We don’t know how lucky we are

When you consider that investors in many, if not most, countries round the world face a comprehensive capital gains tax on shares, our Kiwi customers can be grateful that they don’t have to put up with anything other than their Foreign Investment Fund (FIF) regime, ridiculous though it is.

Many of the countries without a comprehensive capital gains tax regime have half-baked alternatives that look every bit as unwieldy as the FIF regime so Kiwis are lucky compared to most of the rest of the world.

Our Aussie customers do have a comprehensive capital gains tax regime but the fact that both NZ and Australia allow for franking/imputation credits is cause for rejoicing because there has been a worldwide trend away from imputation/franking credits. Australia and NZ are about the only OECD country that still allows imputation credits. I’m sure that in many countries taxes are lower to partially compensate for this but ‘partially’ is the operative word.

Imputation/franking credits eliminate the double taxation of company profits that would arise if companies paid dividends from their after tax profits only to have these dividends taxed again in the hands of the investor.

Your Taxable Income Report will show you at a glance the extent to which imputation/franking credits have reduced your tax liability and which of your investments have had Withholding Tax deducted.

Imputation/franking credits only apply to locally sourced income, so dividends from a company with offshore operations are taxed based on the full amount of the dividend which therefore reduces the after-tax return of the dividends they pay. The net result is that imputation/franking credits favour locally generated income and provide an extra incentive to local companies to pay strong returns to shareholders.

P.S. Sharesight is proud to have Australian and NZ shareholders and to further the spirit of trans-Tasman cooperation it would be great if the NZ Government would allow Australian franking credits to be recognised in NZ and vice versa!

FURTHER READING

My investment portfolio used to be gold bangles

For International Women’s Day, Morningstar's Shani Jayamanne explores the ways that women have taken back financial control.

Simplify property tax & investment tracking with TaxTank + Sharesight

Simplify property tax management with the Sharesight + TaxTank integration—track CGT, investment income, and tax data in one seamless, automated platform.

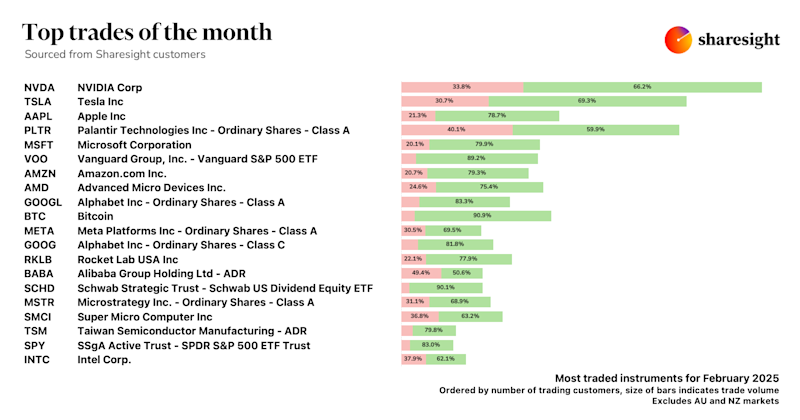

Top trades by global Sharesight users — February 2025

Welcome to the February 2025 edition of Sharesight’s trading snapshot for global investors, where we reveal the top 20 trades by Sharesight users worldwide.