Should I sell my shares?

There are good reasons for some overseas Banks and others to sell out of the share market at present. It’s not because they fear a US recession – they need the money! But that is no reason for private investors to follow suit.

I have had a number of friends ask me recently whether they should bail out of their NZ and Australian shares. Today I received an email that said “Gawd, what do you think of the share market?”

My response is that I think the same about the share market as I always have. It goes up and down – sometimes fast! I don’t really care because I know big falls will occur from time to time and that growth the rest of the time will more than offset them.

I’m in there for the long haul. There are two reasons for this. Firstly, history shows that in the long run, shares give the best returns. Secondly, trying to make money on a consistent basis by buying low and selling high is a recipe for disaster for all but a few skilled (lucky?) operators.

For we lesser mortals this is what usually happens if we don’t take a long term perspective: The market falls, we panic and bail out, usually after most of the damage has been done. The market rises, and we are not there to reap the benefit. Nice one!

The trick is not to invest money in the share market that you know you will need for another purpose at a specific future date. If that date coincides with a sharp drop in the market you will be in trouble.

Many people have only a hazy idea of the return on their shares and this leaves them vulnerable to being panicked by media hype about falls in the market. You need to factor in the impact of dividends and calculate the result on an annualised basis. If this sounds daunting help is at hand. It is easily done in Sharesight and you will get a wealth of other useful information as well.

If you don’t already have a Sharesight account, sign up today, or check out our video to find out more.

This information is not a recommendation nor a statement of opinion. You should consult an independent financial adviser before making any decisions with respect to your shares in relation to the information that is presented in this article.

My investment portfolio used to be gold bangles

For International Women’s Day, Morningstar's Shani Jayamanne explores the ways that women have taken back financial control.

Simplify property tax & investment tracking with TaxTank + Sharesight

Simplify property tax management with the Sharesight + TaxTank integration—track CGT, investment income, and tax data in one seamless, automated platform.

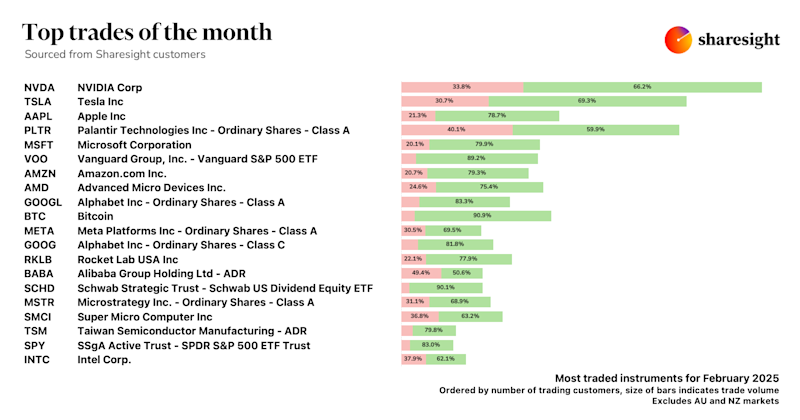

Top trades by global Sharesight users — February 2025

Welcome to the February 2025 edition of Sharesight’s trading snapshot for global investors, where we reveal the top 20 trades by Sharesight users worldwide.