Sharesight users' top 20 trades in US stocks for 2023

Each year, Sharesight looks back at the top 20 buy and sell trades made by Sharesight users throughout the year. Welcome to the 2023 edition of our annual trading snapshot, where we explore the top trades users have made in stocks on the Nasdaq, NYSE and AMEX this year, plus the market-moving news behind some of these stocks.

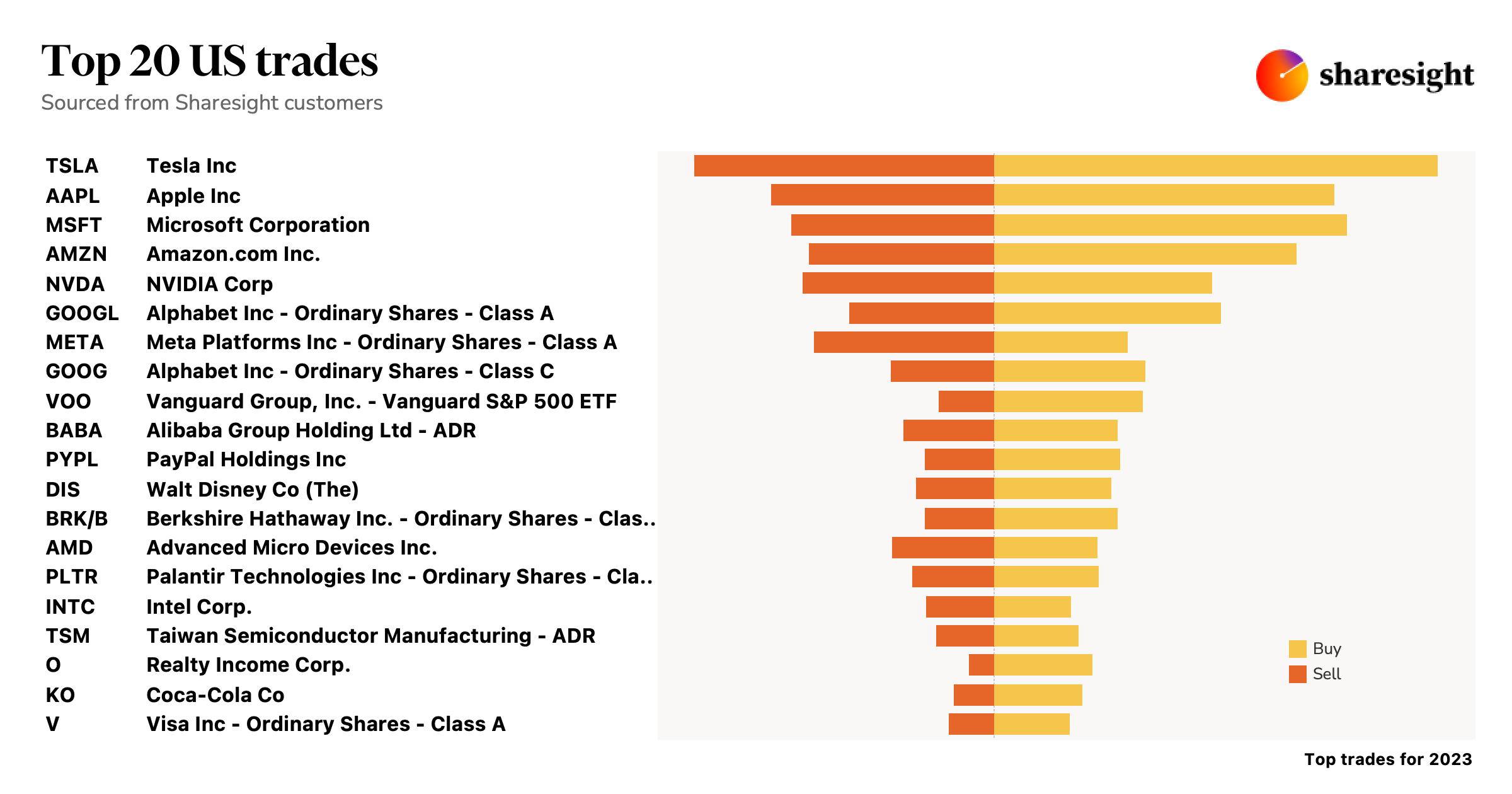

Top 20 US stocks traded in 2023

In this annual snapshot, trades were heavily concentrated on the Nasdaq, with the majority of FAANG stocks making the top 20 trades.

The top trades were led by Tesla (NASDAQ: TSLA), which saw its share price skyrocket in Q2, remaining relatively stable throughout the rest of 2023 and ending the year up almost 129% (as at the time of publishing). Trades were followed by Apple (NASDAQ: AAPL), which saw a steep incline in its share price from Q1 to Q3, with fluctuation throughout Q4, ending the year up almost 56%.

Overall, tech stocks remained popular with Sharesight users in 2023, with little change compared to the top US stocks from 2022. However, it should be noted that 2023 marked an increase in trades outside the tech sector, with new entrants to the top 20 including food and beverage company Coca-Cola (NYSE: KO) and real estate investment trust Realty Income (NYSE: O).

Let’s look at the news behind some of the key stocks in this year’s snapshot:

Tesla (NASDAQ: TSLA)

- January: Tesla’s Q4 net income grows by 59%; slower growth expected in 2023

- February: Share price drops as Chinese vehicle registrations fall for second consecutive week

- March: Tesla ranks as fastest-growing automaker in terms of market share

- April: Tesla share price drops almost 10% due to YoY earnings decline

- May: Elon Musk says Tesla not immune to tough economy; plans to advertise for the first time

- July: Tesla stock dives 10% following latest earnings results

- August: Tesla co-founder’s Redwood Materials raises over US$1 billion to fund EV battery materials business

- September: Tesla delivery and production falls short of expectations

- October: Q3 earnings plummet due to price cuts

- November: EV car registrations surpass diesel for first time in Europe

- December: Tesla vehicle registrations surge almost 19% in China

Apple (NASDAQ: AAPL)

- January: Production problems continue to put downward pressure on Apple stock

- February: Apple sees biggest decline in sales since 2019

- March: Apple launches BNPL service in the US

- May: Sales down but iPhone demand persists

- July: Apple’s market value exceeds US$3 trillion for first time since Jan 2022

- August: Revenue declines for third consecutive quarter

- September: Apple’s revenue from products made in China could drop to less than a third in next five years

- October: Achieves record sales of almost US$6 billion in India

- November: Apple share price up 45% since beginning of 2023

- December: China expands iPhone crackdown

Microsoft (NASDAQ: MSFT)

- January: Microsoft produces solid quarterly earnings results

- February: Share price down following AI-powered search chaos

- April: Microsoft beats analysts’ expectations in latest earnings report, driving up share prices

- July: Microsoft shares drop despite strong earnings results

- August: Bing AI fails to gain search market share

- September: Microsoft CEO says its Co-Pilot AI Assistant will be ‘as significant as the PC’

- October: Microsoft stock jumps after Q1 earnings beat analysts’ expectations

- November: Microsoft share price reaches all-time high after hiring Sam Altman

- December: Analyst dubs Microsoft ‘Top large-cap pick for 2024’

Amazon (NASDAQ: AMZN)

- January: Amazon to lay off another 18,000 employees

- February: Posts weak earnings fuelled by advertising slowdown

- March: Amazon stock struggling amid workforce restructure

- April: Beats analysts’ expectations in latest earnings report, driving up share prices

- May: Amazon cited as top stock amid rising AI demand

- July: More Amazon job cuts announced

- August: Share price rises 10% after beating analysts’ expectations in quarterly earnings report

- September: Plans to invest US$4 billion in OpenAI competitor Anthropic

- October: Amazon almost triples YoY profit, according to Q3 earnings report

- November: Amazon cuts hundreds of jobs from Alexa unit

- December: Share price hits a new 52-week high

NVIDIA (NASDAQ: NVDA)

- February: NVIDIA beats earnings expectations; share price jumps

- April: NVIDIA shares jump as Microsoft announces increased spending on AI infrastructure

- May: Shares rise 20% on record data centre revenue

- August: NVIDIA far exceeds analysts’ expectations in Q2 earnings report

- October: Shares fall following announcement of US restrictions on AI chip exports

- November: NVIDIA triples quarterly revenue, however China sales are a concern

- December: US in talks with NVIDIA about permissible sales of chips to China

Alphabet (NASDAQ: GOOGL)

- April: Alphabet beats expectations in Q1 earnings report

- July: Share price rises as Q2 profits exceed expectations

- October: Alphabet’s cloud division misses revenue estimates while Microsoft cloud booms

- December: Alphabet to pay US$700 million over Google Play feud

Meta (NASDAQ: FB)

- January: Meta fined €390 million for breaking EU data rules

- February: Share price soars as Meta beats earnings estimates

- March: Plans to lay off 10,000 employees

- April: Meta stock soars as company reports first revenue growth in almost a year

- May: Meta charged record US$1.3 billion fine due to data privacy breaches

- July: Share price soars 9% as Q2 earnings beat estimates

- November: Meta’s Q3 revenue skyrockets 23%, profit more than doubles to US$11.6 billion

- December: Hits 52-week high; on track for best year ever

Alibaba (NYSE: BABA)

- January: Ant Group founder Jack Ma to relinquish control of company

- March: Alibaba plans to split into six units, triggering mass layoff fears

- April: Alibaba migrates shares to Hong Kong

- July: Shares rise after Chinese regulators fine Ant Group; investors hope it marks end of regulatory uncertainty

- September: Alibaba shares drop as outgoing CEO quits cloud business

- November: Jack Ma calls for ‘change and reform’ at Alibaba as rivals gain ground

- December: PDD Holdings overtakes Alibaba as China’s most valuable e-commerce company

Track your investment portfolio with Sharesight

Get access to Sharesight20 insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

- Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

- Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis and future income

- Run tax reports including taxable income (dividends/distributions), capital gains tax (Australia and Canada), traders tax (capital gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.