Track stapled securities with Sharesight

Disclaimer: The below article is for informational purposes only and does not constitute a product recommendation, or taxation or financial advice and should not be relied upon as such. Please consult with your financial adviser or accountant to obtain the correct advice for your situation.

Sharesight has a range of convenient features designed to help Australian investors at tax time. This now includes improved support for ASX-listed stapled securities, which have important tax implications for investors. To learn more about stapled securities and how Sharesight helps Australian investors keep track of them, keep reading.

What is a stapled security?

A stapled security is an investment product that is created when two or more securities are legally bound together and cannot be purchased separately. This is typical in real estate investment trusts (REITs), for example, where the trust will have its units stapled to companies that it is closely linked to. Stapled securities are most commonly found in Australia, but exist in markets around the world.

Stapled securities can be challenging to track, which can cost investors time and money when doing their tax return. According to the ATO, while stapled securities are dealt with as one unit, investors need to remember that they consist of multiple securities, each with their own cost base and distributions. This can make tax returns complicated, as the owner of a stapled security will need to include dividends from the company and distributions from the trust separately. Capital gains and losses will also need to be calculated separately for each unit. From a tax perspective, it is crucial that this information is properly recorded, especially where paid and ex dates for dividends are concerned, as well as the ‘trust’ and ‘non-trust’ components of payouts.

Tracking stapled securities with Sharesight

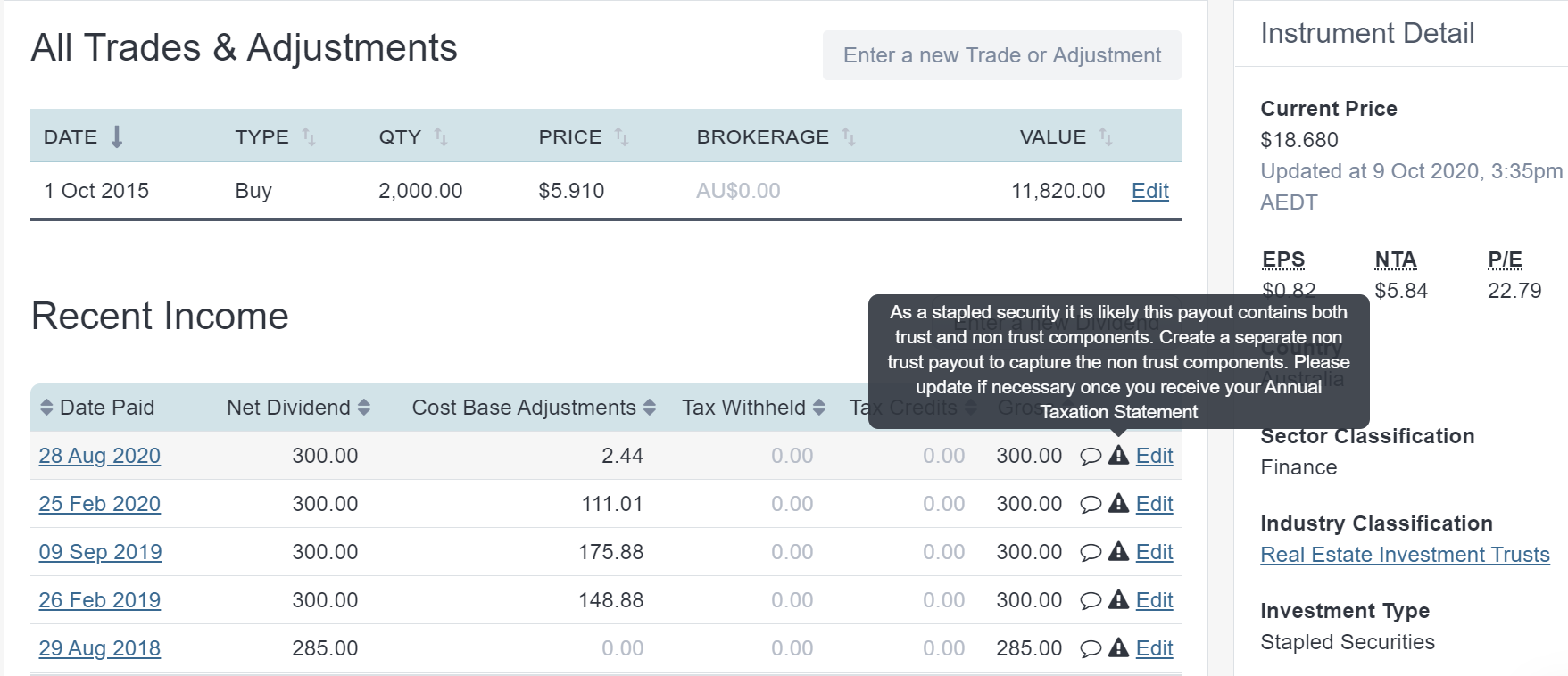

To help users track their stapled securities, Sharesight now has the capability to differentiate stapled securities from unit trusts. Users with stapled securities will receive a prompt asking them to classify their payouts as trust or non-trust components, which ensures they can correctly calculate capital gains and losses alongside the rest of their investments, preventing them from paying more in tax than they need to.

A stapled security holding with distributions that need to be classified as trust or non-trust components.

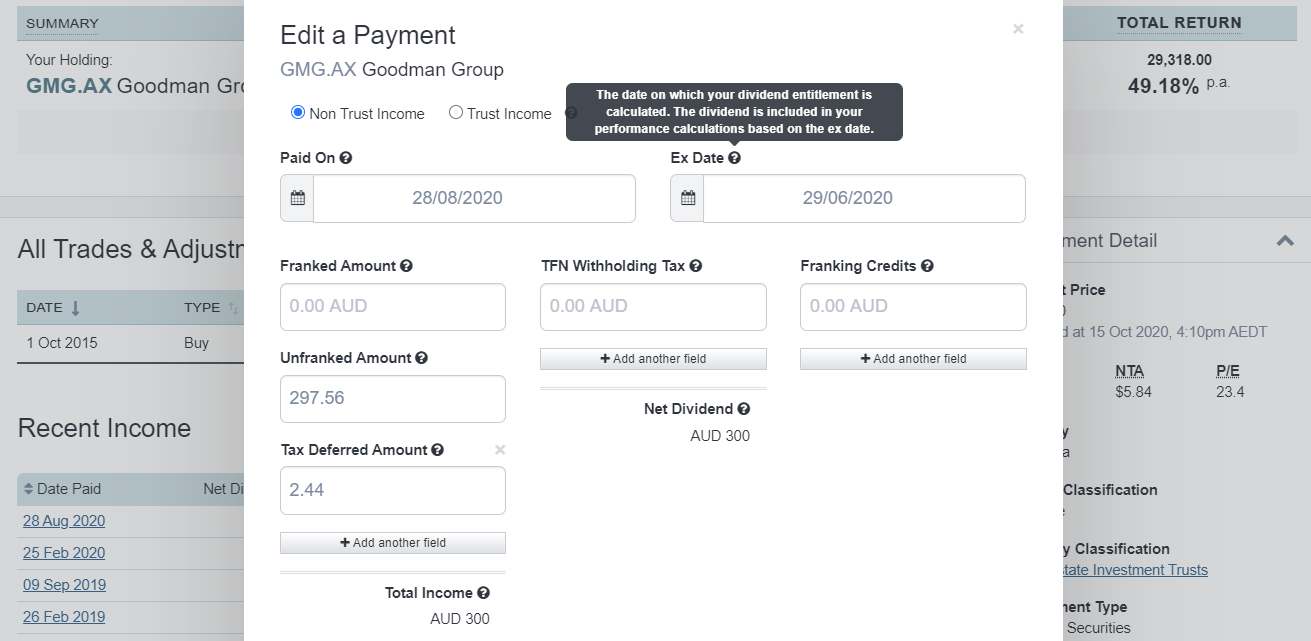

To review the distribution income and ensure the payout details are correct, simply click edit on the highlighted payment and adjust the values accordingly, updating ‘trust’ payouts to include only trust components, and creating a separate payout to track any non-trust components.

Ensuring these components are correct is particularly relevant for payouts with an ex date on one side of the financial year (before 30 June, for example) and a paid date on the other side of the financial year. These details are also best updated at the end of the financial year, when investors receive their final statements for stapled security payouts. This is because while payout statements throughout the year may have component breakdowns, these values can change at year-end.

A stapled security payout classified as a non-trust component.

Properly classifying payouts as trust and non-trust components will also ensure these payments appear in the correct section of Sharesight’s Taxable Income Report. A useful feature for investors who need help with tax reporting, this report compiles a list of all dividends, distributions and interest payments within a selected period, providing the required information for ATO tax returns.

Sharesight – the perfect tool for Australian investors

Sharesight’s support for stapled securities is part of our commitment to helping Australian investors track their investments and save time and money on their taxes.

Built for the needs of Australian investors, with Sharesight you can:

-

Easily share your portfolios with accountants or financial professionals to make admin and tax compliance a breeze

-

Track your investment performance with prices, dividends and currency fluctuations updated automatically

-

Run powerful tax reports built for Australian investors, including capital gains tax, unrealised capital gains, and taxable income (dividend income)

Sign up for a free Sharesight account and start tracking your investments (and tax) today.

FURTHER READING

Why investors are more informed, yet less confident than ever

More information doesn't always mean more confidence. Learn what's driving the client engagement gap and how advisers can close it.

Sharesight product updates – February 2026

This month's key focus was on the rollout of the new Investments tab to all users, along with various enhancements across web and mobile.

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.