Top trades by Australian Sharesight users — February 2025

Welcome to the February 2025 edition of Sharesight’s monthly trading snapshot for Australian investors, where we look at the top 20 trades made by Australian Sharesight users. Below we will look at the top trades overall, plus the top trades in individual stocks, which allows us to observe the broader investment trends by Australian Sharesight users, while also giving us an opportunity to zoom into the most popular stocks and the market-moving news behind them.

Top trades in February 2025

Note: To get a closer look at this chart, you can right-click and open the image in a new tab (for desktop) or press-hold and download the image or open it in a web browser (for mobile).

This month, the top trades were strongly led by Vanguard’s Australian Shares (ASX: VAS) ETF, followed by the iShares S&P 500 (ASX: IVV) ETF and Vanguard’s International Shares (ASX: VGS) ETF.

It should be noted that the assets in our trading snapshots are ordered by the number of Sharesight users trading that asset, while the size of the bars indicate the actual trade volume. So while there are more customers trading in VAS, the volume of IVV trades is higher, meaning that while there are fewer people trading in IVV, they are making more trades.

Most-traded stocks in February 2025

Note: To get a closer look at this chart, you can right-click and open the image in a new tab (for desktop) or press-hold and download the image or open it in a web browser (for mobile).

This month’s top-traded stocks were led by NVIDIA (ASX: NVDA), which posted record earnings but did not necessarily see a commensurate increase in its share price. The top trades were followed by CSL (ASX: CSL), which posted disappointing earnings results and saw its share price decline throughout the month.

Let’s look at some of the market-moving news behind some of this month’s top stocks:

NVIDIA (NASDAQ: NVDA)

- Could NVIDIA shares benefit from the rise of DeepSeek?

- NVIDIA could be severely affected by Chinese AI trade restrictions

- Share price remains flat despite record-breaking earnings

CSL (ASX: CSL)

- CSL delivers disappointing first-half FY2025 results

- CSL talks strategy in the face of a potential trade war

Woodside Energy (ASX: WDS)

- Woodside reports record-breaking production and profit for 2024

- Woodside share price rises following earnings report

- Seeks additional energy acquisitions, plans to reduce stake in US LNG project

BHP Group (ASX: BHP)

- BHP records 23% drop in first-half profit; expects copper and steel demand to bounce back

- Cuts dividend by 30% due to disappointing earnings results

Fortescue Metals (ASX: FMG)

- Pilbara traditional owners seek AU$1.8 billion in damages from Fortescue due to cultural loss

- Mining shares plunge in tariff-driven selloff

Tesla (NASDAQ: TSLA)

- Protests erupt across the US in “Tesla takedown” movement

- Tesla’s European sales plummet as EV competition grows

- Tesla shares nosedive following Elon Musk controversy, poor sales figures

WiseTech Global (ASX: WTC)

- WiseTech suffers mass board exodus over disagreement on controversial founder’s ongoing role; loses billions in market value overnight

- Founder Richard White appointed as executive chairman, allowing him to regain control of company

- ASIC to probe WiseTech following board exodus; executive chairman decision

Track your investment portfolio with Sharesight

Get access to insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you, with Sharesight you can:

- Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

- Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, exposure, multi-period, multi-currency valuation and future income

- Run tax reports including taxable income (dividends/distributions), Capital Gains Tax (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

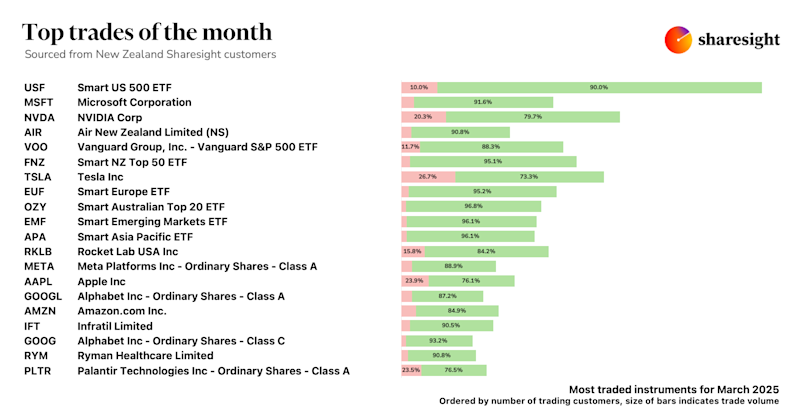

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

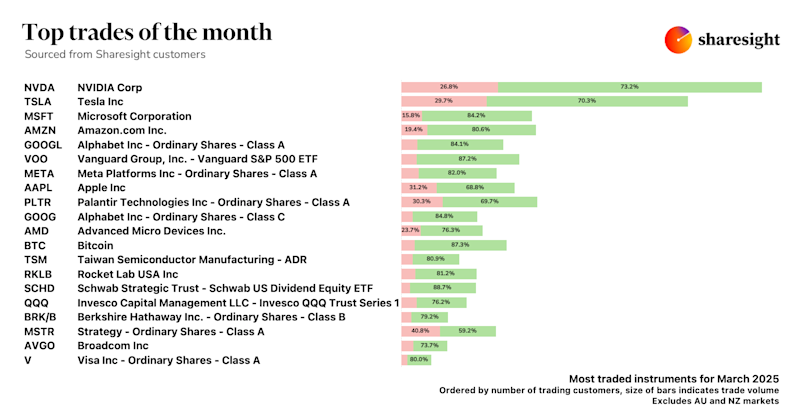

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.