Top 20 trades on the NZX in 2019 - Sharesight20

Disclaimer: The below article is for informational purposes only and does not constitute a product recommendation, or taxation or financial advice and should not be relied upon as such. Please check with your financial adviser or accountant to obtain the correct advice for your situation.

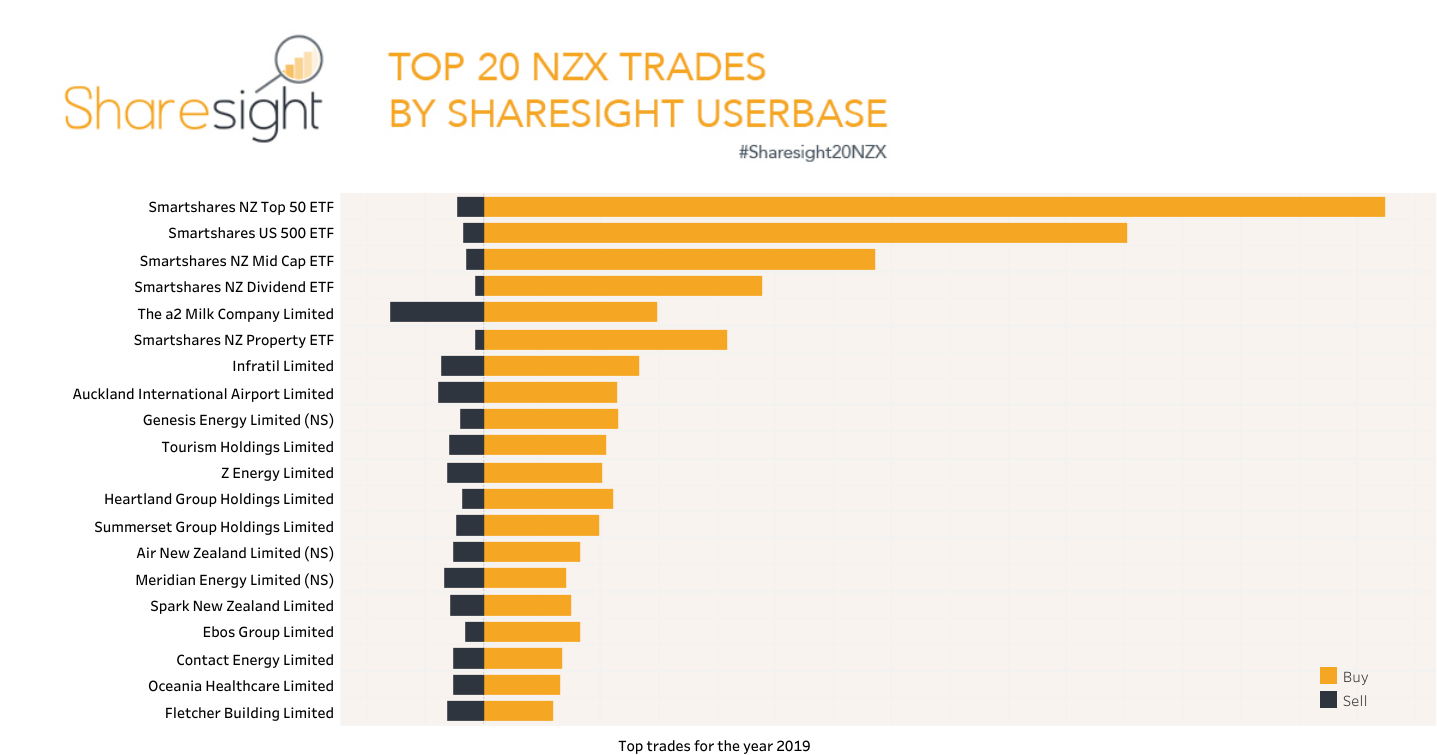

In this Sharesight20 yearly trading snapshot we look at the 20 most traded stocks by Sharesight users on the New Zealand Stock Exchange (NZX) in 2019 and calculate how they performed during the year.

Let’s dive into 2019’s top 20 trades.

Top 20 New Zealand Stock Exchange trades in 2019

Click image to zoom

The Sharesight20 top 20 trades for the NZX in 2019 shows the dominance of the NZX owned Smartshares range of ETFs as a favoured investment vehicle among Sharesight users to gain exposure to a range of asset classes and international opportunities. Of the top 20, Smartshares ETFs make up 5 of the top 6 most traded stocks on the exchange, we also see a significant bias towards buy trades in these ETFs from investors "topping up" the amount invested with regular contributions and taking advantage of dollar cost averaging.

Top 20 NZX trades in 2019 - performance

To calculate the performance of these stocks during 2019 we built a Sharesight portfolio domiciled in the same country as the exchange (to remove the impact of currency fluctuations) that contained these 20 stocks and invested an equally weighted (5% of the total portfolio) amount in each stock on January 1st 2019 (or the first listed date for stocks that listed after that date).

We then ran Sharesight’s Performance Report to calculate the portfolio’s 2019 performance. Here’s the results, ordered by Total Return.

| Code | Name | Capital Gain % | Dividends % | Total Return % |

|---|---|---|---|---|

| MEL | Meridian Energy Limited (NS) | 47.06% | 7.88% | 54.94% |

| HGH | Heartland Group Holdings Limited | 34.06% | 10.06% | 44.12% |

| SUM | Summerset Group Holdings Limited | 39.72% | 2.14% | 41.85% |

| ATM | The a2 Milk Company Limited | 34.71% | 0.00% | 34.71% |

| NPF | Smartshares NZ Property ETF | 25.53% | 4.75% | 30.28% |

| USF | Smartshares US 500 ETF | 28.63% | 0.71% | 29.34% |

| FNZ | Smartshares NZ Top 50 ETF | 24.60% | 4.44% | 29.05% |

| OCA | Oceania Healthcare Limited | 23.36% | 4.39% | 27.76% |

| AIA | Auckland International Airport Limited | 21.87% | 4.30% | 26.17% |

| MDZ | Smartshares NZ Mid Cap ETF | 20.31% | 4.37% | 24.68% |

| EBO | Ebos Group Limited | 20.77% | 3.91% | 24.67% |

| GNE | Genesis Energy Limited (NS) | 15.90% | 8.56% | 24.47% |

| DIV | Smartshares NZ Dividend ETF | 15.00% | 6.37% | 21.37% |

| SPK | Spark New Zealand Limited | 4.34% | 7.78% | 12.12% |

| FBU | Fletcher Building Limited | 4.30% | 4.71% | 9.02% |

| AIR | Air New Zealand Limited (NS) | -5.48% | 9.86% | 4.37% |

| IFT230 | Infratil Limited | -0.93% | 0.00% | -0.93% |

| ZEL | Z Energy Limited | -19.85% | 11.89% | -7.96% |

| Total | 18.55% | 5.34% | 23.89% |

New Zealand Electricity generator and retailer Meridian Energy Limited (NZX: MEL) was the standout performer in 2019 with returns of 54.94% including a healthy dividend yield of 7.88%. Topping Meridian in dividend returns however was fuel retailer and distributor Z Energy Limited (NZX: ZEL) with dividends yielding 11.89% - a return that softened the blow of the 19.85% collapse in the stock’s price during the year.

Overall an equally weighted portfolio of these 20 stocks would have returned 23.89%, which would have been outperformed by an ETF tracking the NZX Top 50, such as the Smartshares NZ top 50 ETF (NZX: FNZ) which returned 29.05%.

Track your investment portfolio with Sharesight

Get access to insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Sharesight automatically tracks your daily price & currency fluctuations, as well as handles corporate actions such as dividends and share splits

-

Run powerful reports built for investors, including Performance, Portfolio Diversity, Contribution Analysis and Future Income (upcoming dividends)

-

Plus run tax reports including Taxable Income (dividends/distributions), Capital Gains Tax (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

FURTHER READING

Sharesight product updates – February 2026

This month's key focus was on the rollout of the new Investments tab to all users, along with various enhancements across web and mobile.

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.