Track your Vanguard Australia trades with Sharesight

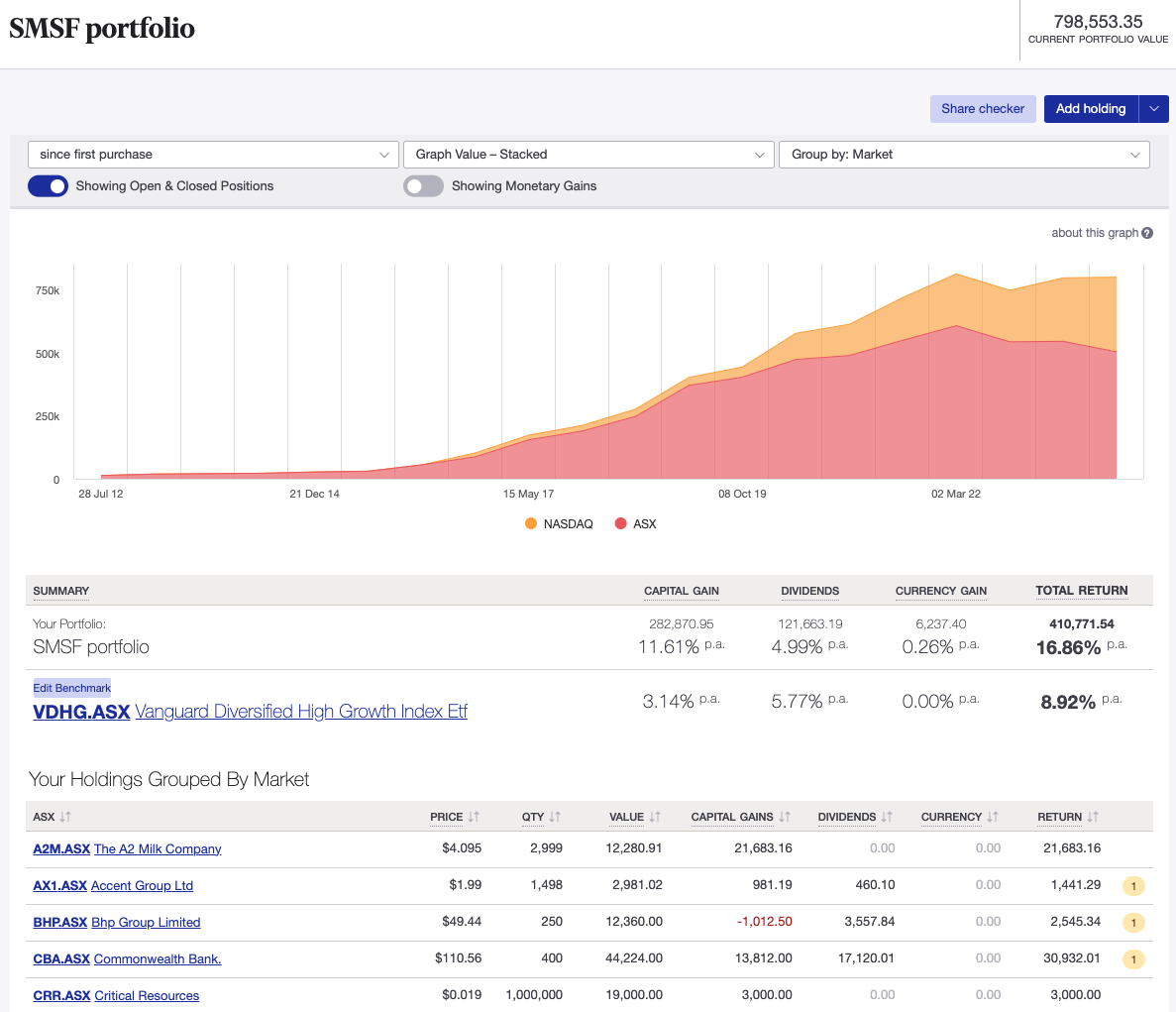

Investors trading with Vanguard Australia Personal Investor can import their trades to Sharesight’s investment tracker, giving them access to award-winning performance, dividend-tracking and tax reporting. With support for more than 200 leading global brokers, plus automatically updated price and dividend information on over 240,000 stocks, ETFs and funds, Sharesight is the ultimate tool to track the performance of all of your investments in one place.

Who is Vanguard Australia Personal Investor?

Established in the US in 1975, Vanguard began with 11 funds and $1.8 billion in net assets, before launching the first index fund for US retail investors in 1976. The fund provider expanded to Australia in 1996 and by 2009, it had launched ETFs for Australian retail investors. As of today, Vanguard is the largest ETF manager in Australia.

Why you should track your Vanguard trades with Sharesight

By importing your Vanguard trades to Sharesight, you can easily track your investment performance across different brokers, asset classes and markets. You will also gain access to Sharesight’s automatic dividend tracking, plus advanced performance and tax reporting tools designed for self-directed investors.

Importantly, Sharesight takes into account the impact of capital gains, dividends, brokerage fees and currency fluctuations when calculating returns – giving you the complete picture of your portfolio’s performance. Sharesight also offers a range of powerful reports including performance, portfolio diversity, contribution analysis, exposure, multi-currency valuation, multi-period and future income (upcoming dividends). The ability to track cash accounts, property and even cryptocurrency is just another reason you should consider using Sharesight to track your investment portfolio.

Track your dividend income

Unlike other portfolio trackers, Sharesight automatically tracks dividend and distribution income (including franked dividends and dividend reinvestment plans) and takes this into account when calculating your investment return. In the screenshot below for example, dividends make a significant contribution to this stock’s returns, highlighting the value of a portfolio tracking solution that includes more than just capital gains in its performance calculations.

![]()

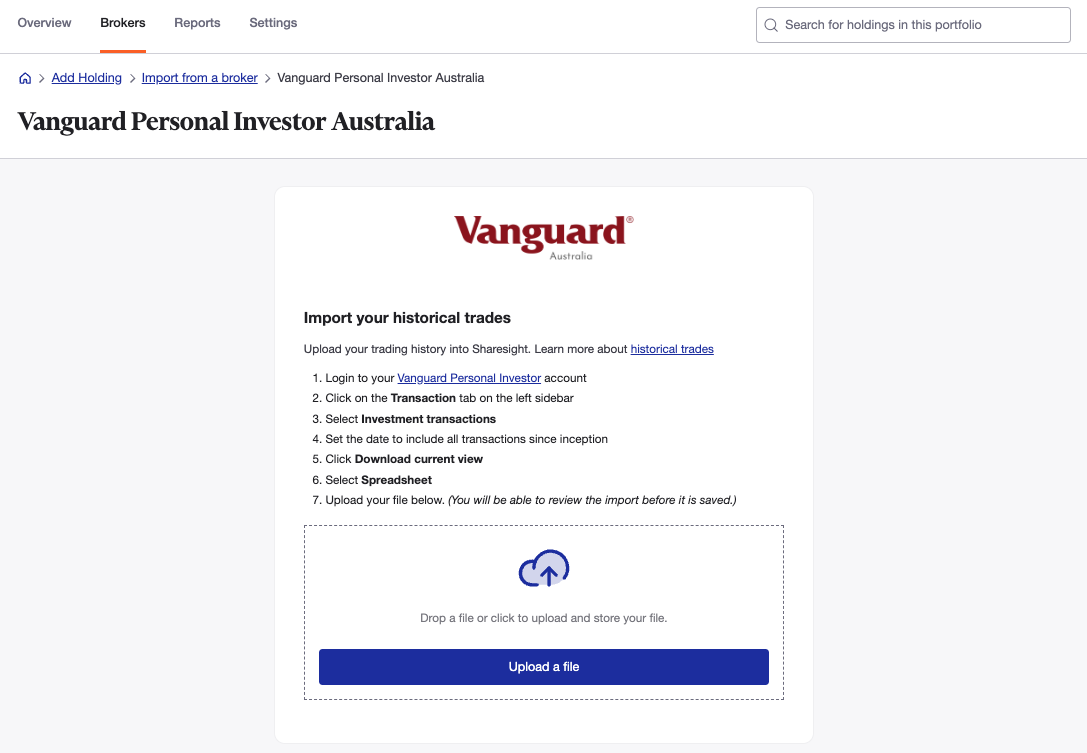

How to import your Vanguard trades to Sharesight

Sharesight allows you to import your historical trades to Sharesight by uploading a spreadsheet file filled with trades from your Vanguard account. This is especially useful if you need to import a large number of trades. All you need to do is select Brokers at the top of the page, search for Vanguard Australia and upload your file.

Start tracking your Vanguard trades with Sharesight

Thousands of investors like you are already using Sharesight to manage their investment portfolios. What are you waiting for? Sign up and:

- Track all of your investments in one place, including Australian and international stocks, ETFs, managed funds, property and even cryptocurrency

- Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, exposure, multi-currency valuation, multi-period and future income

- See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.