What is the role of cash in an investment portfolio?

Investing in stocks and sitting on cash might seem like mutually exclusive options, but they can actually be two sides of the same coin.

Cash is commonly thought of as a defensive asset – a miniscule yield in return for a miniscule risk. However, cash can also turn into an offensive asset – dry powder you hold in reserve until you spot opportunity in the market.

That’s why most investors allocate at least some of their portfolio to cash.

Warren Buffett said it best: "Cash … is to a business as oxygen is to an individual: never thought about when it is present, the only thing in mind when it is absent."

4 reasons investors hold cash in their investment portfolios

Cash can help you minimise risk (particularly as you approach retirement)

The older you are, the harder it is to recover from a stock market crash.

That’s why many experts advise you to steadily reduce your risk as you get closer to retirement – in other words, to steadily increase the portion of cash in your investment portfolio.

In the six months following the collapse of Lehman Brothers in September 2008, the S&P 500 fell 46%, from 1,233.81 to 666.79. For older investors allocating most or all of their portfolio in stocks, the crash would’ve been devastating. But for younger investors in a similar position, the impact would’ve been much less severe, for two reasons:

● They still had many years of wealth creation left ahead of them ● The stock market was likely to recover losses sooner or later (the S&P 500 is now above 3,000 points - regaining its losses and then some)

The value of a stock can collapse to zero – Lehmans, for example, peaked at $86 in 2007, before becoming worthless in 2008. Cash, though, will always retain its face value (minus whatever gets eroded by inflation).

Cash lets you take advantage of opportunities

Cash doesn’t just shield you from losses when markets slide; it also gives you a chance to react quickly and take advantage of potential investment opportunities.

During corrections, as investors engage in panic-selling stocks, even ‘good’ companies fall in value alongside the broader market. That means those stocks effectively go ‘on sale’, offering a golden opportunity for prepared investors who hold reserves of dry powder (cash) to react quickly and buy stocks they see as undervalued.

Again, a little S&P 500 history illustrates the point.

In the four months to 21 September 2001, the index fell 26%, from 1,312.83 to 965.80. In the same period, Amazon’s share price dropped 54%, from $16.38 to $7.48. Of course, hindsight is a wonderful thing, but imagine if you recognised that Amazon had become extremely undervalued and you had liquid cash on hand to buy Amazon stock? Amazon’s share price is now above $1,700.

While all investors love it when markets continue to move up and to the right and none of us want to see a market correction. But when the inevitable occurs, anyone who can buy at the bottom of the cycle is well positioned to earn strong returns over the next market cycle.

Cash doesn’t only mean the money sitting in your investment account

One of the reasons investors like cash is because it’s liquid – ready to use the moment it’s needed.

But this isn’t always true. That’s because not all cash is created equal.

Cash that’s sitting in an on-call account (such as an investment, savings or transaction account) is fully liquid and can be accessed quickly.

Cash that’s invested in a term deposit is also fully liquid, but you might have to wait for the term deposit to end or pay an early termination fee before you can reclaim your money.

Cash that’s invested in money market instruments (such as US Treasury Bills) has cash-like levels of safety, but technically is no longer cash. So you can’t get your hands on the cash until the instrument has been liquidated – either by on-selling it or waiting for it to expire.

So if you devote some of your investment portfolio to cash, you need to understand the market liquidity risk of your different cash positions.

How much cash should you have in your portfolio?

The question of how much cash an investor should hold in their portfolio is harder to answer than it sounds.

Some experts recommend as little as 2%; others as much or more than 20% (especially if you include bonds/fixed interest). Where you sit on that spectrum will be influenced by three things:

● Your emergency savings buffer ● Your age ● Where we are in the cycle

To begin with, it’s important to have ‘emergency cash’. Many experts recommend that you keep enough cash to cover anywhere from three to six months of day-to-day expenses, so you can cope if you lose your job or cop a sudden bill. This emergency money may or may not be inside your investment portfolio, which is why it affects how much cash your portfolio should contain.

Your age is also relevant. As mentioned above, many experts recommend that you steadily increase your cash holdings as you approach retirement, as a form of risk management. Sometimes investors use what is called the 100 minus your age rule as a rule of thumb to calculate their relative equity/fixed interest+cash portfolio allocations - although with increasing life expectancy and ever lower returns expected in fixed interest investments this rule is increasingly questioned.

Finally, it’s important to consider where we are in the market cycle. If you believe the market expansion has a long way to run and there is a low risk of a significant correction, you might want to allocate less to cash; if you think markets are nearing the end of a growth cycle and increasingly risky, you might want to hold more.

Track your cash investments easily with Sharesight

Sharesight was built for the needs of investors actively managing their asset allocations like you, and makes it easy to get the full picture of your investment portfolio. Here’s how:

-

Easily track cash investments with Sharesight’s Cash Account feature

-

Plus use Sharesight’s integration with Xero to sync your cash & fixed interest investment to your portfolio

-

Track Macquarie cash management accounts (CMAs) automatically with a Professional account

-

Intraday foreign exchange rates updated every 5 minutes for 32 worldwide currencies – plus 8 cryptocurrencies to make tracking international cash investments easy

If you’re new to Sharesight, the best way to understand everything you can do to track your investment portfolio with Sharesight is to sign up and try for yourself.

Sharesight’s Cash Account feature is available on Investor and Expert plans as well as Professional plans. Upgrade your Sharesight account and try it today.

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

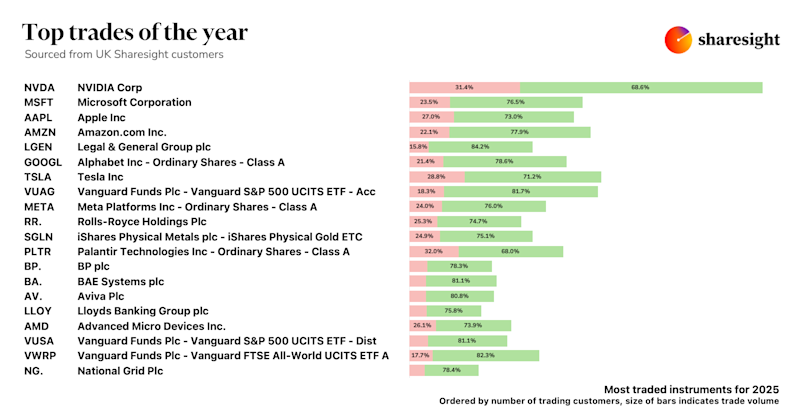

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

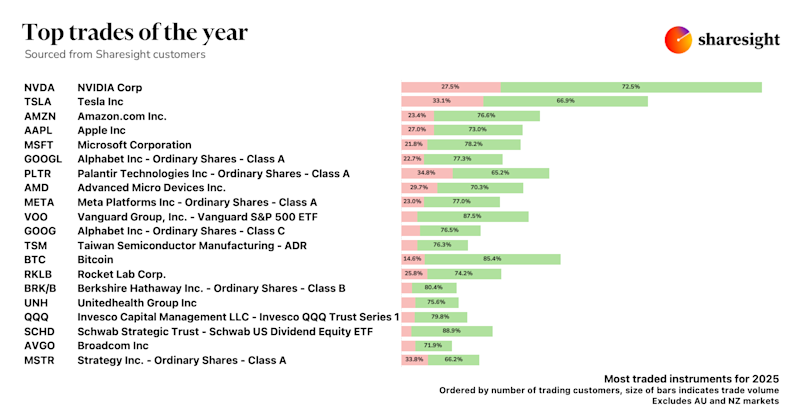

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.