Portfolio sharing between generations

The decision to take control of your own share investments and run your portfolio yourself is one that, with the right management tools and information at hand, has many advantages – something we’ve discussed in numerous other blogs.

What we’d like to focus on here is an uncomfortable issue that many of us like to skirt around – often until it’s too late. And that is, what happens to a share portfolio when its owner passes away. The simple fact is that older people are more likely to own shares, and in most cases will pass them, along with their other assets, on to family members after their death.

However, unlike other more tangible assets, such as property, unless the portfolio is in order and records meticulously kept, even the most generous and well-meaning bequest can result in beneficiaries and executors spending an enormous amount of time, effort and yes, money, trying to unravel the portfolio.

That includes determining exactly what the holdings are in the first place, assessing the taxation status relating to dividends and, in Australia, capital gains. And that’s even before any decisions about what to do with the portfolio itself -- whether to break it up, sell part or all of it and so forth, are made.

We’ve all heard stories about beneficiaries and executors spending months or even longer digging through piles of paperwork kept in shoe boxes and following elusive paper trails in the hope of getting a clear picture of a parent or relative’s true financial situation.

Of course, that’s not the case for all investors. Many take a different path, because they want to avoid passing on that kind of impost on to their families. Concerned about how their hard earned and often closely studied portfolios will be understood and managed after their death, in their later years one popular option for these investors is to simply cash out of their portfolios.

The fact that they are often forced to do so at a time that’s not of their choosing and may as a consequence erode the potential future value of their shares is a trade-off that many will make in the interests of clarity for their estate.

However, we would like to alert share investors to a clearer, easier and potentially more profitable path. Whether you’re the DIY investor considering estate planning or the relative and beneficiary of the investor, using Sharesight to manage the portfolio in question offers a clear, simple solution.

Sharesight provides a comprehensive list of all holdings in the portfolio and detailed, up-to-the-minute records relating to all the activity within it for taxation purposes. Further, it also gives the performance information needed to help both the investor and beneficiaries make informed decisions about whether, when and what elements of the portfolio should be sold.

Another key benefit Sharesight offers for investors in this situation is its portfolio sharing feature. This enables the investor to allow others log-in privileges, so they can either view the portfolio, via ‘read-only’ access or, actually participate in its management, via ‘full access’ functionality.

Imagine both of you being able to chat on the phone about the portfolio with the screens open in front of you. It’s an ideal way to help a relative or executor become familiar with the portfolio and its performance before it becomes an estate matter, and an easy way to open up what can be a difficult or uncomfortable dialogue.

The portfolio sharing feature can also help DIY investors retain control and visibility of their portfolios if they become ill or infirm. A trusted relative or associate, such as an adviser, can continue to manage the portfolio in the manner that’s been agreed, leaving the investor with peace of mind about his or her share investments and the ability to access them at will.

So if you’re a DIY investor thinking about your family’s future, or someone who’s concerned about managing the affairs of your parents or other relatives after they pass away, now’s the time to start talking – and to look to Sharesight for the help you need.

FURTHER READING

My investment portfolio used to be gold bangles

For International Women’s Day, Morningstar's Shani Jayamanne explores the ways that women have taken back financial control.

Simplify property tax & investment tracking with TaxTank + Sharesight

Simplify property tax management with the Sharesight + TaxTank integration—track CGT, investment income, and tax data in one seamless, automated platform.

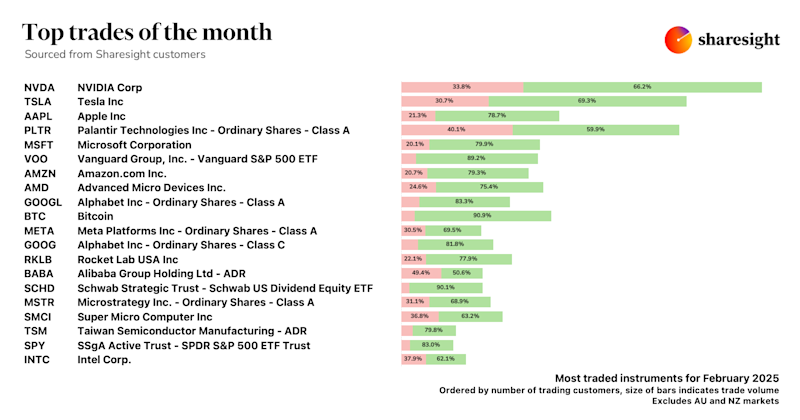

Top trades by global Sharesight users — February 2025

Welcome to the February 2025 edition of Sharesight’s trading snapshot for global investors, where we reveal the top 20 trades by Sharesight users worldwide.