Volatile markets: 3 mistakes investors should avoid

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

Market volatility may be an inevitability, but it can make even seasoned investors nervous. Throw in big macroeconomic themes like inflation, interest rate hikes, the war in Ukraine and ongoing Covid concerns dominating the headlines, and fixed-income securities or even cash may start to look more attractive than equities. However, the silver lining to volatility is that it also creates opportunities for savvy investors who invest for the long haul and avoid some of the common pitfalls.

What is market volatility?

Volatility in the context of financial markets refers to rapid stock price fluctuations and price swings between sectors. But while investors often only associate volatility with downside volatility, the more likely outcome is that the market – and individual listed stocks − will experience both sharp up and sharp down days. And historically the market has produced some of its highest returns in the wake of downturns with both the 2008 financial crisis and the recovery from the Covid-19 pandemic in 2020 being recent examples. While neither of these events were much fun for investors watching their portfolios diminish, those who took the opportunity to buy more stocks as prices fell were often handsomely rewarded in the aftermath.

Common mistakes investors make in volatile markets

With the stock market flashing more red than green, economists weighing up the likelihood of a recession and central banks raising interest rates, it can be tempting for investors to jump the share market ship for safer harbours. But by leaving they risk missing the best days of the market as every dollar invested in a downturn goes further as it has more room to grow over time. Some common mistakes investors make are:

Panic-selling stocks for cash

Wanting to sell out of investment positions when markets drop is very natural, but this instantly makes a temporary loss permanent. The flight to cash when markets are falling means everyone else is rushing to sell and this is generally not the best time to join in.

While some investors may cash out and look to re-enter the market when stocks are trading at a discount, this means timing the market and holding cash for an extended period in an inflationary environment. Buying low and selling high sounds great but, over time, markets go up far more than they go down.

This doesn't mean you should ‘set and forget’ but rather take into account an investment's future prospects and the role it plays in your portfolio, rather than being guided by noise and fear. In most cases, volatility passes and investors who keep their money invested are usually better off as bear markets give way to a steady but possibly uneven recovery with value to be found in market dislocations.

Investors may find some comfort in tracking their portfolio against a benchmark such as an index-tracking ETF that closely resembles their portfolio’s stock holdings or asset allocation. This allows the investor to put their performance into context with the broader market and determine whether their portfolio is underperforming due to their own investment decisions, or whether it has been caused by broader market events – with the latter suggesting that the investor should not necessarily rush to sell off all their underperforming stocks.

Benchmarking is made easy with Sharesight’s benchmarking tool, which allows investors to benchmark their portfolio against over 240,000 stocks, ETFs and funds from around the world.

Missing the rebound

The strong recovery that often follows a market downturn should underscore how exiting can cost you when the market reverses direction. One investment strategy for mitigating volatility is known as dollar-cost averaging, as market fluctuations are less relevant for those with long-term investment horizons. This practice allows savvy investors to exploit lower prices rather than lock in losses by irrationally selling at the bottom of the market by buying set amounts of stock at regular intervals.

Dollar-cost averaging can make it easier for fearful investors to move out of cash, since they can avoid the worry of putting a big chunk of money into the market, only to have the sell-off resume. Aside from taking away the risk of trying to "time the market", this strategy can help to reduce the impact of short-term price volatility risk to a portfolio and maximise its long-term growth by smoothing out the market’s ups and downs. Over time, dollar-cost averaging may result in a lower average cost per share than investing a lump sum.

It should be noted however that dollar-cost averaging can result in higher transaction costs, which may erode returns. To see the impact of brokerage fees on their portfolio’s performance – plus automatically track all their transactions – investors should consider using a portfolio tracking tool such as Sharesight, which shows investors the full picture of their performance and automatically records buy and sell trades, dividends, distributions and DRPs.

Second guessing diversification

Having a diversified portfolio helps to smooth out returns over time but, in times of volatility, investors may be tempted to rebalance the scales. Market downturns can be a great wake-up call to reconsider your risk tolerance, but this is worth reflecting on during times of stability rather than acting to decrease your exposure to equities in favour of bonds and other defensive assets in real time.

Asset classes respond to market conditions differently and there may be many moving parts. For example, the correlation and diversification properties within each asset class are also critical to managing market volatility. However, there is no doubt that market changes can skew a portfolio’s asset allocation from its original target.

During a major market selloff, a portfolio’s asset allocation to equities tends to decrease substantially, as stocks sell off and bonds rally. Investors may neglect to rebalance their portfolios back into equities and, as a result, may extend the amount of time the portfolio takes to recover from market drawdown.

In times of volatility, investors may find it useful not only to establish their asset allocation and calculate their diversification, but also to evaluate the performance of their asset allocation strategy. This can be done automatically with Sharesight’s contribution analysis tool, which breaks down the total return of an investor’s portfolio by the components that are driving their returns, such as stock selection, asset allocation or exposure to certain countries, sectors or industries. By running this report at regular intervals, investors can keep an eye on their portfolio and be ready to rebalance their asset allocation if needed.

Stay on top of volatility by tracking all of your investments in the one place

Thousands of investors worldwide are already using Sharesight to navigate market volatility by tracking all their investments in one place. What are you waiting for? Sign up and:

-

Track all your investments in one place, including stocks in over 40 major global markets, mutual/managed funds, property, and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

-

Run powerful reports built for investors, including Performance, Portfolio Diversity, Contribution Analysis, Multi-Period, Multi-Currency Valuation and Future Income (upcoming dividends)

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account and put your investment portfolio in the best position to navigate market volatility today.

![]()

FURTHER READING

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

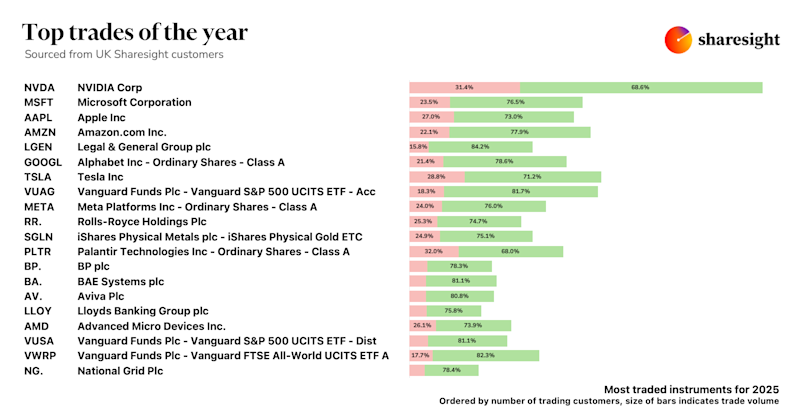

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

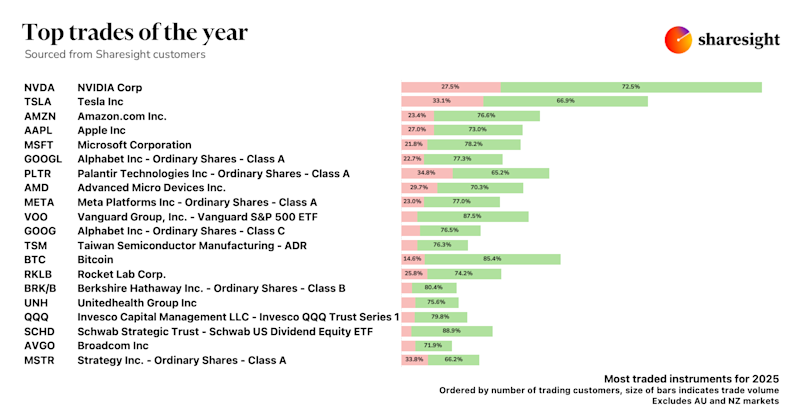

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.