What is a capital call transaction?

Many of our clients are sophisticated and experienced investors who use Sharesight to get a consolidated view across multi-asset class portfolios. Sharesight supports tracking a wide range of asset classes, many with prices updated automatically. In this post we’ll cover how to track what is known as a capital call transaction -- a type of transaction that is commonly encountered in private equity investments.

Private equity capital calls

A "capital call" or “draw down” transaction occurs in the context of private equity and venture capital investments. It is the legal term for the scenario where an investment firm asks for the capital already committed to it by an investor to provide the funds -- usually when an investment deal is due to close.

For example, an investor might commit $500,000 into a private equity fund. This is called capital commitment. But she may pay only $100,000 on signing the agreement. A certain period of time later, the fund may issue a capital call for the remaining $400,000 over a period of years, so the investor can meet her commitments. This means that the cost base of the investment goes up in line with the capital calls.

Returns through return of capital, dividends and interest payments

To illustrate this, consider the following example of an investor (let’s call him Harry) who has committed $500,000 to a private equity fund called PE fund 1. In his Sharesight portfolio, Harry adds this holding as a custom investment under the Investment type ‘Ordinary Shares’ for the original amount paid into the fund of $100,000.

Harry then uses Sharesight’s custom groups feature to create his own group called "Private Equity" into which he has grouped this investment to help track it alongside any other private equity investments.

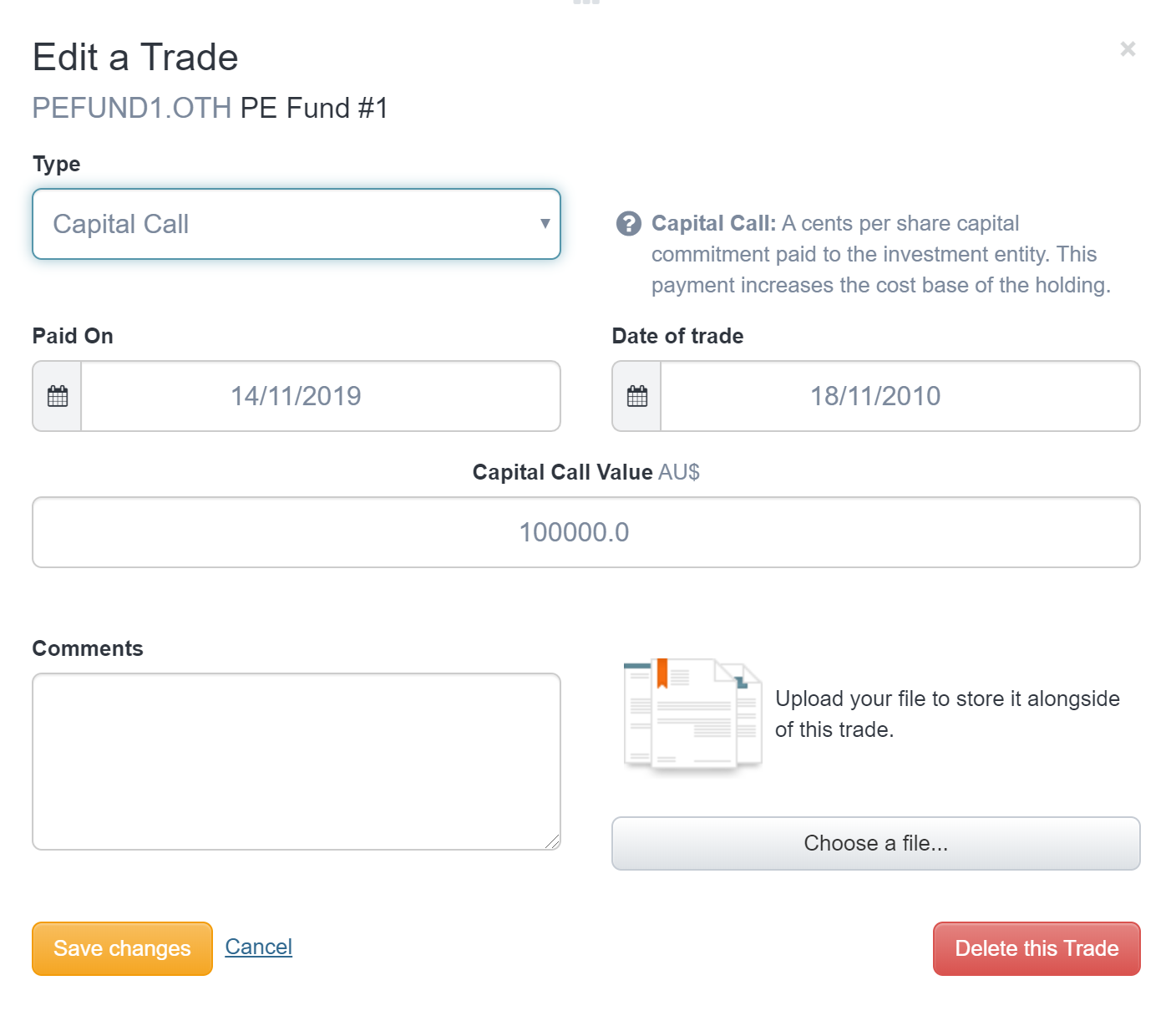

Thereafter, the fund sends a capital call notice to Harry for another $100,000. He records this in Sharesight as a "capital call" transaction by adding a trade or adjustment to the holding and selecting the appropriate transaction type per the screenshot below

Whenever there is a return of capital by the fund, this can be recorded using the same process and instead selecting "return of capital" as the transaction type.

Track multi-asset class portfolios in Sharesight

By bringing all his investments into Sharesight, Harry is able to see the return from the private equity fund, in the same manner as a publicly listed stock. This way, he is able to compare the total annualised return in the same dimension and manner as the rest of his portfolio.

The capital call and return of capital transactions represent the capital movements in and out of the fund, while the dividends are paid as franked or unfranked amounts depending on where the underlying revenue was generated.

The cost base of the holding is increased by the capital call value. Over time the fund is expected to return money (ie: make distributions) in the form of capital or dividends. These have different tax implications depending on the fund and tax implications of the individual investor.

![]()

Be a rational and disciplined investor

A big part of being a disciplined investor is documenting your investment strategy. The reports and features highlighted above are just two of the ways Sharesight makes it easy to track asset allocation and your investment performance.

With Sharesight you can:

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology.

Track all your investments in one place (across multiple asset classes) and in turn compare different asset classes by the same performance metrics so you can identify winners and losers in your portfolio.

The best way to understand what Sharesight is all about is to sign up and try Sharesight for yourself. We’re confident that you’ll agree that it’s the best portfolio tracker for investors.

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.