What is a dividend yield trap?

In an increasingly low-return world, many investors turn to equities that pay strong dividends as a steady source of income to grow their returns. These "dividend investors" screen stocks on the basis of dividend yield. While investing in high dividend yielding stocks can be a good income strategy, it can lead to what’s known as a yield trap, dividend trap, or dividend yield trap.

What is dividend yield?

Dividend yield is the ratio of dividends distributed by a company during the year, divided by its share price. For example, if a company paid an annualised dividend of $5 and its current share price was $50, its dividend yield would be 10%. While it’s a simple ratio, it helps investors estimate the income yield they would earn from dividends by investing in a particular stock for a year.

What’s a good dividend yield?

Many investors consider a "good" yield as one that pays above the existing cash rate. A good dividend yield will vary depending on: the sector, interest rates and general business conditions.

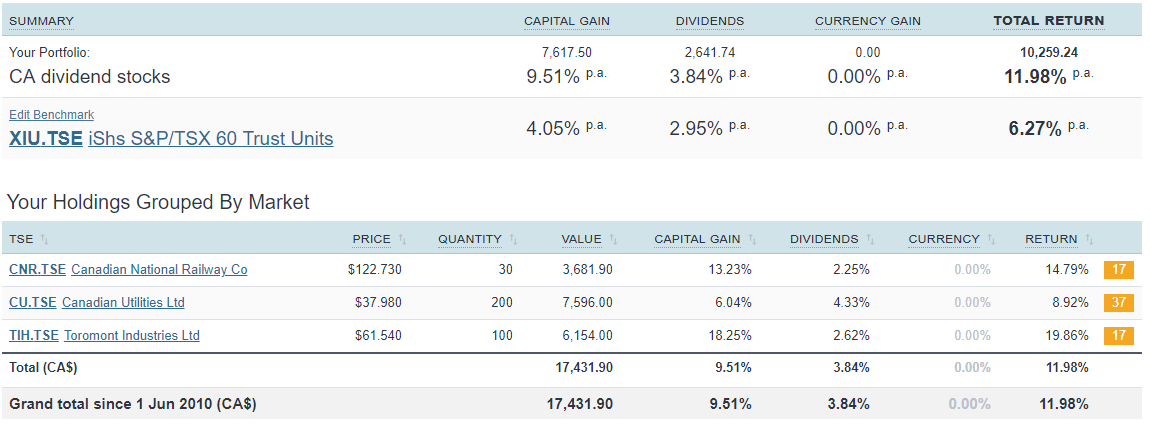

(Examples of high dividend yields in Sharesight)

(Examples of high dividend yields in Sharesight)

Why is seeking dividend yield potentially a trap?

The formula for dividend yield is:

Dividend yield = Annualised dividend payout per share / Stock price per share

This means that the dividend yield can increase if either the dividend payout increases or if the stock price decreases. If the stock price decrease is due to a fundamental issue with the underlying business, then you are buying into an underperforming company.

Hence, the term dividend yield trap.

As life expectancies increase, many retirees and dividend investors are likely to be in a retirement phase for 30-40 years. Therefore it’s important to look beyond just a stock’s dividend yield. Looking at the total shareholder return including both dividends and capital growth is key to make investments last a lifetime.

What are the signs of a dividend trap?

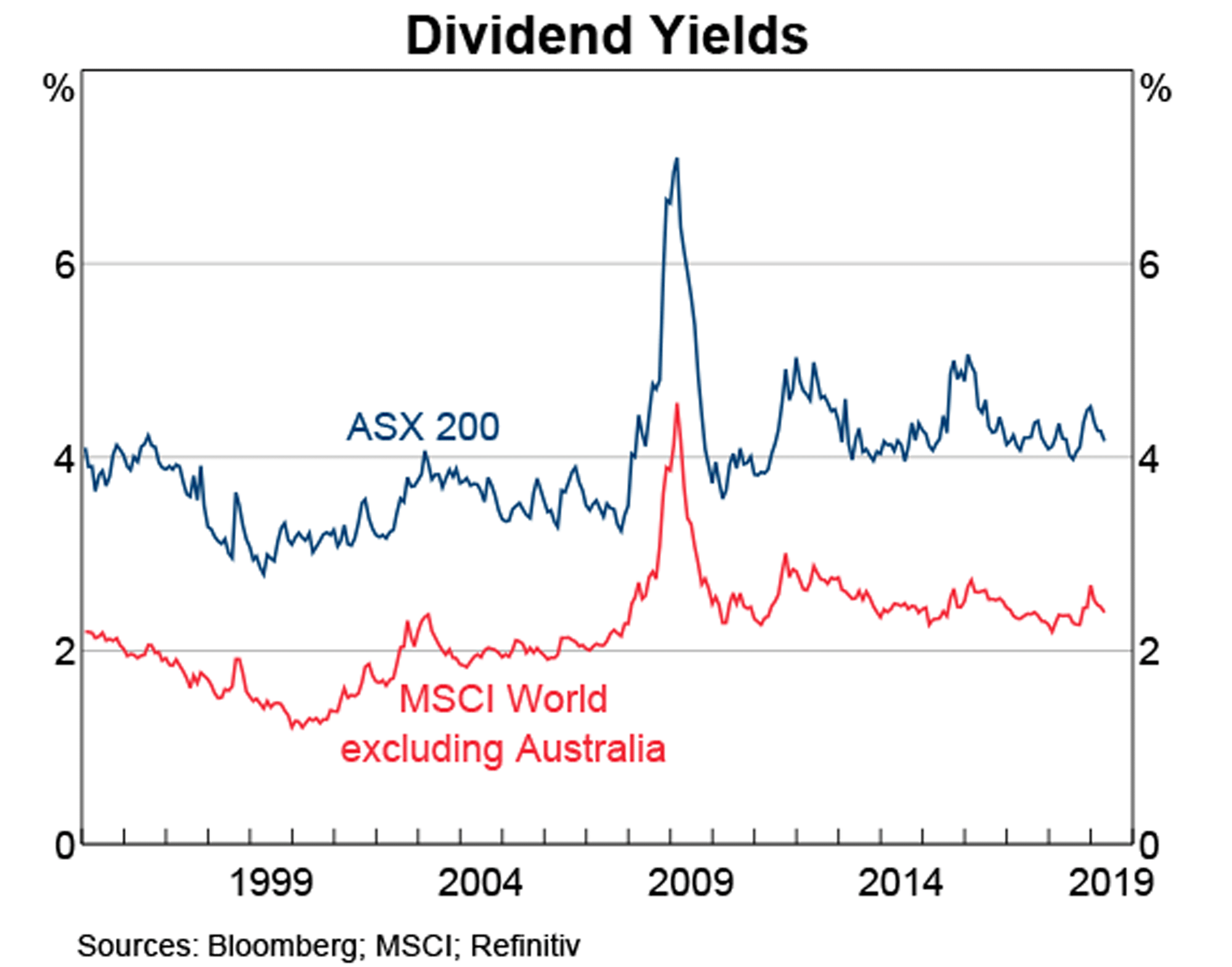

As a point of illustration, the chart below shows the dividend yield of the MSCI World ex-Australia and also the ASX200. The highest dividend yield occurred in 2009, when the stock prices were at their lowest ever. This data point shows that relying solely on the dividend yield is not sufficient.

While there’s no prescribed formula for spotting a dividend trap, some simple ratios should unearth more questions about the stock.

-

Is the yield over-indexing against industry peers? Some industries are known to have high dividend yields. But if a stock’s dividends are completely out of line with the rest of the sector, then it’s something to watch out for.

-

Debt to equity ratio of the company: If a company has too much debt, then it’s a warning sign for equity investors. Should there be a slower growth or any issues with the company, dividends will be impacted.

-

One-off profits: It’s important to look for any one-off profits driving dividend announcements and instead look at cash flow statements of the business.

-

Dividend payout ratio: If the ratio of dividends paid out to shareholders to the company’s net earnings is greater than 100%, that’s a sure shot warning sign. This implies that the company might be using dividends as a temporary appeasement of shareholders because of lacklustre share price performance.

What do investors look for instead?

So far we’ve discussed how to spot a dividend yield trap. Here are some qualities to look for in great dividend yield stocks:

-

History of dividends over a long period and dividend growth

-

Earnings growth

-

Leverage and use of debt on the balance sheet

-

Performance outlook for the company and its industry

How to use Sharesight to look at dividend and growth for a stock

With Sharesight, you can review the past performance and dividend history of any stock, ETF or fund in our database from over 40 leading global markets with the Share Checker tool. While past performance is not always the best indicator of future performance, it’s important to consider a stock’s history before looking toward their future prospects.

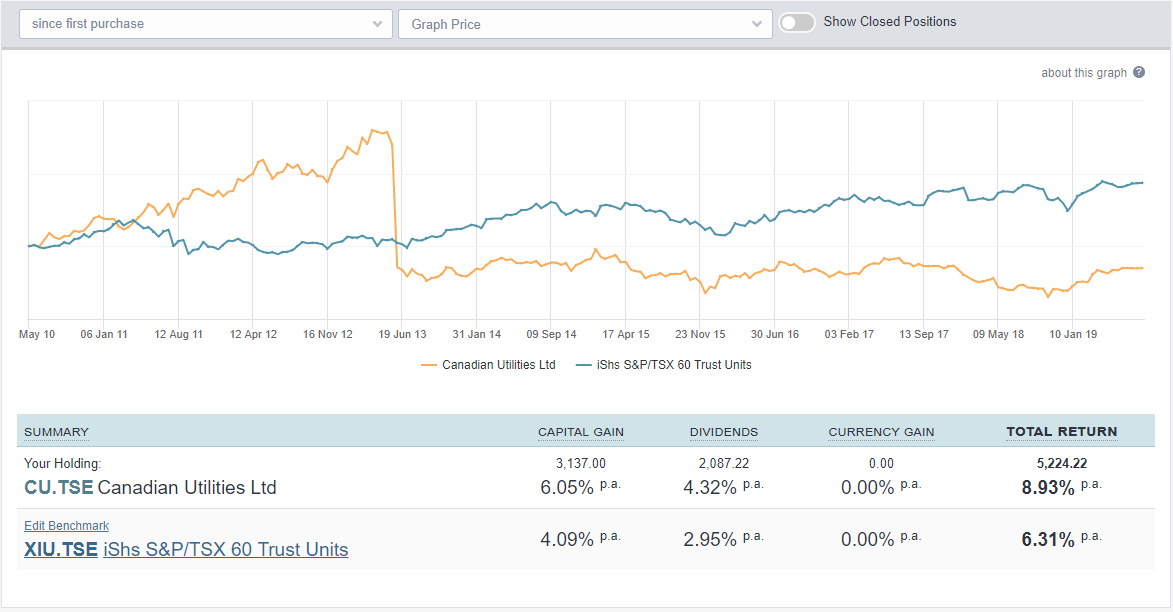

Here’s an overview chart on Sharesight of Canadian Utilities Ltd listed on the TSX.

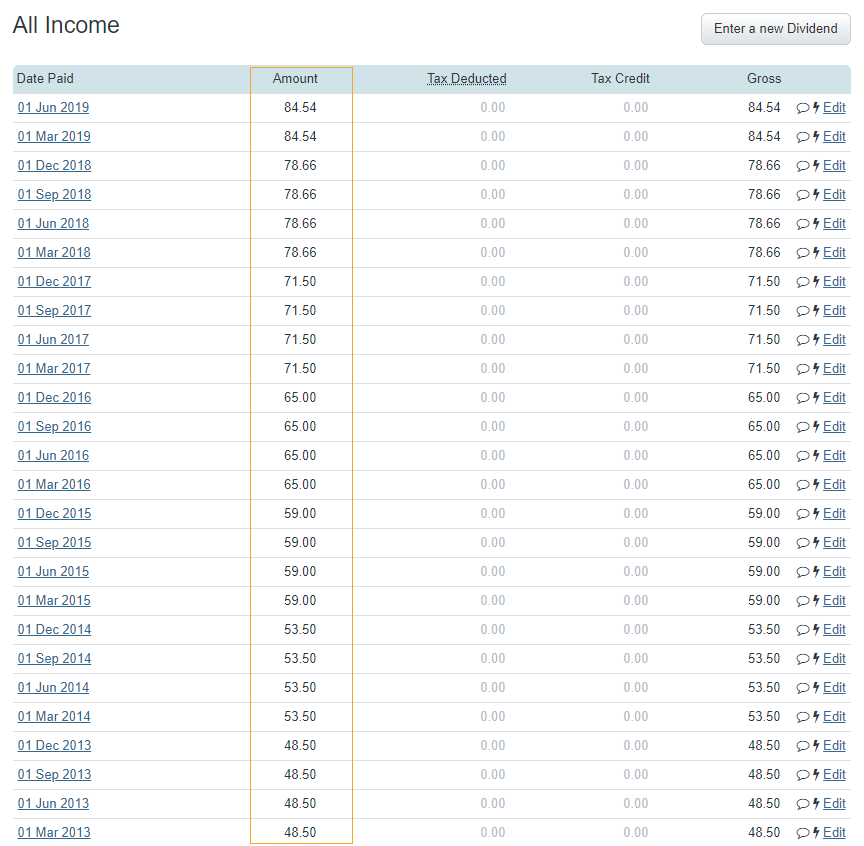

Close inspection of the income section shows consistent dividend and dividend growth for the stock.

Key takeaway

Dividend yield in isolation is not always a good measure for deciding whether to invest in a stock. Before considering dividend yield, it’s important to consider the fundamental business conditions in which the company operates and whether the stock in question has a strong history of dividend payouts to get a complete picture of the company. With Sharesight, dividend investors are better prepared because they see the complete picture of their performance, including both dividends (which Sharesight automatically tracks) and annualised returns.

Sign up for a FREE Sharesight account today to maximise your potential as a dividend-focused investor.

IMPORTANT DISCLAIMER

We do not provide tax or investment advice. The buying of shares can be complex and varies per individual. You should seek tax and investment advice specific to your situation before acting on any of the information in this article.

FURTHER READING

8 ways to use Sharesight's custom groups feature

This blog explains our custom groups feature, including strategies that can help you gain deeper portfolio insights and make more informed investing decisions.

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.