Top 20 NZX trades by Sharesight users – November 2023

Welcome to the November 2023 edition of Sharesight’s monthly NZX trading snapshot, where we look at the top 20 trades Sharesight users made on the NZX during the month.

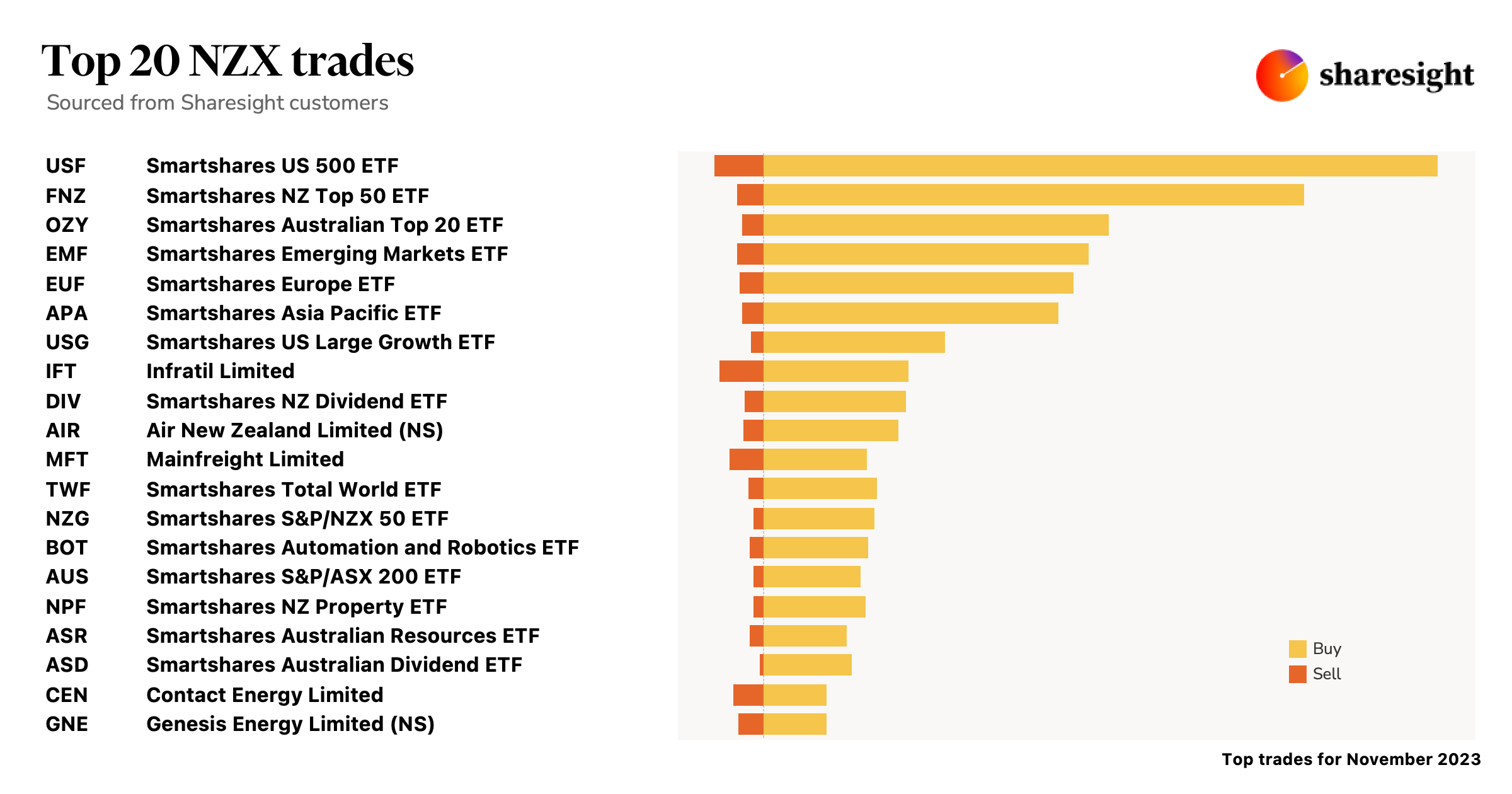

In this snapshot, trades were strongly led by Smartshares’ US 500 (NZX: USF) and NZ Top 50 (NZX: FNZ) ETFs. In terms of individual stocks, trades were led by Infratil Limited (NZX: IFT), which more than doubled its first-half net profit; followed by Air New Zealand (NZX: AIR), which is set to continue discounting fares due to a lack of demand.

Top 20 NZX trades November 2023

Let’s look at the news behind the key stocks in this month’s snapshot:

Infratil Limited (NZX: IFT)

- Infratil more than doubles first-half net profit to NZ$1.2 billion

- Announces reduced dividend for December

- Infratil’s CDC reportedly seeking additional NZ$1.08 billion for five-year expansion plan

Air New Zealand (NZX: AIR)

- Maintenance issues expected to cause up to two years of Air NZ flight disruption

- Virgin Australia and Air NZ to work together again on trans-Tasman flights

- Air NZ poised to continue discounting flights due to reduced demand

Mainfreight Limited (NZX: MFT)

- Mainfreight reports plummeting first-half profit amid slowing global trade

- Share price rises 9% despite disappointing earnings report

Contact Energy (NZX: CEN)

- Contact Energy’s Tauhara geothermal power station forced to delay commissioning by six months

- Plans to lodge NZ$1 billion Southland wind farm consent application

- Residents disapprove of Contact’s proposed Southland wind farm

Genesis Energy (NZX: GNE)

- Genesis Energy ups prices by 30%, citing inflationary pressures

- Genesis Energy’s offshore pipeline throughput rises in Q3

- Renews partnership with DOC to protect NZ’s whio population

Track your investment portfolio with Sharesight

Get access to Sharesight20 insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

-

Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis and future income

-

Run tax reports including taxable income (dividends/distributions), capital gains tax (Australia and Canada), traders tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.