Top 20 trades on the NASDAQ in 2019 - Sharesight20

Disclaimer: The below article is for informational purposes only and does not constitute a product recommendation, or taxation or financial advice and should not be relied upon as such. Please check with your financial adviser or accountant to obtain the correct advice for your situation.

In this Sharesight20 yearly trading snapshot we look at the 20 most traded stocks by Sharesight users on the NASDAQ in 2019 and examine how they performed during the year.

Let’s dive into 2019’s top 20 trades.

Sharesight20 top 20 NASDAQ trades in 2019

Click image to zoom

Investors using Sharesight bought and sold Apple (NASDAQ: AAPL) stock significantly more often than any other stock listed on the NASDAQ in 2019. Among the top 5, trades roughly correlate with company market cap with the exception with the exception of Tesla (22nd by market cap) which jumped ahead of Facebook (4th by market cap) with investors buying into Elon Musk’s vision for the electric car maker.

Now let’s look at the performance of these stocks in 2019.

Top 20 NASDAQ trades in 2019 - investment performance

To calculate the performance of these stocks during 2019 we built a Sharesight portfolio domiciled in the same country as the exchange (to remove the impact of currency fluctuations) that contained these 20 stocks and invested an equally weighted (5% of the total portfolio) amount in each stock on January 1st 2019 (or the first listed date for stocks that listed after that date).

We then ran Sharesight’s Performance Report to calculate the portfolio’s 2019 performance. Here’s the results, ordered by Total Return.

| Code | Name | Capital Gain % | Dividends % | Total Return % |

|---|---|---|---|---|

| AMD | Advanced Micro Devices Inc. | 148.43% | 0.00% | 148.43% |

| TTD | Trade Desk Inc - Ordinary Shares - Class A | 123.95% | 0.00% | 123.95% |

| AAPL | Apple Inc | 86.92% | 1.94% | 88.85% |

| OKTA | Okta Inc - Ordinary Shares - Class A | 81.11% | 0.00% | 81.11% |

| NVDA | NVIDIA Corp | 76.39% | 0.48% | 76.87% |

| MSFT | Microsoft Corporation | 55.83% | 1.87% | 57.70% |

| MDB | MongoDB Inc - Ordinary Shares - Class A | 57.17% | 0.00% | 57.17% |

| FB | Facebook Inc - Ordinary Shares - Class A | 56.20% | 0.00% | 56.20% |

| SBUX | Starbucks Corp. | 36.31% | 2.31% | 38.62% |

| TEAM | Atlassian Corporation Plc - Ordinary Shares - Class A | 35.24% | 0.00% | 35.24% |

| INTC | Intel Corp. | 27.53% | 2.69% | 30.22% |

| GOOG | Alphabet Inc - Ordinary Shares - Class C | 29.10% | 0.00% | 29.10% |

| PYPL | PayPal Holdings Inc | 28.71% | 0.00% | 28.71% |

| ATVI | Activision Blizzard Inc | 27.73% | 0.80% | 28.53% |

| GOOGL | Alphabet Inc - Ordinary Shares - Class A | 28.18% | 0.00% | 28.18% |

| TSLA | Tesla Inc | 25.62% | 0.00% | 25.62% |

| AMZN | Amazon.com Inc. | 23.03% | 0.00% | 23.03% |

| NFLX | NetFlix Inc | 20.92% | 0.00% | 20.92% |

| CSCO | Cisco Systems, Inc. | 10.69% | 3.18% | 13.87% |

| BYND | Beyond Meat Inc | 13.34% | 0.00% | 13.34% |

| Total | 49.49% | 0.66% | 50.15% |

Computer CPU and graphics chipmaker AMD (NASDAQ: AMD) was the standout performer with returns of 148.43% in 2019. Among the top 20 trades, 7 of the companies paid (relatively modest) dividends in 2019, with many companies opting to use capital to reinvest in growth.

Overall an equally weighted portfolio of these 20 stocks would have performed strongly with a 50.15% return during 2019.

Track your investment portfolio with Sharesight

Get access to insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Sharesight automatically tracks your daily price & currency fluctuations, as well as handles corporate actions such as dividends and share splits

-

Run powerful reports built for investors, including Performance, Portfolio Diversity, Contribution Analysis and Future Income (upcoming dividends)

-

Plus run tax reports including Taxable Income (dividends/distributions), Capital Gains Tax (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

FURTHER READING

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

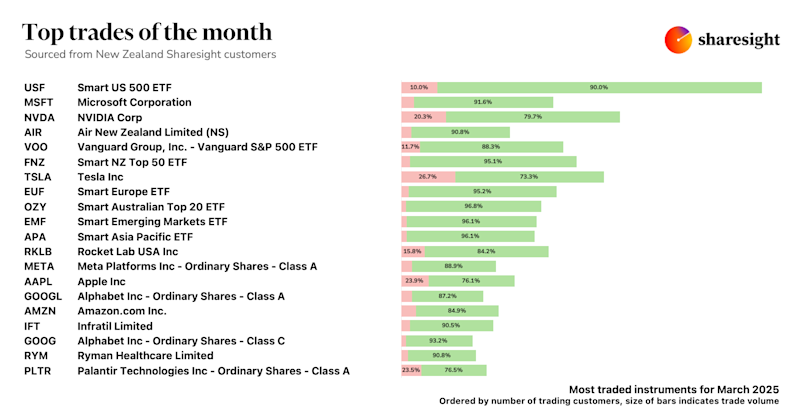

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

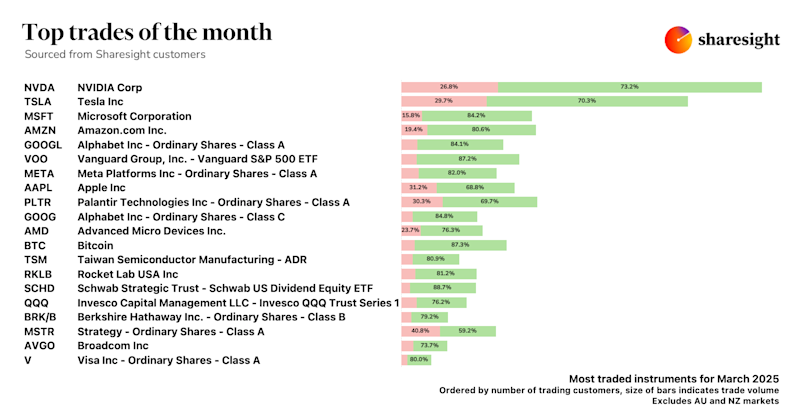

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.