Track Independent Reserve crypto trades with Sharesight

With 6% of Sharesight’s paid users tracking cryptocurrency, including 10% of our Expert plan users, we’ve had a number of requests to make it easy for users to import their crypto. In response to this growing number of requests, we have added support for our first cryptocurrency exchange, Independent Reserve, allowing investors to automatically track their trades in 8 leading cryptocurrencies supported by Sharesight.

Not only can you track crypto, but with support for more than 200 global brokers and over 40 markets worldwide, plus automatically updated price and dividend information on over 240,000 stocks, ETFs, and mutual/managed funds, Sharesight is the ultimate tool to track all of your investments in one place.

What is Independent Reserve?

Established in 2013, Independent Reserve is a digital currency exchange that allows investors to trade in cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP), which are also supported by Sharesight. Based in Australia, the exchange serves investors worldwide, allowing them to trade in cryptos using Australian, New Zealand, US and Singapore dollars.

Why you should track Independent Reserve trades with Sharesight

By syncing your Independent Reserve cryptocurrency trades to Sharesight, you can easily track your investment performance in crypto, stocks, ETFs and managed/mutual funds across different brokers and markets, and take advantage of Sharesight’s advanced performance and tax reporting designed for the needs of self-directed investors.

Built for the needs of global investors, Sharesight takes into account the impact of capital gains, dividends, brokerage fees and currency fluctuations when calculating returns – giving investors the full picture of their portfolio’s performance. Sharesight also offers a range of powerful reports for investors including Performance, Portfolio Diversity, Contribution Analysis, Multi-Currency Valuation and Future Income (upcoming dividends). The ability to track cash accounts and property is just another reason that investors should consider using Sharesight to track their investment portfolio.

How to import your Independent Reserve trades to Sharesight

Sharesight’s Trade Confirmation Emails feature is an effortless way to import historical and ongoing trades to a Sharesight portfolio. By simply having your broker’s trade confirmations forwarded to your unique Sharesight email address, all of your trades are synced to your portfolio, inclusive of corporate actions such as dividends, mergers and stock splits, with no effort on your part.

Note: It is also possible to import your historical crypto trades via spreadsheet file, however enabling the Trade Confirmation Emails feature is the most convenient way to sync your crypto trades to your portfolio.

What if I trade cryptocurrencies not supported by Sharesight?

What if I trade cryptocurrencies not supported by Sharesight?

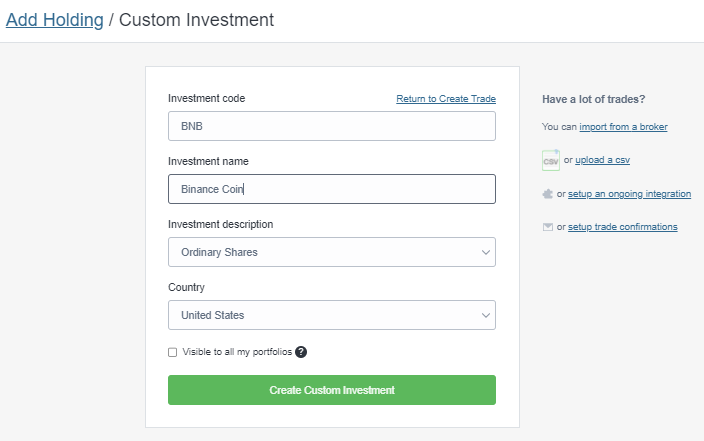

If you trade cryptocurrencies other than the 8 that are supported by Sharesight, you can still track your investments by adding a Custom Investment into your Sharesight portfolio.

To add a Custom Investment, simply click ‘Add New Holding’ on the Portfolio Overview or Holdings page, and select ‘Add a custom investment’ from the top right-hand corner of the Manual Holding screen.

When entering a cryptocurrency custom investment into Sharesight, make sure to select the country of the fiat currency used to purchase your cryptocurrency.

When entering a cryptocurrency custom investment into Sharesight, make sure to select the country of the fiat currency used to purchase your cryptocurrency.

Once you have created a Custom Investment, you will be redirected to the Manual Holding screen to add details such as the trade date, trade type, quantity and price. To track the performance of your crypto investment in your portfolio, simply update the price movements by uploading a spreadsheet of prices or manually entering the price movements on a regular basis.

If you are tracking custom crypto investments along with the rest of the stocks in your portfolio, it is also advised that you classify your investments using the Custom Groups feature to easily differentiate between these different asset classes.

Help us add support for more cryptocurrency exchanges

Are you trading through a cryptocurrency exchange not currently supported by Sharesight? Help us add support for your exchange by leaving a message in the chat interface located at the bottom-right of Sharesight. All we will need is some sample buy and sell trade confirmations (email or PDF) and the email the exchange sends them from.

We only require a few sample documents to support a new cryptocurrency exchange, so reach out today if you want to see yours added!

Track your Independent Reserve trades with Sharesight

Looking for a way to track your cryptocurrency trades along with the rest of your investments? Sign up for Sharesight so you can:

-

Track all of your investments in one place, including stocks, mutual/managed funds, property and cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

-

Run powerful reports built for investors, including Performance, Portfolio Diversity, Contribution Analysis, Future Income and Multi-Currency Valuation

-

See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

Prepare your annual accounts with our historical cost report

Sharesight's historical cost report is a powerful tool for investors who need to prepare annual accounts or financial statements with mark-to-market accounting.

Sharesight product updates – July 2025

This month's focus was on rolling out predictive income forecasting, as well as improved cash account syncing across different brokers and currencies.

5 ways Sharesight helps Australian investors at tax time

Learn how Sharesight’s Australian tax features can not only help you complete your tax return, but also save you time and money at tax time.