Track Qtrade Investor stock trades using Sharesight

It’s easy for Canadians trading with Qtrade Investor to get started tracking their investment portfolio performance using Sharesight. Qtrade Investor clients can import their trading history to Sharesight via spreadsheet, plus capture their ongoing trades by automatically forwarding their trade confirmations, unlocking the power of Sharesight’s performance and tax reporting in a few easy steps.

Why use Sharesight with Qtrade Investor?

-

Sharesight automatically tracks your daily price & currency fluctuations, as well as handles corporate actions such as dividends and share splits

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful tax reports built for Canadian investors, including Capital Gains and Taxable Income

-

Track your TFSA, RRSP and RRIF investment accounts with tax calculations built to CRA rules

How to import your historical Qtrade Investor trading data

Importing your Qtrade Investor trades into Sharesight is easy. All you need to do is:

-

Download your historical trading data CSV from Qtrade

-

Import your historical trades into Sharesight using our file importer tool

Once your trades are imported, Sharesight will automatically calculate the impact of most corporate actions that impact your portfolio (including dividends and share splits).

How to track ongoing Qtrade Investor trades

Sharesight’s Trade Confirmation Emails feature is an effortless way to import historical and ongoing trades to a Sharesight portfolio. By simply having your broker’s trade confirmations forwarded to your unique Sharesight email address, all of your trades are synced to your portfolio, inclusive of corporate actions such as dividends, mergers and stock splits, with no effort on your part.

Start tracking your Qtrade Investor trades with Sharesight

Thousands of investors like you are already using Sharesight to manage their investment portfolios. What are you waiting for? Sign up and:

-

Track all of your investments in one place, including Canadian and international stocks, mutual/managed funds, property and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

-

Run powerful reports built for investors, including Performance, Portfolio Diversity, Contribution Analysis, Future Income, Multi-Period and Multi-Currency Valuation

-

See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

![]()

FURTHER READING

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

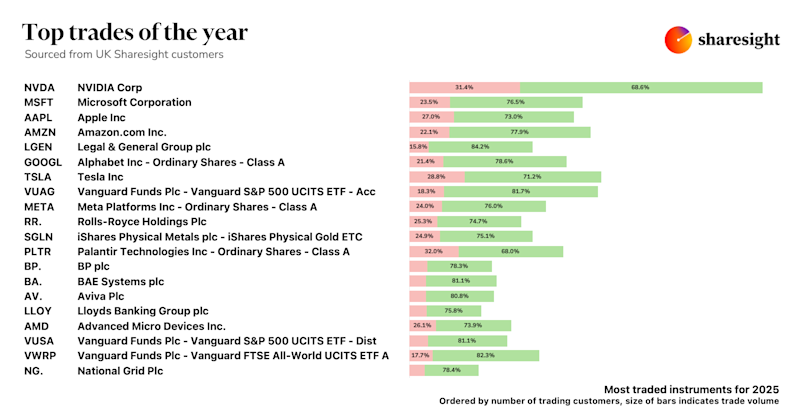

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

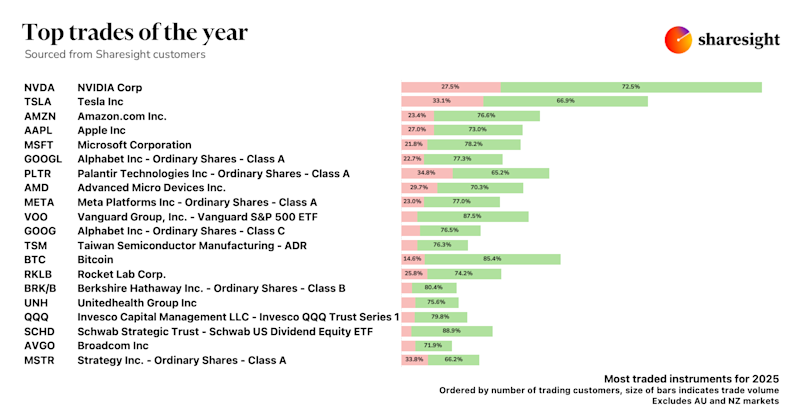

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.