Top 20 ASX trades by Sharesight users – July 2022

Welcome to the July 2022 edition of Sharesight’s monthly ASX trading snapshot, where we look at the top 20 trades Sharesight users made on the ASX during the month.

In this snapshot, buy trades were overwhelmingly led by Vanguard’s Australian Shares Index ETF (ASX: VAS). In terms of individual equities, buy trades were led by BHP (ASX: BHP), which announced strong quarterly performance results. At the same time, sell trades were led by Woodside Energy (ASX: WDS), which saw its share price drop despite announcing significant increases in production and revenue compared to last quarter. Overall, this month’s top 20 ASX trades were dominated by blue chip stocks, particularly those in the mining and banking sectors.

Top 20 ASX trades July 2022

Let’s look at the news behind some of the key stocks in this month’s snapshot:

BHP (ASX: BHP)

-

BHP struggling with labour shortage due to lack of skilled migrant workers

-

Reports strong quarterly performance, but warns of volatile FY23

-

Leading broker sees upside for BHP share price following quarterly results

Woodside Energy (ASX: WDS)

-

Oil price slide causes slump in Woodside shares

-

Woodside share price drops despite strong Q2 revenue

-

Reveals AU$13 million investment in Indian bio-engineering company, String Bio

Fortescue Metals (ASX: FMG)

-

Fortescue ships record amount of iron ore; believes output could lift again this year

-

Share price rises following record iron ore exports

-

Challenges ahead as inflationary pressures grow

Rio Tinto (ASX: RIO)

-

Rio reports 29% drop in half-year earnings amid falling commodity prices

-

Slashes dividend by more than half

-

Rio signs breakthrough deal to resume work at world’s biggest undeveloped iron ore deposit

ANZ (ASX: ANZ)

-

ANZ announces AU$5 billion deal to acquire Suncorp

-

IT experts cite concerns over Suncorp integration

-

Raises AU$1.7 billion through institutional entitlement offer

Macquarie Group (ASX: MQG)

-

Macquarie reports strong quarterly earnings, but warns of ‘softening’ ahead

-

Share price on watch following Q1 earnings report

-

Plans to prioritise tech modernisation to achieve growth

Westpac (ASX: WBC)

-

Westpac plans to merge 100 branches over the next 18 months

-

Reveals new targets to cut carbon emissions

-

Plans to sell off investment platform for AU$1 billion

Whitehaven Coal (ASX: WHC)

-

Bushfire survivors launch legal action against Whitehaven’s Narrabri coal mine expansion

-

Whitehaven reports estimated total earnings of AU$3 billion for financial year

-

Share price grows amid strong energy sector and bullish broker notes

Track your investment portfolio with Sharesight

Get access to Sharesight20 insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

-

Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful reports built for investors, including Performance, Portfolio Diversity, Contribution Analysis and Future Income

-

Run tax reports including Taxable Income (dividends/distributions), Capital Gains Tax (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

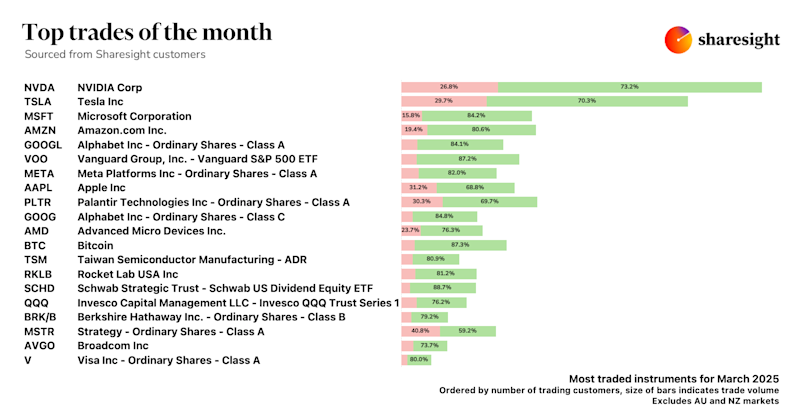

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.

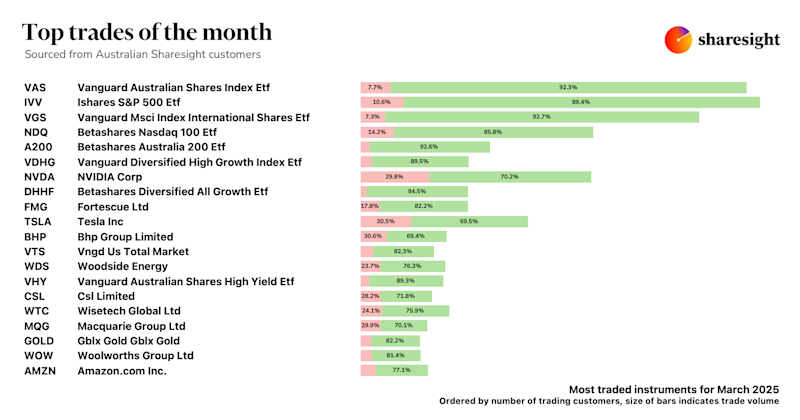

Top trades by Australian Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot for Australian investors, where we look at the top 20 trades by Australian Sharesight users.