Track Charles Schwab trades using Sharesight

Investors can now import trades automatically to their Sharesight portfolio from US broker Charles Schwab and leverage Sharesight’s award-winning performance, dividend tracking, and tax reporting features.

Why use Sharesight with Charles Schwab?

There’s a raft of features that make Sharesight the must-have portfolio tracking tool for investors, with Sharesight you can:

-

Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful reports built for investors, including Performance, Portfolio Diversity, Contribution Analysis, Future Income (upcoming dividends) & Taxable Income (dividends/distributions)

Import your historical Charles Schwab trading data

Importing your historical Charles Schwab trading history into Sharesight is easy. All you need to do is:

-

Download your historical trading data CSV from Charles Schwab

-

Import your historical trades into Sharesight using our broker import wizard

Automatically import ongoing trades to Sharesight

Sharesight’s Trade Confirmation Emails feature is an effortless way to import historical and ongoing trades to a Sharesight portfolio. By simply having your broker’s trade confirmations forwarded to your unique Sharesight email address, all of your trades are synced to your portfolio, inclusive of corporate actions such as dividends, mergers and stock splits, with no effort on your part.

We need your help to add more brokers in the USA!

If your broker is not yet on Sharesight’s list of supported brokers but they send you trade confirmation emails (or you’re able to download the PDF trade confirmations, or a CSV of historical trades from your broker manually), then ask us to support your broker by leaving us a message in the chat interface when logged in to your Sharesight account.

We just need a handful of sample trade confirmation emails/CSV examples in order to support a new broker, so reach-out today if you’d like to see yours added!

FURTHER READING

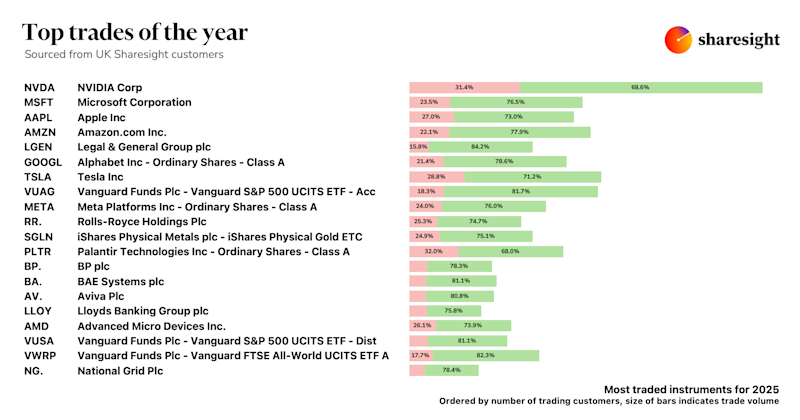

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

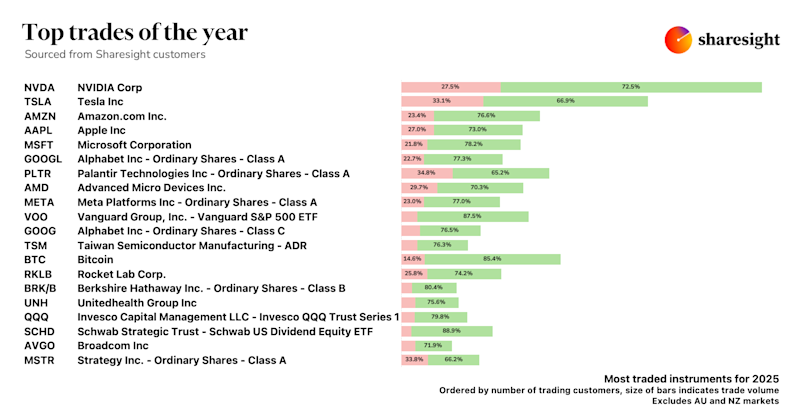

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.

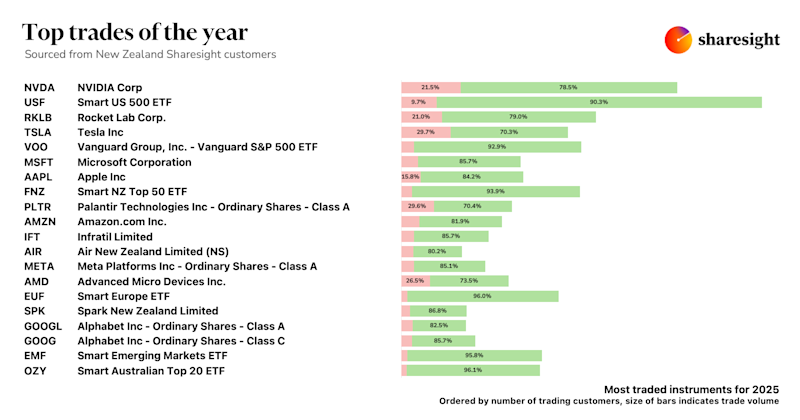

Top trades by New Zealand Sharesight users in 2025

Welcome to the 2025 edition of our New Zealand trading snapshot, where we dive into this year’s top trades by Sharesight users.