Top 20 ASX trades by Sharesight users – November 2023

Welcome to the November 2023 edition of Sharesight’s monthly ASX trading snapshot, where we look at the top 20 trades Sharesight users made on the ASX during the month.

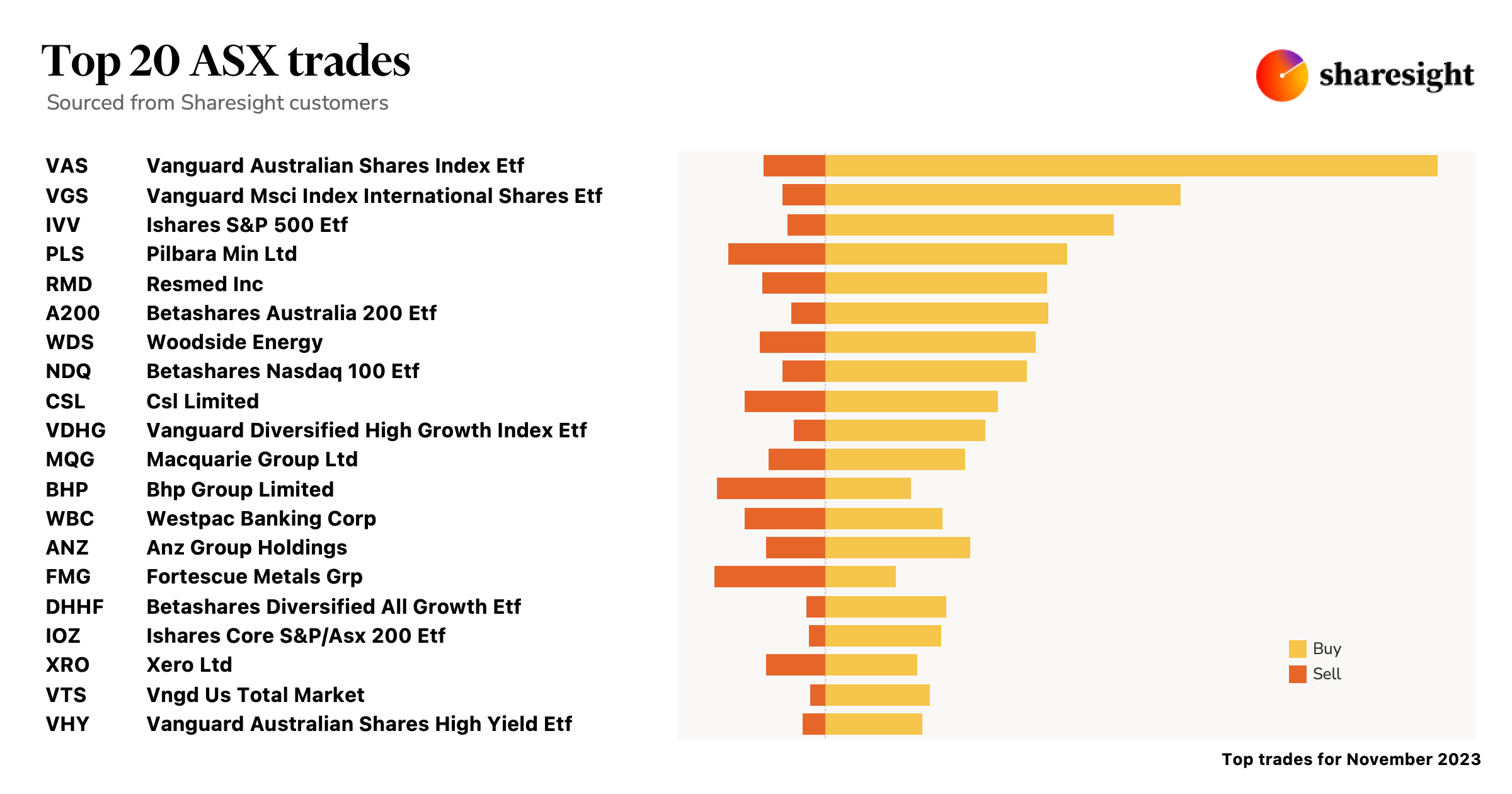

In this snapshot, buy trades were strongly led by Vanguard’s Australian Shares Index ETF (ASX: VAS). In terms of individual stocks, buy trades were led by Pilbara Minerals (ASX: PLS), which continues to be targeted by short-sellers. Over the same period, sell trades were led by BHP (ASX: BHP) and Fortescue Metals (ASX: FMG), both of which saw their share prices rise throughout November.

Top 20 ASX trades November 2023

Let’s look at the news behind some of the key stocks in this month’s snapshot:

Pilbara Minerals (ASX: PLS)

- Short-sellers make huge bets against Pilbara Minerals

- Pilbara Minerals rumoured to be buying shares of Azure Minerals

- Share price has dropped 26% over the past six months

Woodside Energy (ASX: WDS)

- Woodside CEO appears in court over violence restraining orders against climate activists

- Woodside blames poor customer uptake for slow progress on clean energy goals

- CEO warns regulation uncertainty could jeopardise WA’s energy security

Macquarie Group (ASX: MQG)

- Macquarie cuts jobs as tech expenses grow

- Number of financial advisers declines, led by Macquarie Group

- Macquarie Group purchases 15% stake in insurance platform The Envest Group

BHP (ASX: BHP)

- Leading broker sees upside for BHP shares due to higher-than-expected iron ore prices

- BHP share price up 10% in a month

- Could BHP dividends rebound in 2024?

Westpac (ASX: WBC)

- Westpac is the weakest of the big banks, says analyst

- Westpac releases strong earnings report; announces share buyback

- Share price rises on strong earnings, big dividend and AU$1.5 billion share buyback

ANZ (ASX: ANZ)

- ANZ posts record annual profit amid rising interest rates

- ANZ shares plummet as latest earnings fall short of expectations

- ANZ still analysts’ preferred bank stock despite profit miss

Fortescue Metals (ASX: FMG)

- Fortescue share price rises 11% in two weeks, likely due to rising iron ore prices and strong demand expectations

- Plans to invest AU$1.14 billion in green hydrogen projects over the next three years

- Fortescue share price hits two-year high

Track your investment portfolio with Sharesight

Get access to Sharesight20 insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

- Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

- Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, exposure, multi-period, multi-currency valuation and future income

- Run tax reports including taxable income (dividends/distributions), Capital Gains Tax (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.