Top 20 ASX trades by Sharesight users – October 2022

Welcome to the October 2022 edition of Sharesight’s monthly ASX trading snapshot, where we look at the top 20 trades Sharesight users made on the ASX during the month.

In this snapshot, buy trades were strongly led by Vanguard’s Australian Shares Index ETF (ASX: VAS). In terms of equities, buy trades were led by Core Lithium (ASX: CXO), which has seen its share price tumble following its failure to secure a deal to supply lithium to Tesla. At the same time, sell trades were led by Pilbara Minerals (ASX: PLS), which saw its share price hit a record high following the release of strong quarterly earnings results. It was a strong month for mining stocks overall, with 9 of the top 20 trades belonging to companies in the mining and minerals sectors.

Top 20 ASX trades October 2022

Let’s look at the news behind some of the key stocks in this month’s snapshot:

Pilbara Minerals (ASX: PLS)

-

Pilbara Minerals reveals strong quarterly earnings

-

Share price hits record high after earnings update

-

Share price falls following broker downgrade

BHP (ASX: BHP)

-

Govt. iron ore price forecast suggests BHP shares could suffer

-

Activists denounce BHP proposal to extend QLD coal mine until 2116

-

Relief for BHP as Chile lowers mining taxes

Core Lithium (ASX: CXO)

-

Core Lithium fails to secure Tesla deal

-

Share price plummets following failed Tesla deal

-

Opens first lithium mine in Northern Territory

Macquarie Group (ASX: MQG)

-

Macquarie share price hits 52-week low

-

Share price on watch ahead of latest earnings results

-

Macquarie share price slides while big banks rally

Fortescue Metals (ASX: FMG)

-

Iron ore price drop puts pressure on Fortescue dividend payment

-

Fortescue reveals record quarter for iron ore shipments

-

Share price rises following strong quarterly results

Whitehaven Coal (ASX: WHC)

-

Whitehaven share price up 200% in 2022

-

Share price drops following weak quarterly results

-

Floods cut access to Whitehaven coal mine sites

Westpac (ASX: WBC)

-

Westpac signs 10-year AusPost deal as it continues to shut branches

-

Westpac share price is up 16% this month

-

Reveals AU$1.3 billion hit to half-year earnings

Track your investment portfolio with Sharesight

Get access to Sharesight20 insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

-

Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful reports built for investors, including Performance, Portfolio Diversity, Contribution Analysis, Multi-Period, Multi-Currency Valuation and Future Income

-

Run tax reports including Taxable Income (dividends/distributions), Capital Gains Tax (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

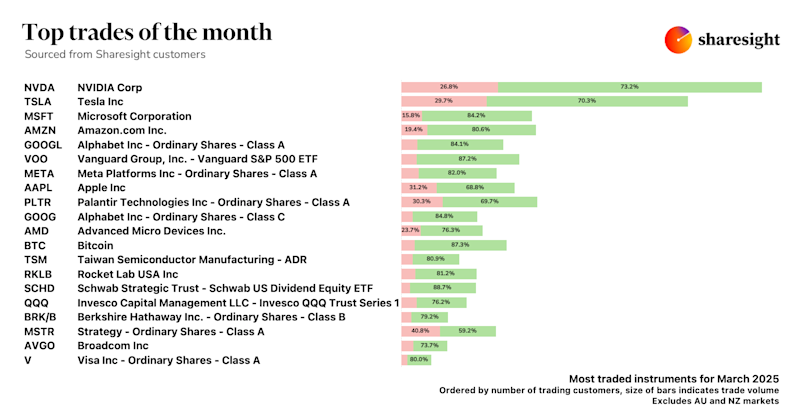

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.