Top 20 ASX trades by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly ASX trading snapshot, where we look at the top 20 trades Sharesight users made on the ASX during the month.

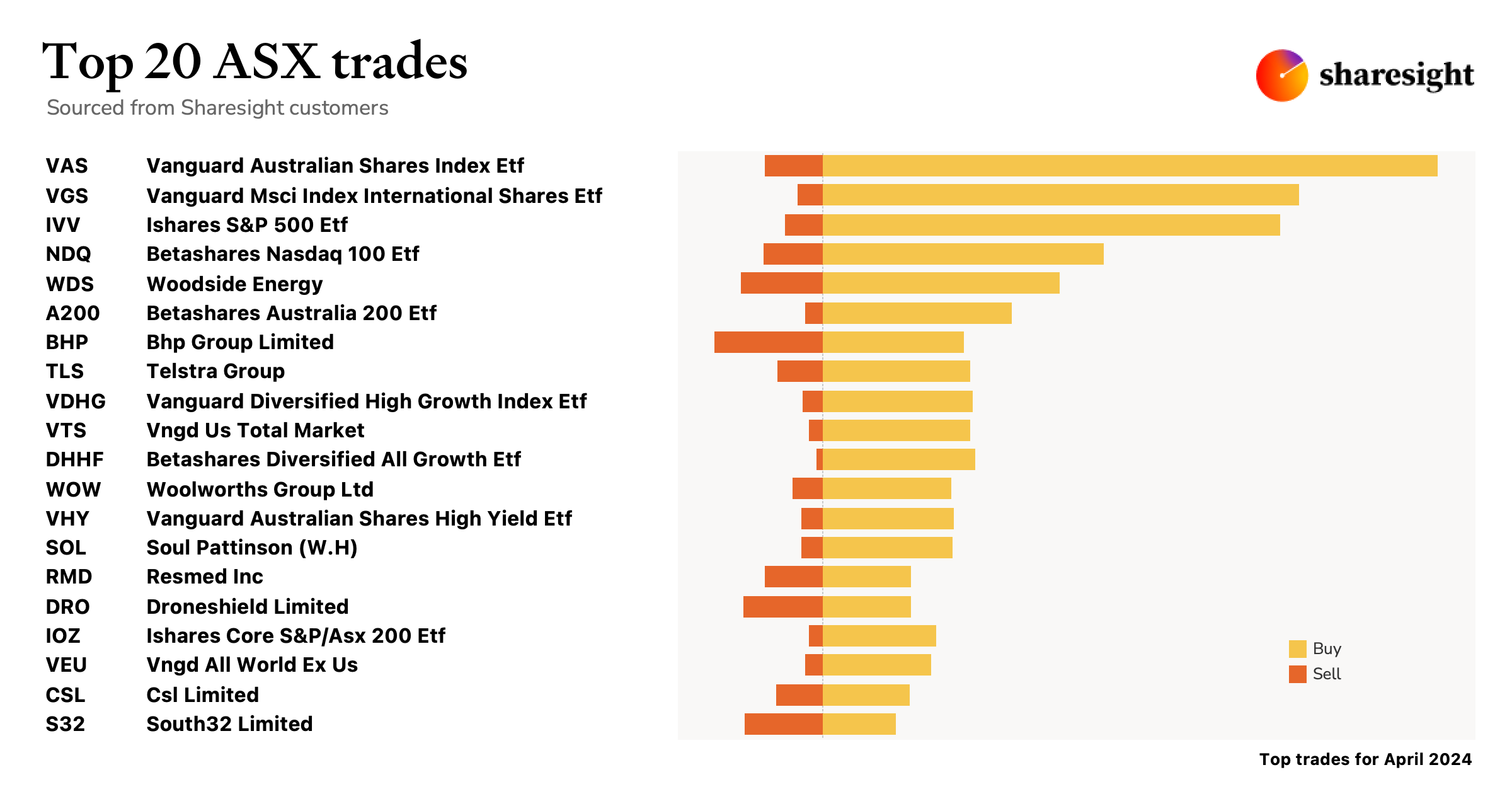

In this snapshot, buy trades were strongly led by Vanguard’s Australian Shares Index ETF (ASX: VAS). In terms of individual stocks, buy trades were led by Woodside Energy (ASX: WDS), which saw its share price drop after revealing a 12% decline in its quarterly profit. Over the same period, sell trades were led by BHP (ASX: BHP), which produced mixed financial results, including a loss in its nickel division.

Top 20 ASX trades April 2024

Let’s look at the news behind some of the key stocks in this month’s snapshot:

Woodside Energy (ASX: WDS)

- Majority shareholders lead protest vote against Woodside’s climate plans

- Woodside ditches plan to sell stakes in WA Macedon and Pyrenees oil and gas fields

- Woodside shares fall following 12% decline in quarterly profit

BHP (ASX: BHP)

- BHP and Mitsubishi complete AU$4.1 billion sale of Queensland coal mines

- BHP could become world’s largest copper producer with the help of AI

- Loss-making nickel division in focus in BHP’s latest financial results

Telstra (ASX: TLS)

- Telstra share price hits a new 52-week low as investors sell off shares amid high interest rates

- Telstra considers strategic review of its health division

- Thousands of customers have details leaked in file posted to hacking forum

Woolworths (ASX: WOW)

- Woolworths CEO threatened with six months jail time over contempt of Senate

- Woolworths, Coles and ALDI accused of misleading shoppers with confusing labels

- Partners with Tesco on AU$190 million venture capital fund

Resmed (ASX: RMD)

- Resmed share price dives on positive news about weight loss drug trials

- Leading broker dismisses idea that Resmed shares are at risk due to Ozempic

- Share price on watch ahead of Resmed’s latest quarterly earnings report

Droneshield Limited (ASX: DRO)

- Droneshield upsizes capital raise from AU$75 million to AU$100 million amid geopolitical tensions

- Signs first ever counter-drone procurement agreement with NATO

- Droneshield share price rises 16% on news of NATO deal

CSL (ASX: CSL)

- CSL share price falls despite FDA approval of kidney disease treatment

- CSL share price could almost double over the next three years, says analyst

- Could Telix pharmaceuticals become the next CSL?

Track your investment portfolio with Sharesight

Get access to Sharesight20 insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

- Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

- Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, exposure, multi-period, multi-currency valuation and future income

- Run tax reports including taxable income (dividends/distributions), Capital Gains Tax (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Top 50 finance and investing blogs in 2025

Check out this list created by the Sharesight team, covering the 50 best personal finance and investment blogs from around the world.

Why invest in listed investment companies?

Listed Investment Companies (LICs) offer access to professional fund management, franked income and long-term capital growth. Keep reading to learn more.

Sharesight vs. alternatives: Why investors choose our portfolio tracker

Compare Sharesight to alternative portfolio trackers and see why 500,000+ investors trust Sharesight for smarter portfolio management and tax reporting.