The top 20 trades made by SMSFs in September 2020

Disclaimer: This article is for informational purposes only and does not constitute a product recommendation, or taxation or financial advice and should not be relied upon as such. Please consult with your financial adviser or accountant to obtain the correct advice for your situation.

Each month, Sharesight highlights the top 20 stocks traded by its users in a range of global markets, and the market-moving news behind them. This article details the top 20 buy and sell trades made by SMSFs in September 2020. To find out the news behind these stocks, keep reading.

The top trades by SMSFs in September

CSL (ASX: CSL) secured two new deals this month to manufacture vaccines for Covid-19, with the potential to manufacture into 2022. While analysts agree that there is positive market sentiment around this news, they have also raised concerns about CSL’s declining plasma donations, which are a key part of the company’s core business operations.

Sydney Airport (ASX: SYD) was the most-bought stock by SMSFs in September. The company has seen a massive drop in its revenue since the beginning of the Covid-19 pandemic, and this has been reflected in its share price. The airport reported a 35% revenue decrease in its HY20 report, while also announcing a $2 billion capital raise. Analysts are split on this stock, which was performing well before the pandemic, but currently has a high debt-to-equity ratio and an uncertain economic recovery ahead.

Woodside Petroleum (ASX: WPL) has done well throughout FY20, leading output growth in the Australian oil industry. However, Woodside’s share prices have recently declined due to a drop in oil prices. This could threaten Woodside’s ability to secure long-term contracts for investments in offshore gas fields, and has already caused delays in the company’s plan to develop a second LNG train at Pluto in Western Australia.

Afterpay (ASX: APT) was the most-sold stock by SMSFs in September. The company had an eventful month, announcing the resignation of CFO Luke Bartoli and the appointment of Rebecca Lowde in his place. Afterpay also suffered a decline in its share prices following news that Paypal is launching its own BNPL service, Pay-in-4.

Telstra (ASX: TLS) has seen a massive decline in its share price over the past few months, recently hitting a 52-week low following weak FY21 guidance. However, things are looking up for Telstra, with the telco launching its 5G home internet plans and entering into a partnership with Microsoft to develop products using 5G, cloud computing and artificial intelligence.

Commonwealth Bank (ASX: CBA) made an attempt to hit back at the BNPL market this past month, announcing its intention to launch a no-interest credit card. At the same time, CBA is facing fresh money laundering allegations following a leak of secret bank reports connecting CBA to millions of dollars worth of transactions traced to suspicious activity.

The a2 Milk Company (ASX: A2M) saw a significant drop in its share price following the release of its updated FY21 outlook, which revealed the impact of Covid-19 on daigou sales of the company’s products. There are also questions over the longevity of a2’s relationship with China in general, considering the recent strain in Australia-China relations.

Zip Co (ASX: Z1P) has seen its share price plummet from its all-time high in August, with investors concerned over Paypal’s announcement of Pay-in-4, as well as the announcement of no-interest credit cards from CBA and NAB. September also saw the appointment of a new director who is expected to lead the company’s global expansion.

Keep track of your SMSF with Sharesight

Join over 150,000 investors tracking their investment performance (and tax) with Sharesight.

Built for the needs of SMSF trustees, with Sharesight you can:

-

Organise holdings according to your documented SMSF asset allocation and investment strategy, providing valuable insights throughout the year

-

Easily share SMSF portfolios with accountants or financial professionals to make admin and tax compliance a breeze

-

Track SMSF investment performance with prices, dividends and currency fluctuations updated automatically

-

Run powerful tax reports built for Australian investors, including capital gains tax, unrealised capital gains, and taxable income (dividend income)

Sign up for a free Sharesight account and get started tracking your SMSF investments today.

FURTHER READING

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

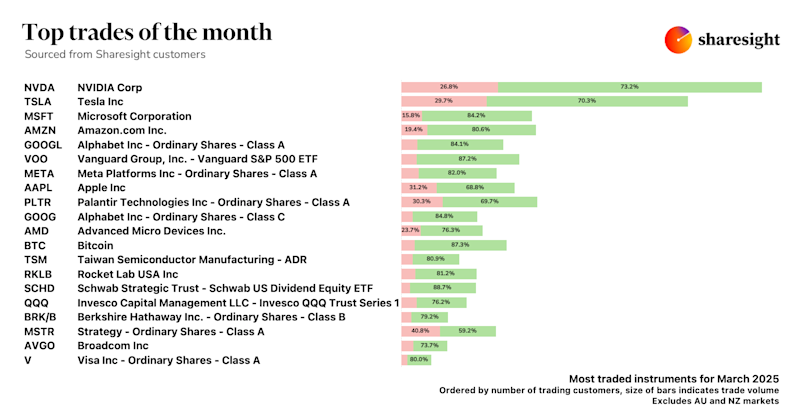

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.