What does the economic future hold for NZ? (part 2)

For those of us with an interest in the share market this is an issue of some importance. We all know that when the markets take a tumble they will rise again, but it would be great to get a handle on how long it will be before we see an upturn and how strong that upturn will be.

So what does the economic future hold for NZ? Here's my take on the situation. Caveat: I might change my mind next week!

There is no doubt that there is going to be a major reorganisation of credit globally. In my last blog I said that the consequences of such a massive change that will embroil the Government (and quasi-government organisations) so extensively in the financial markets, are impossible to predict. I hold to this, but I also think that while this process is occurring, the productive sector will quickly get back to something approaching normalcy. In other words the players will soon stop obsessing over the score and concentrate on the game.

Clearly NZ will not escape the impact of the credit crisis (particularly as our household debt is so high) or the recession that is likely to hit most of our trading partners. But there are good reasons to believe we will be less severely affected than most. Unlike many countries we have not had major bank collapses, our financial system has not been hijacked by out-of-control derivatives trading and the Reserve bank has more latitude than its overseas counterparts to provide further stimulus via interest rate cuts if necessary.

All this suggests to me that the NZ economy is likely to be less severely affected than most (in marked contrast to the situation that prevailed after the 1987 share market crash). Reduced demand as a result of the looming world-wide recession should keep the lid on oil prices for some time and further aid NZ's recovery. In addition, renewable energy and sustainable food production are likely to become watch-words and NZ will be in the vanguard in both these vital areas.

So back to our share market. What might all this mean? I believe it will be good news. Our economy will recover more quickly than most and be less severely affected. This will enhance NZ's reputation as a sound place to invest and re-stimulate investment in our share market from both local, and more importantly, offshore investors.

This is not to say it will not be tough going in NZ for a few years but here's another bit of good news. I believe that the full impact of current downturn in the NZ economy is already fully reflected in the NZ share market and then some. Not convinced? Consider this quote:

I've given up looking at my own share price because it doesn't make any sense to real life at all. I mean if I looked at it I'd think there was something gravely wrong with the company, which there is isn't. I mean it's bloody stupid.

Michael Hill

So how long before an upturn and how strong will it be I don't know but I have certainly persuaded myself not to give up on the NZ share market. How about you?

This information is not a recommendation nor a statement of opinion. You should consult an independent financial adviser before making any decisions with respect to your shares in relation to the information that is presented in this article.

FURTHER READING

My investment portfolio used to be gold bangles

For International Women’s Day, Morningstar's Shani Jayamanne explores the ways that women have taken back financial control.

Simplify property tax & investment tracking with TaxTank + Sharesight

Simplify property tax management with the Sharesight + TaxTank integration—track CGT, investment income, and tax data in one seamless, automated platform.

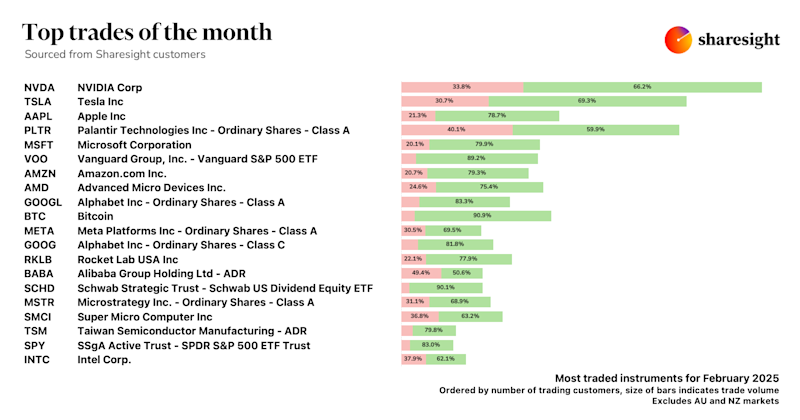

Top trades by global Sharesight users — February 2025

Welcome to the February 2025 edition of Sharesight’s trading snapshot for global investors, where we reveal the top 20 trades by Sharesight users worldwide.