Top 20 trades in US stocks by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly USA trading snapshot, where we look at Sharesight users’ top 20 trades in US stocks on the Nasdaq, NYSE and NYSE American market (AMEX) over the month.

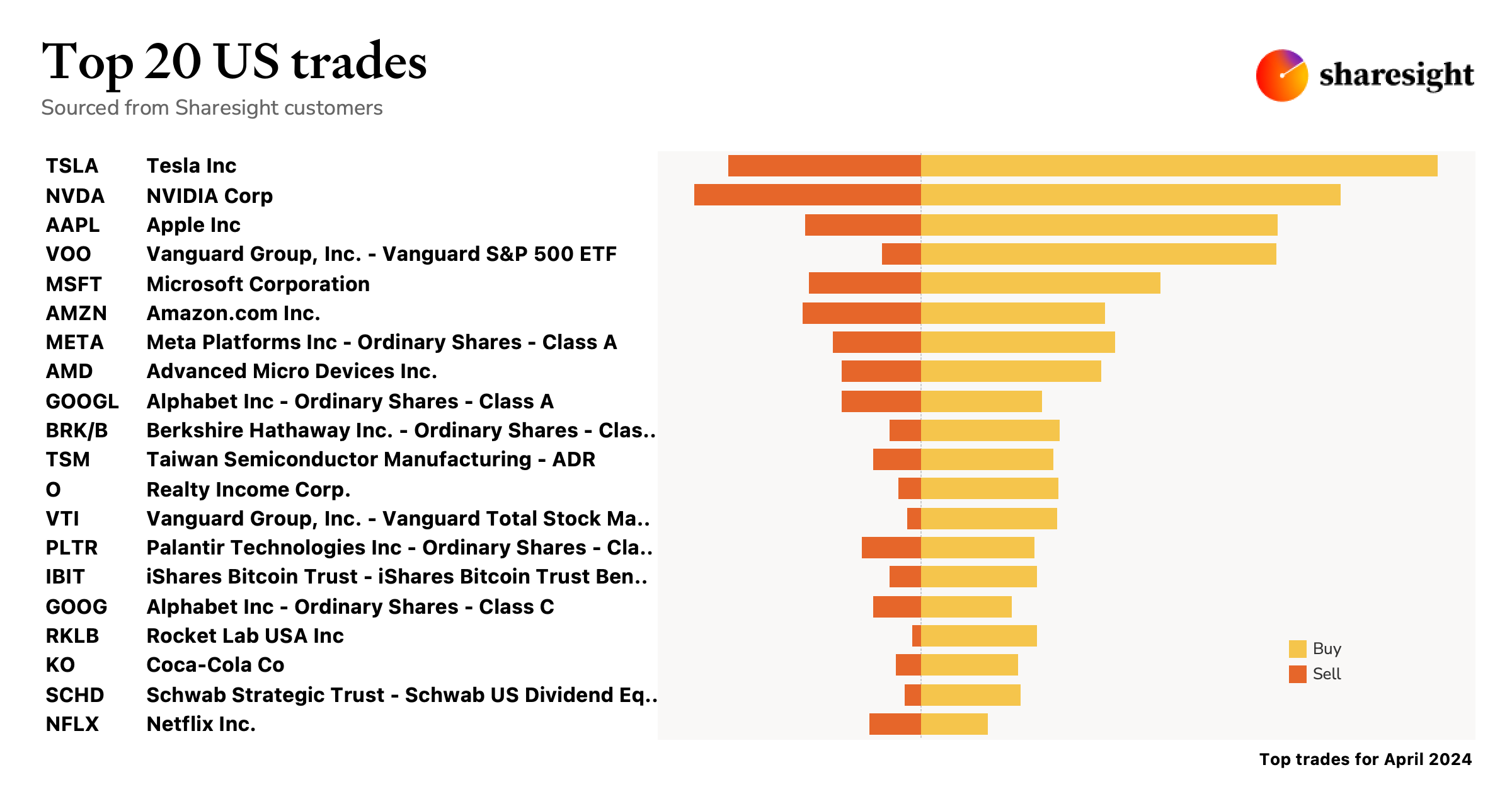

In this snapshot, buy trades were led by Tesla (NASDAQ: TSLA), which has seen its share price swing dramatically throughout April, with investors concerned about the automaker’s declining sales and ongoing price cuts. Over the same period, sell trades were led by NVIDIA (NASDAQ: NVDA), which also saw its share price drop as part of a widespread tech stock selloff. It was a tech-heavy month overall, with 13 of the top 20 stocks belonging to the tech, EV, semiconductor and e-commerce sectors.

Top 20 US stock trades April 2024

Let’s look at the news behind some of the key stocks in this month’s snapshot:

Tesla (NASDAQ: TSLA)

- Tesla shares sink on news of YoY sales decline

- Shares plummet further following price cut announcement

- Tesla abandons plans to manufacture “low-cost family car”

NVIDIA (NASDAQ: NVDA)

- NVIDIA shares plummet 10% as tech stocks fall out of favour with investors

- Analyst sees 81% upside for NVIDIA shares amid AI craze

- NVIDIA share price on watch ahead of May earnings report

Apple (NASDAQ: AAPL)

- Apple share price could have 48% upside potential, says analyst

- Apple stock upgraded ahead of earnings report

- Investors have ‘low expectations’ of Apple’s Q1 earnings due to weak iPhone sales and growing competition

Microsoft (NASDAQ: MSFT)

- Microsoft is the best positioned software stock to turn ‘AI hype’ into ‘revenue reality’, says analyst

- Makes US$1.5 billion investment in UAE-based AI firm

- Microsoft exceeds earnings expectations; share price rises 5%

Amazon (NASDAQ: AMZN)

- Amazon share price reaches record high; valuation on the cusp of US$2 trillion

- Amazon share price on watch ahead of Q1 earnings report

- Share price drops amid widespread tech stock selloff

Meta (NASDAQ: FB)

- Meta expected to reveal earnings growth in upcoming Q1 report

- Share price tumbles 15% after news of aggressive AI spending plans

- Meta stock has worst day in years, losing billions in value

Advanced Micro Devices (NASDAQ: AMD)

- AMD shares drop as interest-rate-sensitive investors reassess stock’s outlook

- Could AMD stock outshine NVIDIA?

- Analyst predicts 38% upside potential for AMD share price

Track your investment portfolio with Sharesight

Get access to Sharesight20 insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

-

Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis and future income

-

Run tax reports including taxable income (dividends/distributions), capital gains tax (Australia and Canada), traders tax (capital gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

8 ways to use Sharesight's custom groups feature

This blog explains our custom groups feature, including strategies that can help you gain deeper portfolio insights and make more informed investing decisions.

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.