What is a dividend?

If you’re like most investors, you probably receive some dividend payments throughout the year. Keeping track of your dividend income can be a tedious process, but it is a necessary part of tax reporting for investors, not to mention an important part of calculating your portfolio’s performance. This blog will explain some of the different types of dividends, the pros and cons, the tax implications and how a dedicated portfolio tracking tool like Sharesight can help investors keep track of their dividend income.

What is a dividend?

If you are a shareholder of a company, they may pay you a dividend. A dividend is a small amount of money paid to shareholders either out of the company’s profit or by the company going into debt, as a reward for investing in the company. Not all companies pay dividends however; some companies choose to reinvest the profits they have made back into the company.

How do dividends work?

When it has been decided and approved by the board of directors, dividends are then paid to every shareholder on a per unit basis, according to the following process:

Step 1: The board of the company of which you are a shareholder discusses what should be reinvested in the company and whether a dividend should be paid to shareholders. If a dividend is decided, it is paid on a per-share basis.

Step 2: The decision is signed off by the board of directors.

Step 3: The company declares the dividend. This announcement will also include the value per share and the date on which the dividend will be paid.

Step 4: Shareholders receive their dividends.

Types of dividends

There are a variety of types of dividends a company may pay to its shareholders. These include:

Cash dividends: Cash dividends are the most common type of dividends you may receive. A cash dividend is a cash payment deposited directly into your linked bank account.

Special dividends: This type of dividend is not recurring like a cash dividend, but instead, it is a one-off payment. It is usually linked to a windfall or a large sale of assets. A special dividend is often larger than a cash dividend.

Scrip dividends: Scrip dividends occur when a company is low on cash. A scrip dividend is an alternative for cash or legal tender offered to investors. This may take the form of credit but is most often a document that acknowledges a debt to the investor.

Property dividends: These are assets provided to the investor instead of cash. Property dividends may take the form of the products produced by the company. The market value of the product is calculated and provided to the shareholder at the same value a cash dividend would be.

Stock dividends: Rather than paying cash dividends, companies may offer their shareholders extra stocks in the company.

Dividend reinvestment programs (DRPs/DRIPs): Similar to stock dividends, a DRIP program can give current shareholders a discount on shares and allow them to reinvest their cash dividends into the company.

Preferred dividends: A preferred dividend is paid on preferred stock. When a company cannot pay all dividends, preferred dividend claims are prioritised over common stock dividends.

How often are dividends paid?

How often dividends are paid varies from company to company. A majority of companies who are listed on the Australian Stock Exchange (ASX) will pay two dividends a year. The first dividend is paid halfway through the financial year. This is known as an "interim dividend" and is usually paid before a company's annual general meeting. The second dividend is known as a “final dividend”. Paid at the discretion of the Board of Directors, a final dividend is a percentage of earnings paid out after the capital expenditures and working capital.

Listed funds (ETFs) tend to pay dividends quarterly rather than semi-annually. Meanwhile, it isn’t uncommon for smaller companies to not pay dividends at all and instead reinvest their capital into the company for the shareholder’s future benefit. "Special dividends" can also be paid at any time, with a one-off payment occurring if the company experiences a large sale of assets or a windfall of some type.

How are dividends paid?

With the redistribution of a company’s profits to its shareholders, dividends can be paid in a variety of ways. This includes:

Dividend check: This is a relatively standard practice where dividends are mailed to the shareholder. Dividend checks are usually mailed after the ex-dividend date, which is when the stock begins trading without the previously declared dividend.

Cash: Cash is also a common way dividends are paid. Cash is paid into the shareholder’s nominated bank account at the same time as dividend checks.

Stock: Shareholders may be paid in the company’s stock to the value of the dividend. Also known as DRP/DRIP (dividend reinvestment programs), being paid in stocks allows the shareholder to increase their investment in the company over time.

Are dividends a steady form of income? And are they taxable?

In Australia, any dividends you earn as a shareholder are considered taxable income, although this varies according to the country in which you live. There are two types of dividends in terms of tax in Australia; franked dividends and unfranked dividends.

Franked dividends: This is a dividend that has a tax credit attached. Established in Australia in 1987, franked dividends were created to avoid shareholders paying double tax. When a shareholder pays tax with a franked dividend, they will only be taxed on the dividend portion, minus the franking credit.

Unfranked dividends: Unfranked dividends have had no tax paid on them, so there are no franking credits with which to offset the tax you will need to pay on your dividend.

It can be complex and confusing to calculate taxes on your investment portfolio, and using a dedicated portfolio tracking tool (rather than a spreadsheet) can be revolutionary. Built specifically for self-directed investors, Sharesight’s investment portfolio tax reporting can help simplify the process.

What are the pros and cons of dividends?

Companies that pay dividends distribute their net income amongst their shareholders. This extra income can be beneficial but is not always reliable. So what are the pros and cons of dividends?

The drawbacks of dividends:

-

Dividends can be unpredictable. Depending on decisions made by the board of directors, you may or may not receive a regular dividend on your shares, meaning dividends cannot be relied on as a steady stream of income.

-

If dividends are being paid on a stock, it means less money is being invested back into the company, which can be disadvantageous for the company in the long term. Companies that reinvest their income may grow more rapidly and expand more than those which redistribute their net income. Therefore, paying dividends may indicate a company has no plans for growth.

-

There can be taxation implications associated with dividends and losses resulting from this. Firstly, the company pays tax on its profits. Secondly, depending on the country you live in, you will need to pay a differing rate of tax on the dividends you receive.

The benefits of dividends:

-

Dividends provide you with income, even if it is not reliable. This is a great way to receive a return as a shareholder, without selling your shares. Dividends are also a form of passive income which requires no outlay of time and effort from you in order to earn money.

-

Dividends provide you with more money to invest. Reinvesting your dividends allows you to become an even larger shareholder in the company without risking money from any other part of your income.

-

Dividend income may be tax advantaged compared to capital gains on investments (varies by country/investment type).

How to calculate dividend per share (DPS)

Many companies follow what is known as a consistent dividend payout ratio. When this is the case, the company will consistently pay a percentage of its earnings to shareholders in the form of dividends per share (DPS). DPS is the sum of all declared dividends issued by the company you are a shareholder in, paid per outstanding share.

Companies will declare a dividend of X cents per share. To calculate dividend per share (DPS), you will need to multiply this by the number of shares you hold. Manually calculating dividends can be complicated, but our dividend calculator makes it easy to see your expected income at a glance. Our portfolio tracker also takes the hassle out of tracking your investments, giving you a running list of all your dividends and distributions over any period of time, as well as any upcoming (announced) dividend income.

What is the average dividend payout?

The average dividend payout varies between companies and between payments of dividends. The average dividend yield across the Australian stock market is around 4%. This is twice the average across the globe.

Track your dividends with Sharesight

Keeping track of your dividends can be a complicated and time-consuming process, especially for investors with large, mixed-asset portfolios. Sharesight’s portfolio tracker automatically tracks dividends and distributions, reducing the time investors spend on portfolio admin, especially at tax time. Other convenient features include the ability to track dividend reinvestment plans (DRPs), opt-in to email notifications about upcoming announced dividends, and see your upcoming dividend income with the Future Income Report.

Because dividends can have a significant impact on returns, Sharesight also includes dividends in its performance calculations, along with capital gains and losses, brokerage fees and currency fluctuations. This gives investors the full picture of their portfolio’s performance.

Track the impact of dividends on your investment performance

With Sharesight’s advanced dividend tracking and performance reporting features, investors can access unparalleled insights into their investments at the click of a button. With Sharesight investors can:

-

Automatically track your dividend and distribution income from stocks, ETFs, LICs and Mutual/Managed Funds – including the value of franking credits

-

Use the Dividend Reinvestment Plan (DRPs/DRIPs) feature to track the impact of DRP transactions on your performance (and tax)

-

Run powerful reports to calculate your dividend income with the Taxable Income Report, portfolio diversity and Capital Gains Tax obligations (Australia and Canada)

-

Easily share access of your portfolio with family members, your accountant or other financial professionals so they can see the same picture of your investments as you do

Sign up for a free Sharesight account and start tracking the impact of dividends on your investment portfolio today!

Disclaimer: The above article is for informational purposes only and does not constitute a product recommendation, or taxation or financial advice and should not be relied upon as such. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

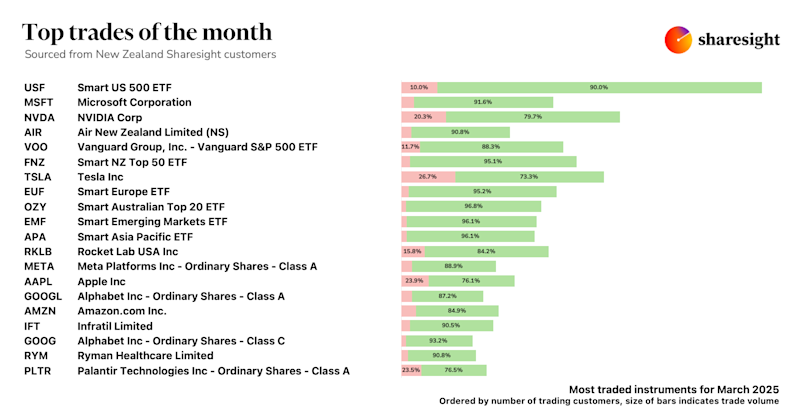

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.