Top 20 trades in US stocks by Sharesight users – March 2024

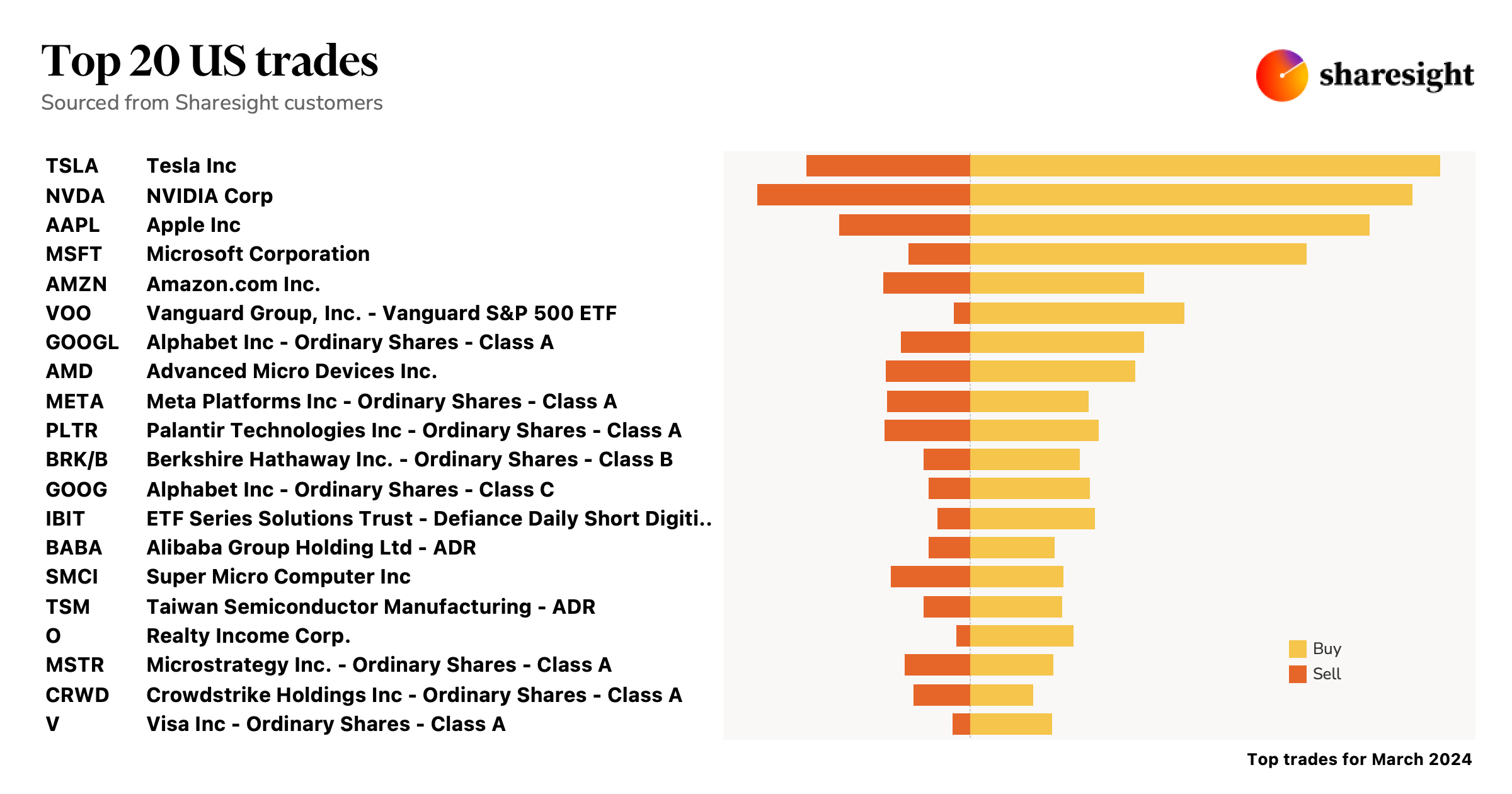

Welcome to the March 2024 edition of Sharesight’s monthly USA trading snapshot, where we look at Sharesight users’ top 20 trades in US stocks on the Nasdaq, NYSE and NYSE American market (AMEX) over the month.

In this snapshot, buy trades were led by Tesla (NASDAQ: TSLA), which saw its share price rise throughout the month due to rumours of an Italian truck production deal, plus news that US customers will receive a full self-driving software trial. Over the same period, sell trades were led by NVIDIA (NASDAQ: NVDA), which saw its share price hit an all-time high amid the AI stock frenzy. It was a tech-dominated month overall, with 16 of the top 20 stocks belonging to the tech, EV, semiconductor and e-commerce sectors.

Top 20 US stock trades March 2024

Let’s look at the news behind some of the key stocks in this month’s snapshot:

Tesla (NASDAQ: TSLA)

- Tesla shares rise on news that US customers will receive full self-driving software trial

- SEC urged to investigate Tesla over board independence and conflicts of interest

- Shares jump following reports Italian ministry officials contacted Tesla about producing trucks

NVIDIA (NASDAQ: NVDA)

- NVIDIA share price on watch ahead of Q1 earnings report

- NVIDIA share price drops due to “market broadening” rather than sell-off

- NVIDIA leads the ‘Magnificent Seven’ stocks in 2024

Apple (NASDAQ: AAPL)

- Apple CEO visits Shanghai as Chinese iPhone sales lag

- US files landmark lawsuit against Apple for monopolising smartphone market

- Share price has declined over 11% in 2024

Microsoft (NASDAQ: MSFT)

- Analyst sees 18% upside for Microsoft shares on AI feature adoption

- Microsoft CEO dismisses OpenAI’s importance amid closed source controversy

- Microsoft appoints DeepMind co-founder as CEO of new AI unit

Amazon (NASDAQ: AMZN)

- Amazon completes US$4 billion investment in AI startup Anthropic

- No cash raises for senior Amazon employees this year

- Jeff Bezos sells US$8.5 billion-worth of Amazon shares

Meta (NASDAQ: FB)

- Facebook plans to shut down its news tab in the US and Australia by April

- Meta’s Mark Zuckerberg enters global rich list with US$158 billion fortune

- Meta shares see their worst day in eight months

Alibaba (NYSE: BABA)

- Plans to buy Cainiao stake for up to US$3.75 billion, abandoning Hong Kong IPO plans

- Alibaba announces strategy shift including enhanced logistics and share buybacks

- Hong Kong shares reach 6-week low after Cainiao IPO withdrawal

Track your investment portfolio with Sharesight

Get access to Sharesight20 insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

-

Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis and future income

-

Run tax reports including taxable income (dividends/distributions), capital gains tax (Australia and Canada), traders tax (capital gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

8 ways to use Sharesight's custom groups feature

This blog explains our custom groups feature, including strategies that can help you gain deeper portfolio insights and make more informed investing decisions.

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.