We have had another share market collapse. So what?

My top 5 points to ponder before you act on the latest share market collapse

Just when we thought the worst was over, the share market takes another tumble.

I know we have to be mindful about what is happening overseas but things are much better in Australia and NZ so what is the problem?

If, like me, you are not sure what the problem is we are in good company. Retail king Gerry Harvey was recently quoted as saying ‘Australians should be as happy as pigs in shit with low unemployment and a resources boom, but instead they're scared to spend money’.

So it looks like we are not spending money and we are taking it out of the share market as well. But where is all this new-found cash going? If it’s reducing debt great, but if you think it might be safer under the bed because the share market is heading south, here are my top 5 points to ponder before you take action.

-

The share market is volatile – you knew that before you invested. Dramatic gains can be offset by equally dramatic losses. But history shows very clearly that in the long run our markets produce good returns with gains exceeding losses.

-

Don’t over-emphasise what happens today. It is human nature to do this but current events, good or bad, are not the way to gauge what will happen in the long run.

-

To ensure you can maintain a long-term focus, only invest cash that you are sure you will not need for short-term requirements.

-

If the market takes a tumble you have made a paper loss; not a real one. Ask yourself if you know a better place (under the bed?) to put your money than in share market – especially when it is at low point! As long as you don’t bail out you are guaranteed to participate 100% in the inevitable bounce back!

-

Finally remember that doing something is not necessarily better that doing nothing. Besides doing nothing is easier and in the case of the share market, may well produce a better result.

This information is not a recommendation nor a statement of opinion. You should consult an independent financial adviser before making any decisions with respect to your shares in relation to the information that is presented in this article.

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

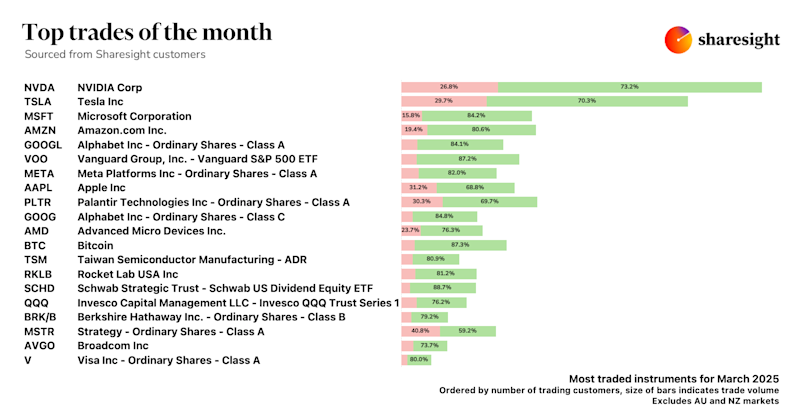

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.