Time-Weighted vs Money-Weighted Rates of Return

We often get asked the difference between time-weighted versus money-weighted (or dollar-weighted) returns when calculating portfolio performance. So in this blog, we’re going to dive into the differences between the two, and why Sharesight uses the money-weighted method in calculating your portfolio performance.

First, let’s briefly define both before going into more detail:

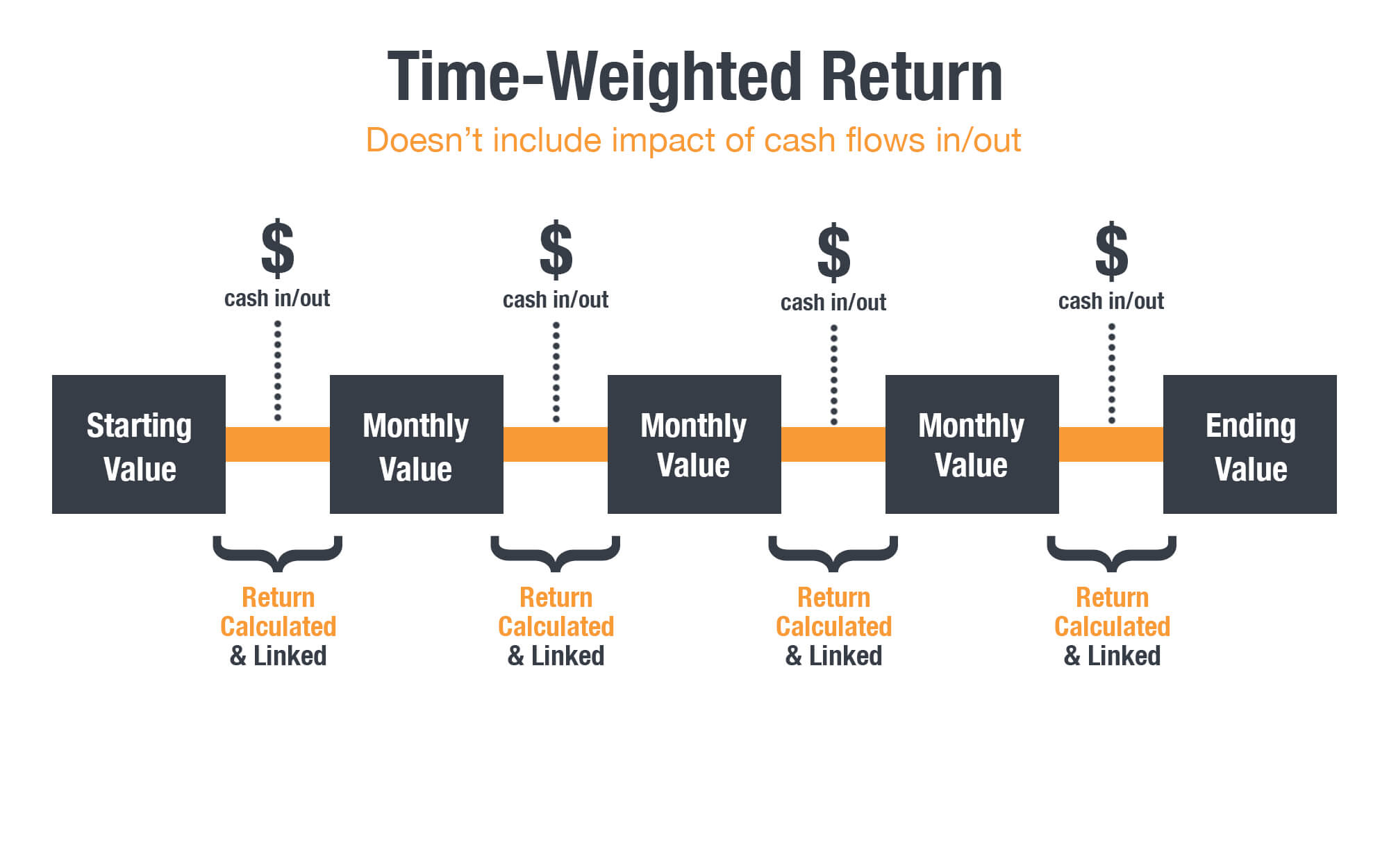

Time-Weighted: Time-weighted rates of return do not take into account the impact of cash flows into and out of the portfolio.

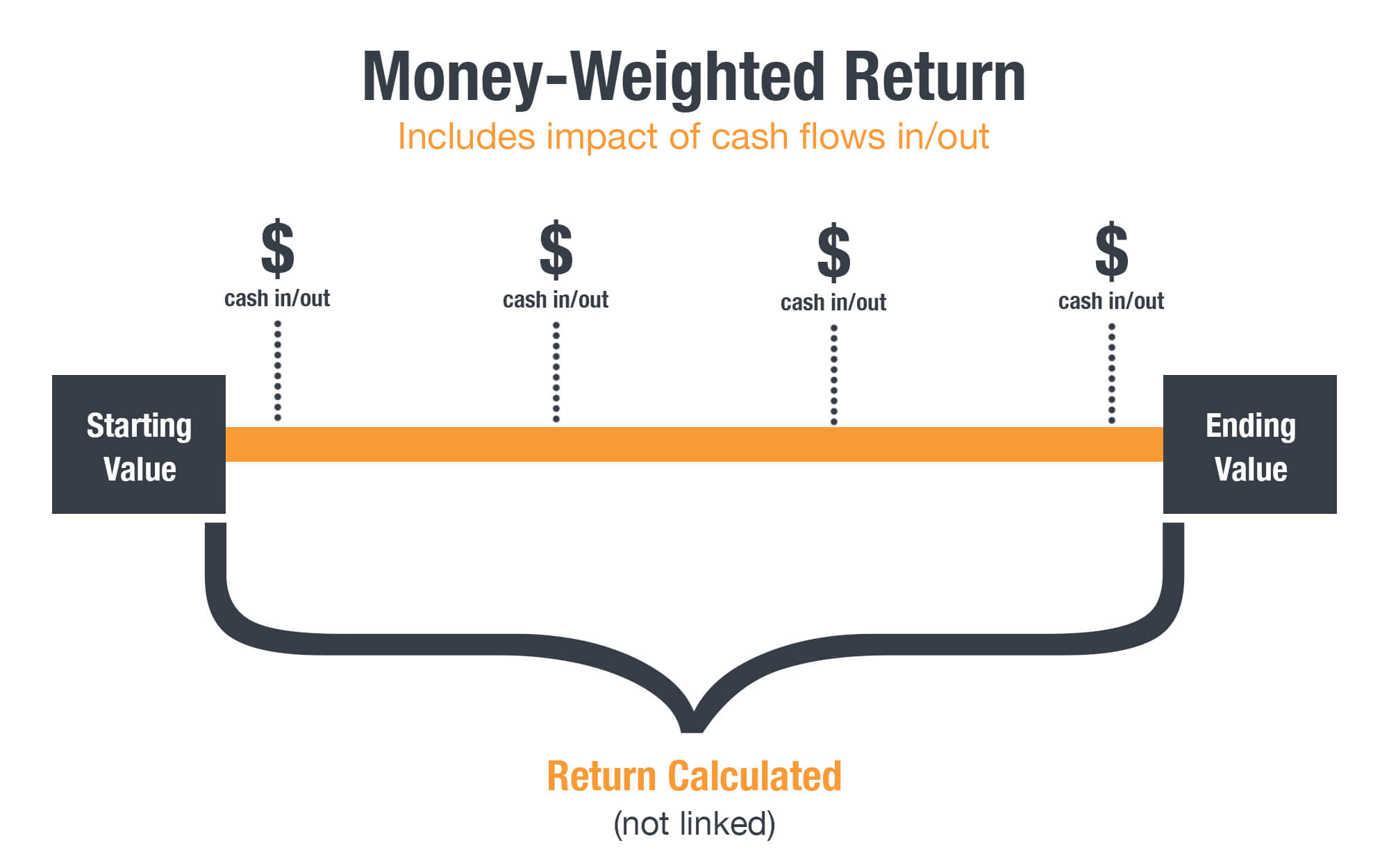

Money-Weighted: Money-weighted rates of return do take into account the impact of cash flows into and out of the portfolio.

Now let’s explore the reasons why these differences matter, the use cases for each, and why Sharesight uses one calculation but not the other when calculating the performance of your investment portfolio.

Time-weighted rates of return

Time-weighted rates of return attempt to remove the impact of cash flows when calculating the return. This makes it ideal for calculating the performance of broad market indices or the impact of a fund manager on the performance of an investment. Time-weighting is important in this context as fund managers do not control the timing of cash flows into and out of their fund – investors control that – so it is not reasonable to include that effect when evaluating the performance of the fund manager.

The definition for Time-weighted rate of return (from Investopedia)

"(Time-weighted rate of return) is defined as the compounded growth rate of $1 over the period being measured. The time-weighted formula is essentially a geometric mean of a number of holding-period returns that are linked together or compounded over time (thus, time-weighted)."

If your eyes glazed over while reading that definition, don’t worry. At its core a time-weighted rate of return breaks the portfolio performance across the time period being measured into smaller ‘sub-periods’ whenever there is an inflow or outflow for the portfolio. Then the performance of each sub-period is calculated, before being linked to find the ‘geometric mean’ performance across the entire period.

If cash flows into or out of the portfolio during a sub-period, the period is broken down into smaller periods at this point to calculate the performance for each intra-period before then being combined to calculate performance for the sub-period.

Money-weighted rates of return

Unlike a time-weighted methodology, which removes the impact of cash flows when calculating your rate of return, money-weighted rates of return calculate investment performance taking account both the size and timing of cash flows in and out of an investment portfolio, placing a greater weight on periods when the portfolio size is largest.

For the vast majority of investors a money-weighted rate of return is the most appropriate method of measuring the performance of your portfolio as you, the investor, control inflows and outflows of the investment portfolio.

Time vs Money-weighted – an example

To help explain the difference between time-weighted and money-weighted returns, let’s imagine an investor who made three trades in a particular stock over a period of two years. Let’s assume that:

- On December 1st 2015, the investor invested $1,000 to buy 1,000 units of StockABC at $1.00 per share

- On December 1st 2016, they bought another 1,000 units of StockABC at a price of $2.00 per share (spending $2,000)

- On December 1st 2017 the investor sold their entire holding of 2,000 StockABC shares after the price fell to $1.25

In this scenario the investor lost $500 in this portfolio over the two years.

Here’s how the return numbers for each of these performance methodologies differ in this instance:

- Money-weighted return: -12.77% p.a.

- Time-weighted (CAGR) return: 11.80% p.a.

Despite the investor losing money on the portfolio, the time-weighted return was positive. This is because the time-weighted return is only measuring the underlying performance of the shares held in the portfolio and not the actions of the investor buying into or out of those shares (inflows and outflows) or the impact of the size of those actions over the period being measured.

Why Sharesight uses a money-weighted rate of return methodology

At Sharesight we think the time-weighted rate of return methodology is both less useful and potentially misleading for individual investors, who do control when cash flows in and out of their portfolios. We believe a money-weighted performance methodology will help you best analyse the true performance of your investment portfolio and how your choices -- the inflows (buys) and outflows (sells) from your portfolio – have contributed to the returns you have achieved as an investor.

Notes:

What are considered inflows and outflows from a portfolio?

Outflows

- The price paid for any investment

- Reinvested dividends or interest (price paid for any DRP/DRIP purchases)

- Withdrawals (cash removed from the portfolio by the investor)

Inflows

- The proceeds from any investment sold (cash that remains in the portfolio from any shares sold)

- Dividends or interest received (cash earned from investments)

- Contributions (cash injected into the portfolio by an investor)

Note also: If there are no cash flows in or out of the portfolio during the period being measured, both money-weighted and time-weighted rates of return will be the same.

Start tracking your returns with Sharesight

Join thousands of global investors already using Sharesight to manage their investment portfolios. With Sharesight you can:

-

Track all of your investments in one place, including stocks, ETFs, mutual/managed funds, property and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

-

Run powerful reports built for investors, including Performance, Portfolio Diversity, Contribution Analysis, Future Income and Multi-Currency Valuation

-

See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

Further reading

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.