Track Bitcoin and other cryptocurrencies with Sharesight

With Sharesight, you can automatically track over 100 major cryptocurrencies, including Bitcoin, Ethereum, Tether, Binance Coin and many more. Prices are updated every five minutes, with intraday cryptocurrency prices (in addition to intraday foreign exchange rates) provided through Open Exchange Rates’ API. Keep reading to learn more about our crypto support and how you can benefit from tracking crypto – along with the rest of your investments – using Sharesight’s portfolio tracker.

![]()

Why track cryptocurrencies with Sharesight?

With support for a range of leading cryptocurrencies plus intraday updates, Sharesight’s portfolio tracker is the perfect tool for investors who trade in crypto along with other asset classes. Using Sharesight, you can track cryptocurrency, stocks, ETFs, managed funds, and even custom investments such as cash accounts and property to get the complete picture of your investments in a single place. Sharesight users will also benefit from the platform’s award-winning performance and tax reporting features, plus powerful reports including performance, diversity, contribution analysis, multi-period analysis, multi-currency valuation and future income (upcoming dividends).

An example of a portfolio tracking cryptocurrency, along with stcoks on the ASX and Nasdaq.

What cryptocurrencies does Sharesight track?

Investors can track over 100 different cryptocurrencies in Sharesight, such as:

-

Bitcoin (XBT)

-

Ethereum (ETH)

-

Tether (USDT)

-

XRP (XRP)

-

Binance Coin (BNB)

-

Dogecoin (DOGE)

-

Monero (XMR)

-

Cardano (ADA)

See our help page for the full list of cryptos supported by Sharesight. If you are invested in cryptos outside this list, you can still manually track them using the custom investments feature.

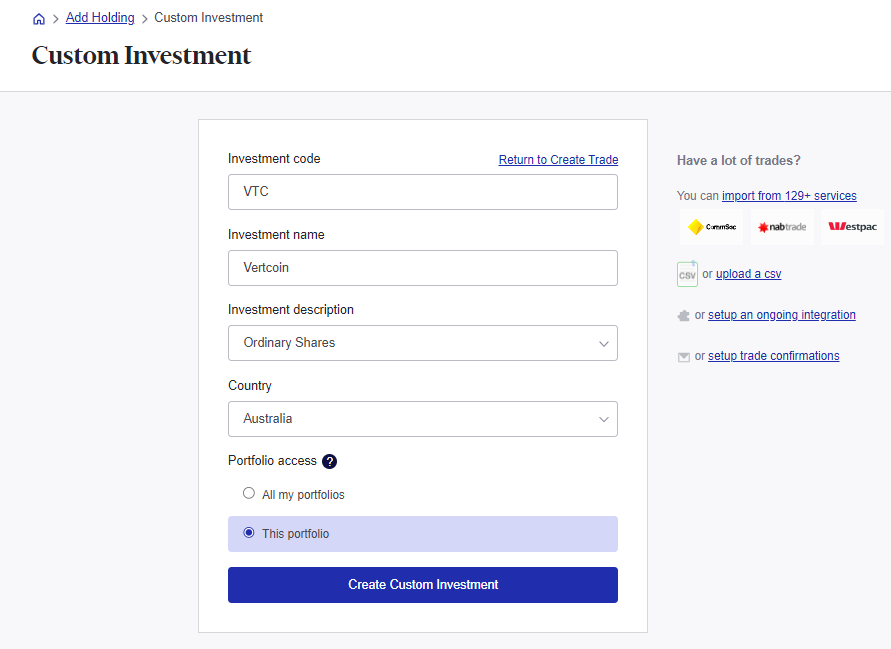

What if I trade cryptocurrencies not supported by Sharesight?

If you trade cryptocurrencies that are not supported by Sharesight, you can still track your investments by adding a custom investment into your Sharesight portfolio.

To add a custom investment, simply click ‘Add holding’ on the Overview or Holdings page, and select ‘Manually add a trade’. Then once you're on the manual holding screen, select 'Add a custom investment' from the top right-hand corner.

Once you have created a custom investment, you will be redirected to the manual holding screen to add details such as the trade date, trade type, quantity and price. To track the performance of your crypto investment in your portfolio, simply update the price movements by uploading a spreadsheet of prices or manually entering the price movements on a regular basis.

If you are tracking custom crypto investments along with the rest of the stocks in your portfolio, it is also advised that you classify your investments using the custom groups feature to easily differentiate between these different asset classes.

Tracking cryptocurrencies in USD

If you commonly trade cryptocurrencies on international exchanges, you might prefer to see the values denominated in a particular fiat currency such as USD (if you trade USD/XBT pairs, for example). However, if the fiat currency differs from the currency of the tax residency of your Sharesight portfolio, you will need to add a separate Sharesight portfolio with a tax residency that uses that particular fiat currency.

How to track cryptocurrencies with Sharesight

Watch this video to learn how to track your crypto with Sharesight:

Embedded content: https://youtu.be/u6TBVwJphLg?si=sfvSe5Jt9i9o0Bfc

For more information, including how to bulk import your historical buy and sell crypto trades via spreadsheet, see our Help page.

Track cryptocurrency with Sharesight today

Thousands of investors like you are already using Sharesight to track crypto, plus the rest of their investments in stocks, ETFs and funds. So what are you waiting for? Sign up and:

-

Track all of your investments in one place, including stocks, ETFs, mutual/managed funds, property and even cash accounts

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

-

Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period analysis, multi-currency valuation and future income (upcoming dividends)

-

Easily share access of your portfolio with family members, your accountant or other financial professionals so they can see the same picture of your investments as you do

Sign up for a FREE Sharesight account and get started tracking your crypto and other investments today.

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.