Top 20 trades in US stocks by Sharesight users – November 2023

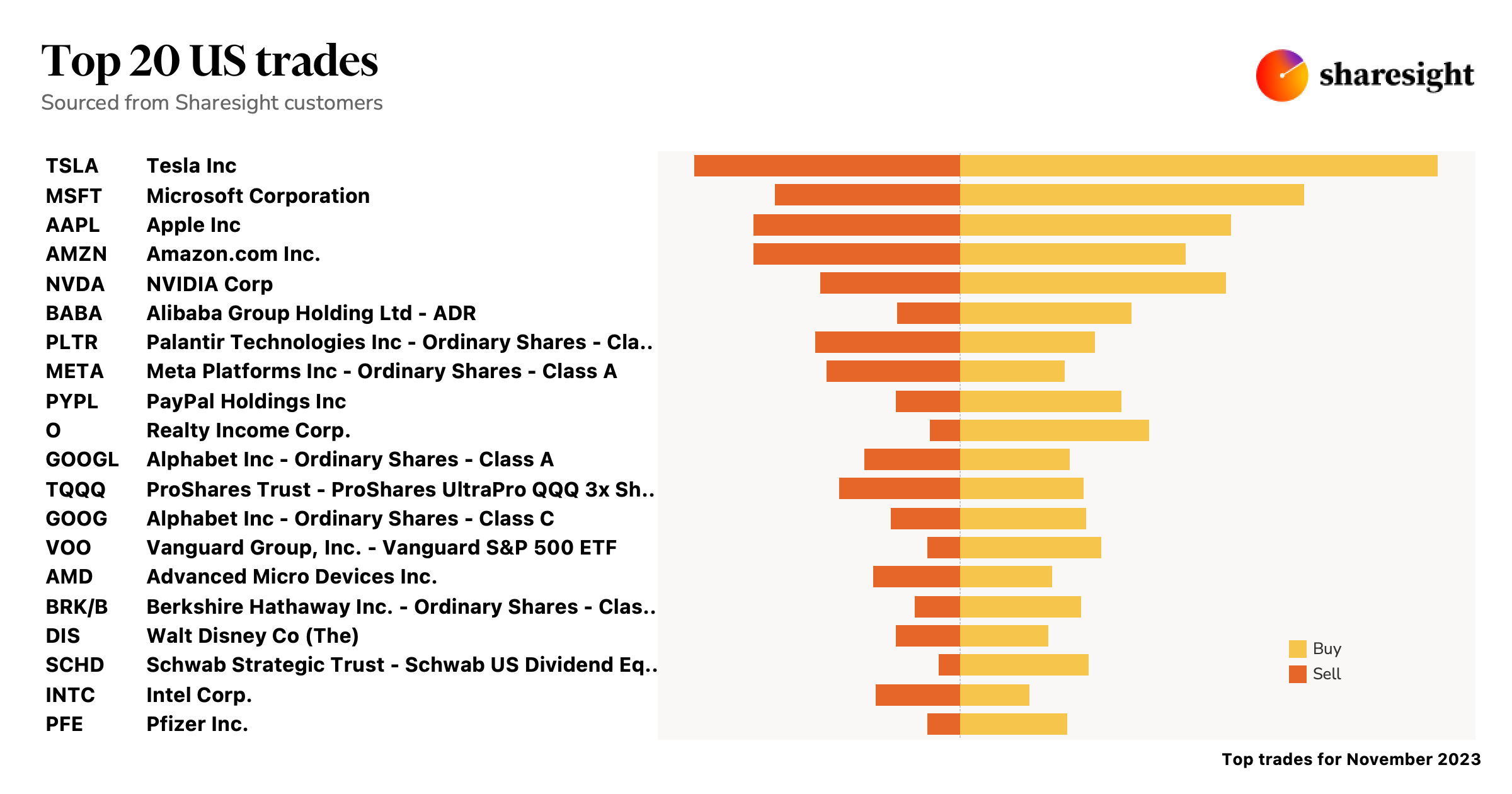

Welcome to the November 2023 edition of Sharesight’s monthly USA trading snapshot, where we look at Sharesight users’ top 20 trades in US stocks on the Nasdaq, NYSE and NYSE American market (AMEX) over the month.

In this snapshot, buy and sell trades were strongly led by Tesla (NASDAQ: TSLA), which is currently seeing strong competition from rival companies such as General Motors (NYSE: GM). Trades were followed by Microsoft (NASDAQ: MSFT), which has been in the spotlight since hiring former OpenAI CEO, Sam Altman.

Top 20 US stock trades November 2023

Let’s look at the news behind some of the key stocks in this month’s snapshot:

Tesla (NASDAQ: TSLA)

- Tesla visits Indonesian nickel plant for potential investment

- EV car registrations surpass diesel for first time in Europe

- Analysts predict ‘major growth’ for Tesla rival General Motors

Microsoft (NASDAQ: MSFT)

- Microsoft hires Sam Altman after he fails to return to CEO position at OpenAI

- Microsoft share price reaches all-time high after hiring Sam Altman

- Microsoft unlikely to get seat on OpenAI board, say experts

Apple (NASDAQ: AAPL)

- Apple share price up 45% since beginning of 2023

- Post-earnings rally comes to a halt due to soft iPhone sales data

- Apple partner Foxconn plans to invest US$1.54 billion in Indian expansion plan

Amazon (NASDAQ: AMZN)

- Amazon stock close to hitting new high

- Amazon cuts hundreds of jobs from Alexa unit

- Amazon shares rise following Salesforce deal; reports it surpassed FedEx, UPS in deliveries

NVIDIA (NASDAQ: NVDA)

- NVIDIA triples quarterly revenue, however China sales are a concern

- NVIDIA shares to soar on autonomous vehicle boom, say analysts

- Analysts forecast 50% upside for NVIDIA stock

Alibaba (NYSE: BABA)

- Alibaba shares down 65% since 2021

- PDD Holdings close to overtaking Alibaba as China’s most valuable e-commerce company

- Jack Ma calls for ‘change and reform’ at Alibaba as rivals gain ground

Meta (NASDAQ: FB)

- Meta’s Q3 revenue skyrockets 23%, profit more than doubles to US$11.6 billion

- Meta share price up 275% in a year

- Meta share price due to drop, according to analysts

Track your investment portfolio with Sharesight

Get access to Sharesight20 insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

-

Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, exposure and future income

-

Run tax reports including taxable income (dividends/distributions), capital gains tax (Australia and Canada), traders tax (capital gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.