Track investments in over 100 currencies

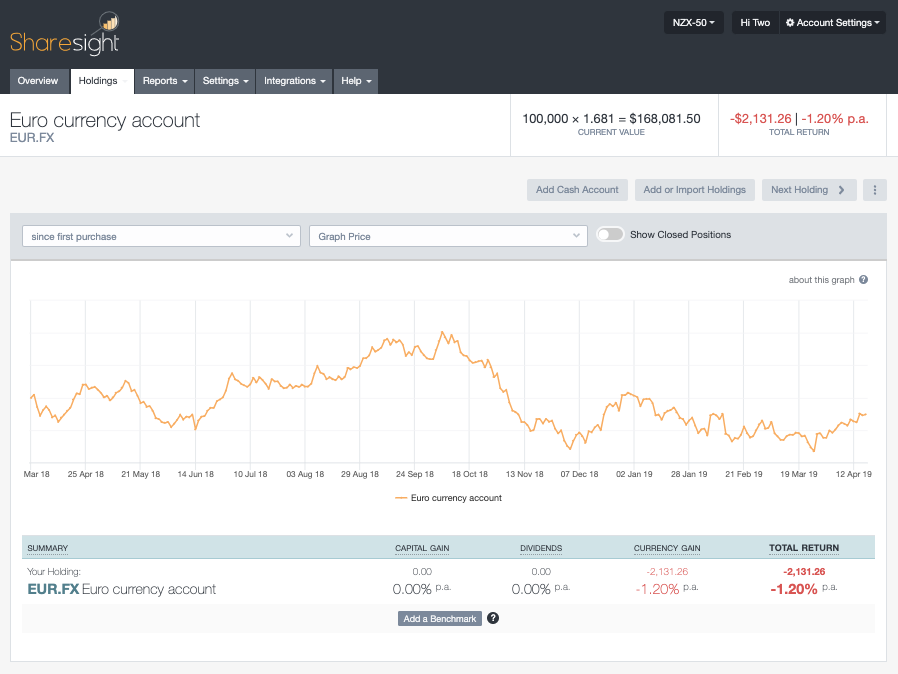

Sharesight now supports over 100 currencies, allowing investors to track FX holdings and hold investments denominated in a vast range of worldwide currencies, with prices updated every 5 minutes (20 minute delayed).

We’ve expanded support to include the full list of currencies tracked by the OpenExchange Rates API – so investors can track investments in the currency of almost any country on earth.

Track over 100 different FX currencies with Sharesight

With this change, investors can now track FX holdings in over 100 currencies, in addition to a range of cryptocurrencies.

Create Sharesight portfolios in even more countries

Sharesight is already used in over 100 countries worldwide, with native support for over 100 global currencies, investors can easily track the impact of foreign exchange rates on on their portfolio performance.

Sharesight is the investor’s passport

Sharesight understands the importance of diversifying your investments internationally. Adding support for even more intraday exchange rates (and now tracking over 40 stock exchanges around the world) is all part of our vision to be the investor’s passport and help you achieve the best investment performance.

Track your global investment portfolio with Sharesight

Thousands of investors like you are already using Sharesight to manage their investment portfolios. What are you waiting for? Sign up and:

-

Track all of your investments in one place, including stocks, ETFs and managed funds from over 40 global markets, property and even cryptocurrency

-

Automatically track your dividend and distribution income as well as dividend reinvestment plans (DRPs/DRIPs)

-

Run powerful reports built for investors, including Performance, Portfolio Diversity, Contribution Analysis, Future Income and Multi-Currency Valuation

-

See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.