How to track DRP residual balances

If you already use Sharesight to track your dividend reinvestment plan (DRP or DRIP), you know how easy it is to automatically track dividend reinvestments (or to manually record them if required). Either way, Sharesight eliminates the paperwork and headaches normally associated with keeping track of dividend reinvestments. Our latest enhancement takes DRP tracking one step further by automatically tracking the residual balances that can occur with some DRPs.

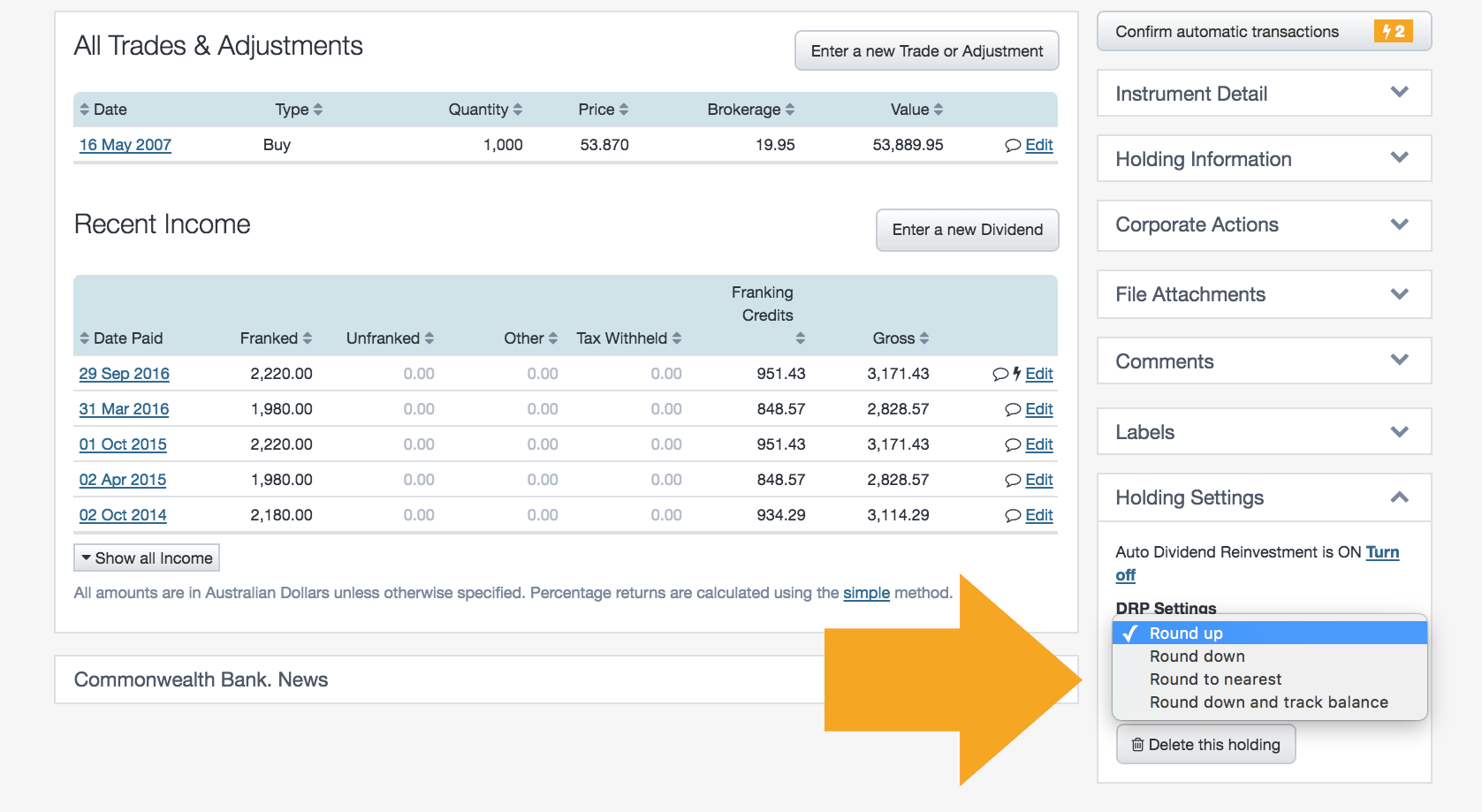

How to track DRP residual balances in Sharesight

-

Sign-up for a Sharesight account and add your holdings. Sharesight will automatically backfill past dividends (and continues to add new ones as they are announced).

-

If the holding is ASX or NZX listed you can activate the Auto Dividend Reinvestment feature1, which will automatically record a reinvestment for each dividend payment. This setting can be found under the “Holding Settings” section in the sidebar of the Holding page for each stock. Additionally you can now set the appropriate rounding policy as per the company’s DRP scheme as follows:

- Round down -- this will always round down the shares allocated as a result of a DRP. Any residual value will be lost – this is the default.

- Round to the nearest -- this applies standard rounding rules.

- Round up -- this will always round up the shares allocated as a result of a DRP.

- Round down and track balance -- this will always round down the shares allocated as a result of a DRP. However, any residual balance will be carried forward to the next dividend reinvestment.

1 Please note that Auto Dividend Reinvestment is currently only available for ASX or NZX listed companies that have offered a dividend reinvestment plan and for which we have the DRP data available. If you have activated a DRP for a holding not listed on the ASX or NZX, you may manually record a dividend reinvestment when you add or edit a dividend payment.

MORE INFO

- Sharesight Forum -- DRP residual balance tracking

- Sharesight Help -- How to automatically track a DRP

- Sharesight Help -- How to manually reinvest dividends

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.