Top 20 ASX trades by Sharesight users – January 2024

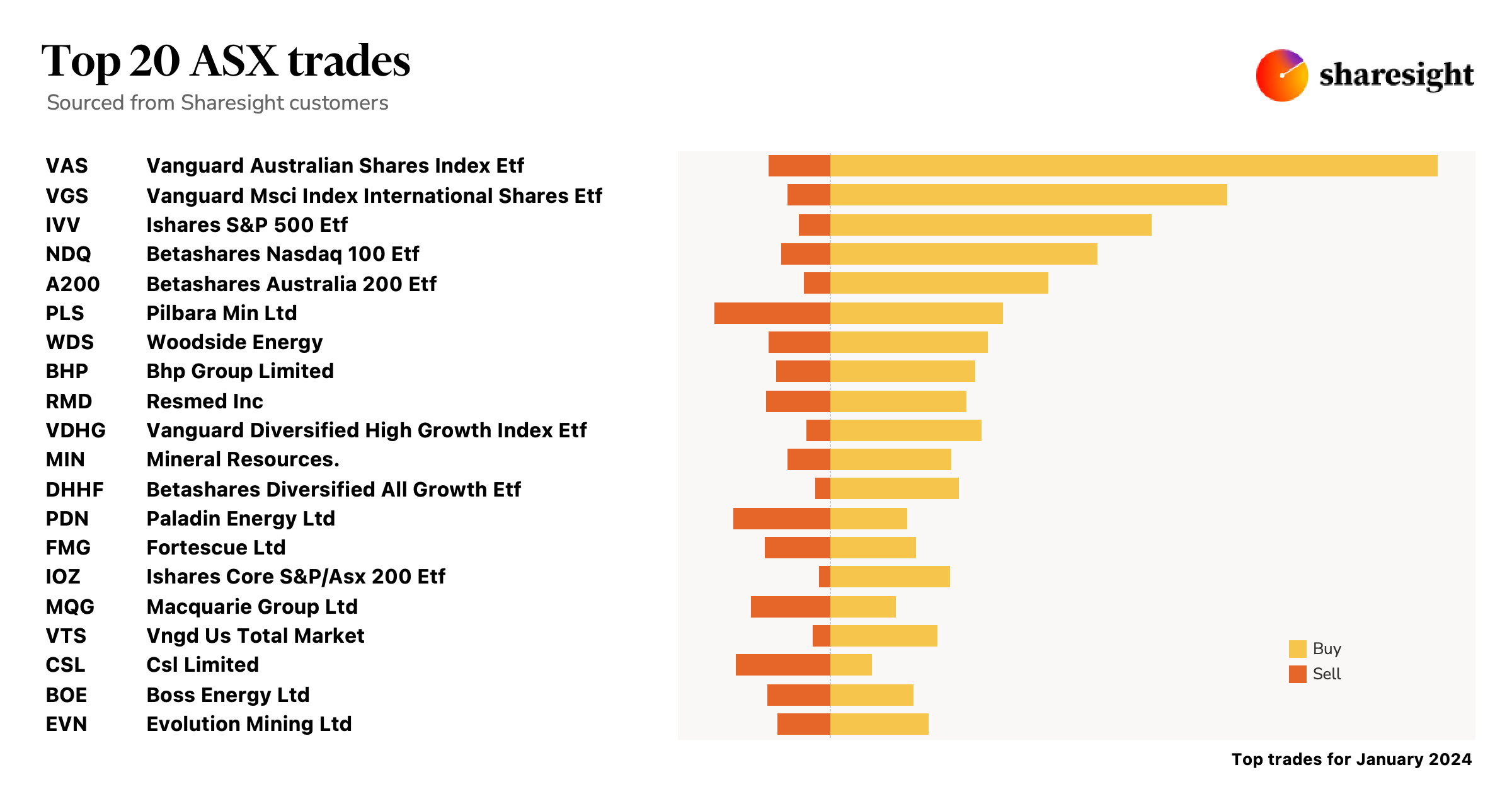

Welcome to the January 2024 edition of Sharesight’s monthly ASX trading snapshot, where we look at the top 20 trades Sharesight users made on the ASX during the month.

In this snapshot, trades were strongly led by Vanguard’s Australian Shares Index ETF (ASX: VAS). In terms of individual stocks, trades were led by Pilbara Minerals (ASX: PLS), which remains the most-shorted stock on the ASX. Trades were followed by Woodside Energy (ASX: WDS), which recently announced its commitment to supply gas to Australia’s east coast.

Top 20 ASX trades January 2024

Let’s look at the news behind some of the key stocks in this month’s snapshot:

Pilbara Minerals (ASX: PLS)

- Pilbara share price drops despite news of expanded offtake agreement with Ganfeng Lithium

- Pilbara remains the most-shorted ASX stock

- Goldman Sachs forecasts upward trend for lithium prices

Woodside Energy (ASX: WDS)

- Woodside and Exxon pledge to supply gas to east coast market amid shortfall fears

- Fortescue Metals founder decries Woodside’s decision to commence seismic testing of Scarborough gas project

- Plans to collaborate with South Korean utilities giant to explore potential offtake deals and investments in hydrogen and ammonia projects

BHP (ASX: BHP)

- BHP to suspend operations at WA nickel processing plant from June

- Announces new WA iron ore president

- BHP share price drops following lacklustre Q2 results

Paladin Energy (ASX: PDN)

- Paladin Energy shares skyrocket 10%, hitting decade high

- Shares rally on news that US govt. plans to build domestic uranium supply

- Paladin’s Langer Heinrich Mine to return to production in 2024

Fortescue Metals (ASX: FMG)

- Share price drops from record highs upon news of iron ore derailment

- Fortescue founder shuts WA nickel mines bought for AU$760 million just six months ago

- Fortescue share price rose 42% in 2023

Macquarie Group (ASX: MQG)

- Macquarie raises AU$8.72 billion for new European infrastructure fund

- Long-term equities chair steps down

- Macquarie to benefit from Blackrock’s acquisition of Global Infrastructure Partners

Boss Energy (ASX: BOE)

- Boss Energy reports high-grade uranium results at SA site

- Uranium price hits highest level since 2007, fuelling ASX nuclear rally

- Reports positive developments at proposed Alta Mesa project acquisition

Track your investment portfolio with Sharesight

Get access to Sharesight20 insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

- Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

- Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, exposure, multi-period, multi-currency valuation and future income

- Run tax reports including taxable income (dividends/distributions), Capital Gains Tax (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.