Top 20 ASX trades by Sharesight users – January 2022

Welcome to the January 2022 edition of Sharesight’s monthly ASX trading snapshot, where we look at the top 20 trades Sharesight users made on the ASX during the month.

In this snapshot, buy trades were strongly led by Vanguard’s Australian Shares (ASX: VAS) and International Shares (ASX: VGS) ETFs. As for individual equities, buy and sell trades were led by Brainchip (ASX: BRN), which saw its share price skyrocket throughout January; followed by BHP (ASX: BHP), which announced its plan to unify its dual-listed company structure. Overall, January’s top trades were dominated by index-tracking ETFs, as well as stocks in the mining and technology sectors.

Top 20 ASX trades January 2022

Let’s look at the news behind some of the key stocks in this month’s snapshot:

Brainchip (ASX: BRN)

-

Brainchip reaches AU$3b market cap

-

Share price gains 100% in a month due to promising partnerships

-

Shares drop 6.5% as investors take profits

BHP (ASX: BHP)

-

Shareholders vote for BHP to abandon dual-listed structure and return to Australian market

-

Plans to invest AU$50m in Tanzania’s Kabanga Nickel project

-

BHP could target Nutrien takeover, says analyst

-

BHP warns of disruption risk for iron ore business if WA eases border restrictions

Fortescue Metals (ASX: FMG)

-

Fortescue acquires Williams Advanced Engineering for AU$310m

-

Iron ore exports better than ever but revenue hit by growing price penalties

-

Fortescue argues delay in easing WA border restrictions will worsen labour supply shortage

Westpac (ASX: WBC)

-

All eyes on Westpac share price after increase in loan interest rates

-

Westpac trading at 52-week low

-

Westpac share price underperformed compared to other big banks in 2021

Pilbara Minerals (ASX: PLS)

-

Lithium prices skyrocket, outstripping analysts’ expectations

-

Pilbara share price surges 35% in a month

-

Lithium demand could double, says leading broker

Novonix (ASX: NVX)

-

Share price drops despite Phillips 66 technology development deal

-

Share price drops 6% as Novonix announces plans to acquire share of Kore Power

-

Novonix shares surged 600% in 2021

Zip Co (ASX: Z1P)

-

Zip Co confirms plans to buy Sezzle

-

Share price down 25% YTD; trading at 52-week low

-

Brokers disappointed by Zip’s Q2 earnings report

CSL (ASX: CSL)

-

CSL faces gender discrimination lawsuit

-

Issues AU$6.3b placement to institutional investors; money to fund Vifor Pharma acquisition

-

Share price has dropped 13% since emergence of Omicron variant

Track your investment portfolio with Sharesight

Get access to Sharesight20 insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

-

Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful reports built for investors, including Performance, Portfolio Diversity, Contribution Analysis and Future Income

-

Run tax reports including Taxable Income (dividends/distributions), Capital Gains Tax (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

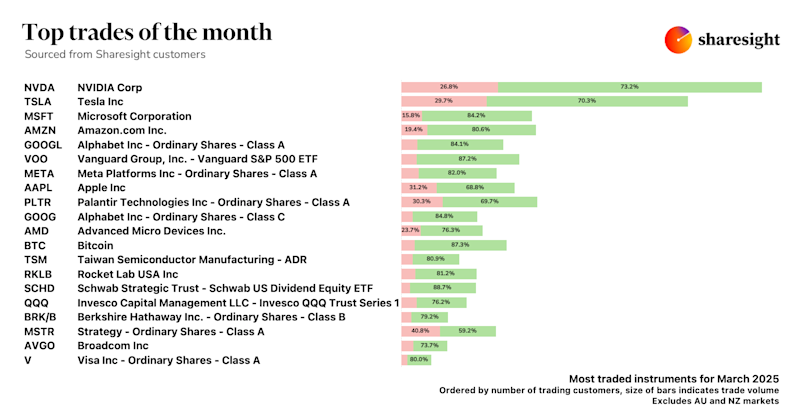

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.