Top trades by New Zealand Sharesight users — February 2025

Welcome to the February 2025 edition of Sharesight’s monthly trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users. Below we will look at the top trades overall, plus the top trades in individual stocks, which allows us to observe the broader investment trends by Sharesight users in New Zealand, while also giving us an opportunity to zoom into the most popular stocks and the market-moving news behind them.

Top trades in February 2025

Note: To get a closer look at this chart, you can right-click and open the image in a new tab (for desktop) or press-hold and download the image or open it in a web browser (for mobile).

This month, the top trades were strongly led by the Smartshares US 500 ETF (NZX: USF). Overall, it was a strong month for ETF trading, with 9 of the top 20 trades consisting of ETFs. It’s also worth noting that the majority of these trades are buy trades, which is to be expected in an ETF-heavy snapshot. Overall, this snapshot suggests that many New Zealand Sharesight users are employing a long-term buy-and-hold strategy.

Most-traded stocks in February 2025

Note: To get a closer look at this chart, you can right-click and open the image in a new tab (for desktop) or press-hold and download the image or open it in a web browser (for mobile).

This month’s top-traded stocks were led by Apple (NASDAQ: AAPL), which saw its share price fluctuate throughout the month. The top trades were followed by NVIDIA (NASDAQ: NVDA), which posted record-breaking earnings but failed to see growth in its share price.

Let’s look at some of the market-moving news behind some of this month’s top stocks:

Apple (NASDAQ: AAPL)

- Apple pledges to invest $500 billion in US production

- Partners with Alibaba to bring AI services to Chinese devices

NVIDIA (NASDAQ: NVDA)

- Could NVIDIA shares benefit from the rise of DeepSeek?

- NVIDIA could be severely affected by Chinese AI trade restrictions

- Share price remains flat despite record-breaking earnings

Tesla (NASDAQ: TSLA)

- Protests erupt across the US in “Tesla takedown” movement

- Tesla’s European sales plummet as EV competition grows

- Tesla shares nosedive following Elon Musk controversy, poor sales figures

Palantir Technologies (NASDAQ: PLTR)

- Palantir shares plunge 32% from record high as investors fret over upcoming tariffs

- Will Palantir’s AI shift result in a share price boost?

Microsoft (NASDAQ: MSFT)

- Microsoft cancels data centre plans, raises prices to recoup AI costs

- Plans to shut down Skype to focus on Teams

Amazon (NASDAQ: AMZN)

- Amazon share price rises as Alexa gets generative AI update

- Amazon’s Australian sales soar, fuelled by Prime subscriptions

Spark NZ (NZX: SPK)

- Spark NZ records 78% drop in first-half profit; slashes full-year earnings guidance

- Spark loses NZ$1 billion in market value following disappointing earnings results

Air NZ (NZX: AIR)

- Air NZ re-suspends Seoul services due to engine shortages

- Plans to address engine shortages with aircraft leasing plan

- Anticipates challenging 2025 due to engine maintenance

Track your investment portfolio with Sharesight

Get access to insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you, with Sharesight you can:

- Track all your investments in one place, including stocks, ETFs, mutual/managed funds, property, and even cryptocurrency

- Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, exposure, multi-period, multi-currency valuation and future income

- Run tax reports including taxable income (dividends/distributions), Capital Gains Tax (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

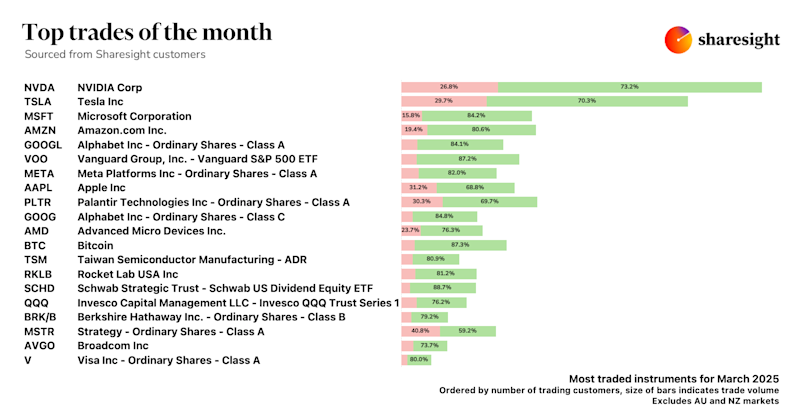

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.