What is a corporate action?

The term "corporate action" might sound dull, but when they occur, corporate actions can have material impacts on your investment performance.

The term reminds me of the cheesy 1987 film, Secret of My Success, starring Michael J. Fox. At one point, Fox’s character says something like "if we reduce costs and increase revenue, we can turn this thing around!" A bunch of people nod, one guy points to a folded copy of the Wall Street Journal, charts are pointed at, and there you have it... corporate action.

The bottom line for you, the investor, is that the corporate actions decided in the boardroom impact the investment performance and tax of shareholders. When a corporate action is announced you can bet on dramatic share price fluctuations -- and where there are performance disruptions, there are also tax implications.

In Australia, we’ve seen a flurry of corporate action activity this year involving some well-known brands. Wesfarmers announced they’ll demerge their Coles Supermarkets business, Nine Entertainment Group announced plans to acquire Fairfax Media, and French company Unibail Rodamco is acquiring Australian shopping centre operator Westfield.

In the simplest terms, a corporate action refers to when a company buys or spins off another company, or vice versa. There are a range of other complexities involving mergers, overseas stock exchanges, partial sales, special dividends, delistings, etc.

For investors, a corporate action typically results in:

-

Another company appearing in your portfolio

-

The company you originally bought is replaced by another

-

You receiving a special cash dividend

Technically, dividends are corporate actions as well.

In many cases, your broker won’t have a record of these corporate actions, which means you may be investing blind if you rely on these figures -- unless you use Sharesight of course!

Using the acquisition of Westfield for example, an investor owning Westfield shares will end up owning shares in not one, but two new companies and receive a cash distribution. Complex to be sure, but where does that leave you in terms of managing your portfolio?

How corporate actions affect your performance

When corporate actions are announced, the share market typically reacts in a dramatic way -- positively or negatively -- to the news. On the day the NEG/FXJ merger was announced Nine’s share fell 12%, while the price of Fairfax rose by 13% by the end of trade.

Obviously, you’ll want to stay on top of these corporate actions as they will affect the value of your portfolio. Fortunately with Sharesight you can be alerted when dramatic share price changes like this occur.

But as an investor, after a corporate action takes place your portfolio might now include holdings in unfamiliar companies. If you diligently research which companies to buy, it can be upsetting to now own something you are not familiar with.

As an example, years ago, I bought Spectra, an American energy company specialising in natural gas transportation. My theory was, "this is an undervalued company poised to take advantage of the natural gas boom, and the US is transitioning to exporting more and more of its energy". This theory worked for awhile, until the company was acquired by Enbridge, a Canadian company. After looking into the acquirer, I wasn’t really interested in being a shareholder so I sold out of the position before my theory could take effect.

One-off, cash dividends as a result of corporate actions are also common. These are the result of the acquiring company using shares and cash to purchase the target company. If you’re not monitoring your portfolio, you might be surprised to find a significant cash balance upon your next login. Receiving cash dividends like this is not necessarily a bad thing, unless of course you want to remain fully invested in the market. And of course, receiving a cash payment comes with tax implications.

How corporate actions affect your tax

Every corporate action is different, and each carry their own tax rules, which vary by country.

Corporate actions have a way of rewriting your investment history. If a company you own spins-off a new listed company, in effect you ’acquire’ that company at a particular price -- almost like a forced buy. That is, the transaction results in a change to your original cost base, which in turn affects your capital gain or loss amount.

If there is any sort of special or one-off dividend payment, typically this is treated as taxable income at the highest rate. In some instances, you might receive a stapled security or hybrid investment. These can combine equity and debt securities, resulting in you receiving some kind of fixed interest payment.

Sharesight and corporate actions

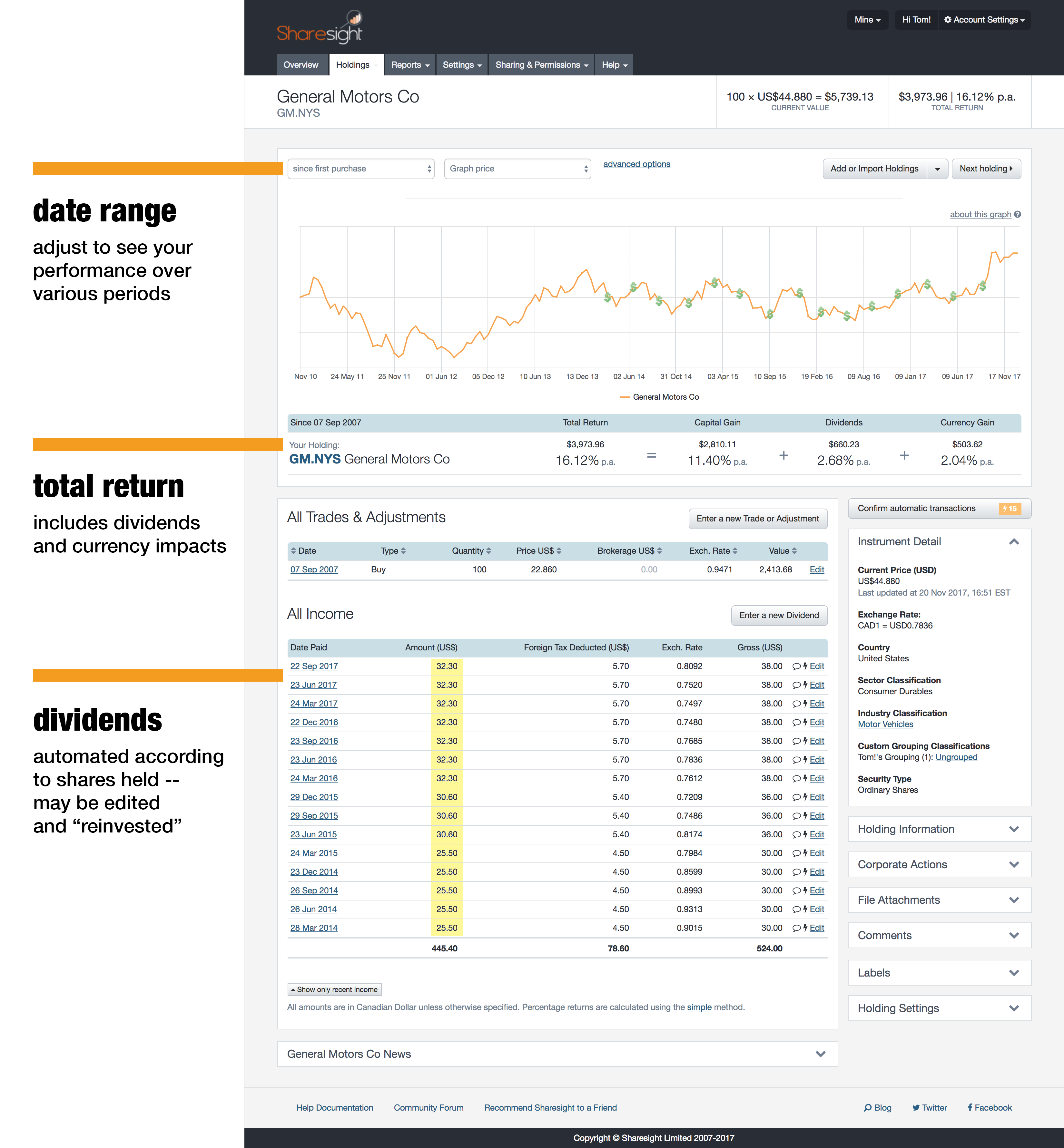

At Sharesight, we automatically handle most corporate actions that impact your portfolio. Whenever dividends, company name changes or share splits occur they will typically be recorded automatically by Sharesight on your behalf, and you’ll be alerted via our email notification feature.

There are some corporate actions, however, where there are adjustments you’ll need to record manually. Anytime there’s a shareholder decision involved (e.g. do you want a cash dividend or shares?) you’ll need to take action inside Sharesight.

The Sharesight client support team monitors market announcements to inform you of upcoming corporate actions that require manual adjustments, and proactively reaches out to investors with step-by-step guides on how to handle them where possible. Should you need help recording an adjustment from a corporate action and we don’t already have a guide in our help centre, send a message to our team for assistance.

Corporate actions don’t have to be a chore

Staying on top of corporate actions before Sharesight used to be a chore. With Sharesight automatically recording corporate actions such as dividends and stock splits, if you’re not already using Sharesight, what are you waiting for?

Join thousands of investors around the world already using Sharesight to manage their investment portfolios. To get started, simply sign-up for a FREE Sharesight account to start tracking your investments and find out what you’ve been missing.

To learn more about how Sharesight handles corporate actions, visit our Corporate Actions help page. And for help with other corporate actions, leave a message on our community forum.

Important Disclaimer: We do not provide tax advice. Make sure you seek appropriate tax advice before implementing the ideas in this post.

FURTHER READING

8 ways to use Sharesight's custom groups feature

This blog explains our custom groups feature, including strategies that can help you gain deeper portfolio insights and make more informed investing decisions.

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.