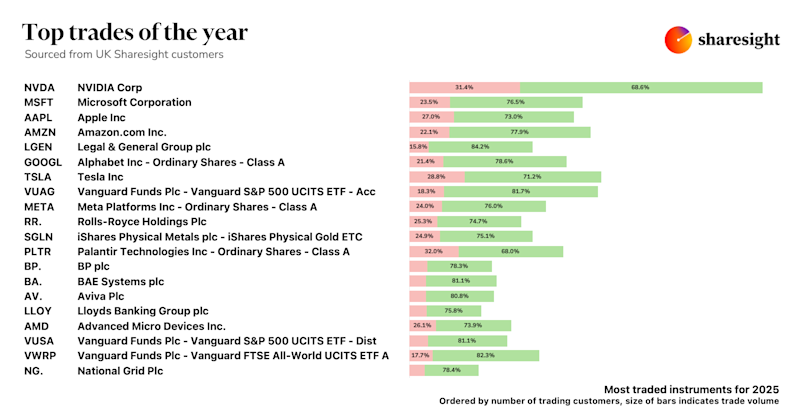

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

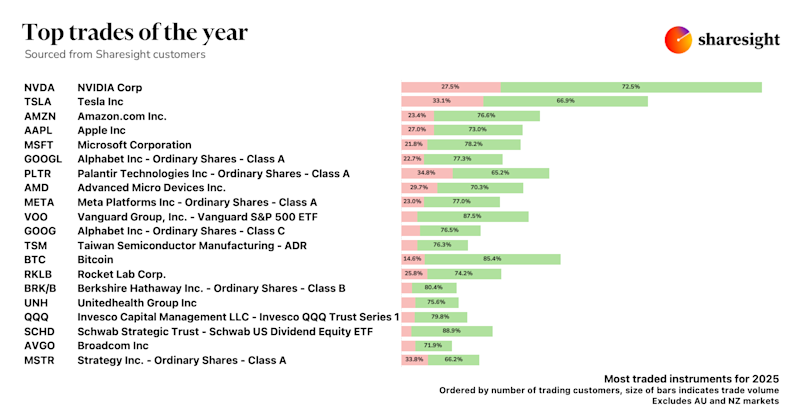

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.