Sharesight users' top 20 trades in LSE stocks for 2023

Each year, we look back at the top 20 buy and sell trades made by Sharesight users throughout the year. Welcome to the 2023 edition of our annual trading snapshot, where we explore the top trades users made in stocks on the London Stock Exchange (LSE), plus the market-moving news behind some of these stocks.

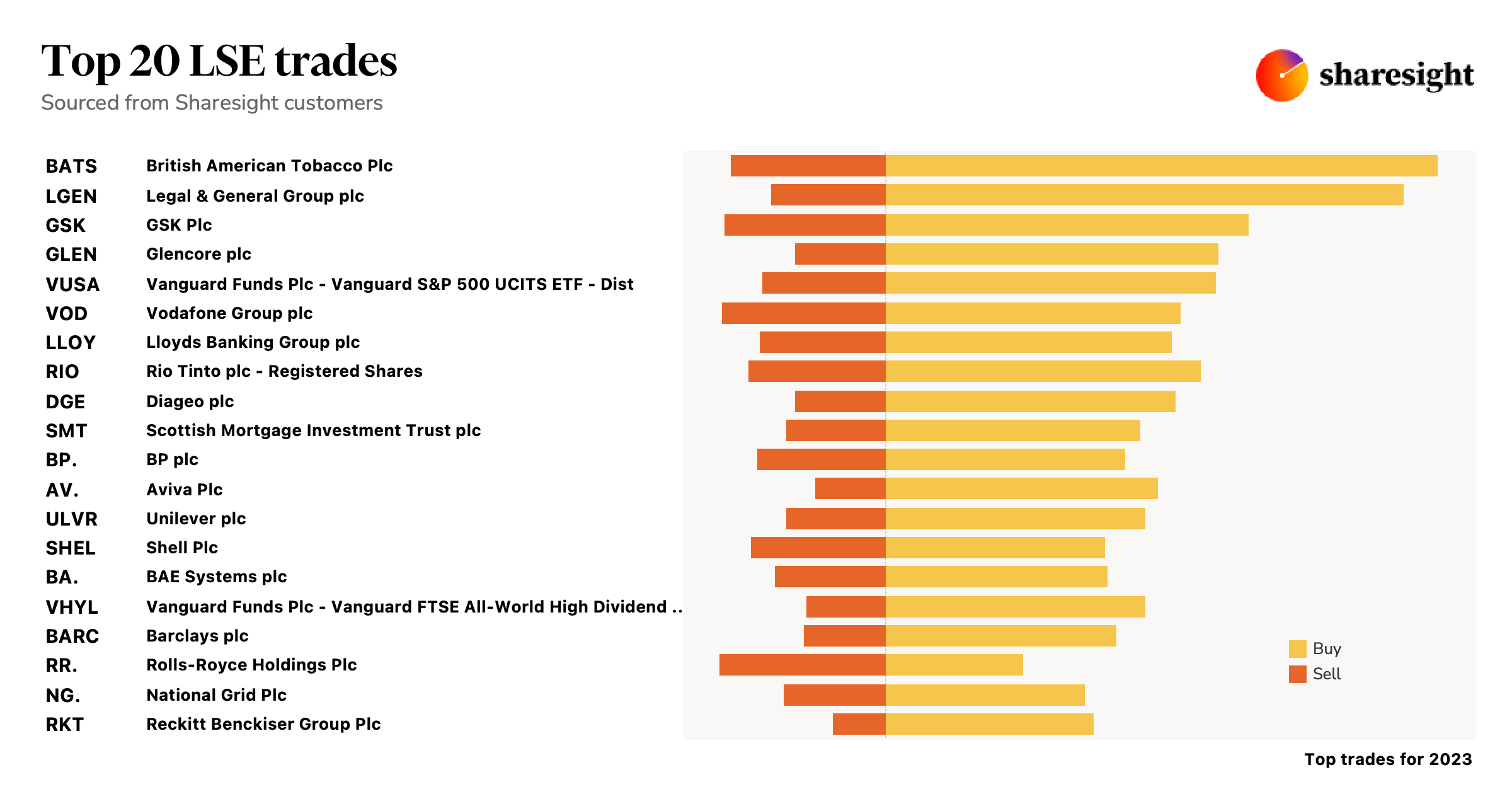

Top 20 LSE stocks traded in 2023

In this yearly snapshot, trades were led by British American Tobacco (LSE: BATS), which saw its share price decrease steadily over 2023, ending the year down more than 31% (as at the time of publishing). Trades were followed by Legal & General (LSE: LGEN), which saw its share price peak in Q1, followed by a period of decline until its rebound in Q4, where it ended the year down just over 1%. It was a varied year overall, with the top trades spanning sectors including consumer goods, financial services, pharmaceuticals, natural resources, telecommunications and more.

British American Tobacco (LSE: BATS)

- April: British American Tobacco to pay £512 million for breaching North Korean sanctions

- June: British American Tobacco shuffles board in aim to transition towards vapes and further US growth

- November: Calls for greater regulation on vapes

- December: Dutch court orders British American Tobacco to pay €107 million for tax evasion

Legal & General (LSE: LGEN)

- May: L&G halts new production at modular home factory near Leeds

- June: L&G appoints new CEO

- August: Records 10% drop in assets under management as interest rates bite

- December: L&G considering US-style bonuses for UK asset managers

GSK (LSE: GSK)

- May: FDA approves GSK’s world-first RSV vaccine for older adults

- June: FDA delays approval decision on GSK’s US$1.9 billion blood cancer medication

- November: GSK plots comeback after pulling multiple myeloma drug Blenrep from US markets

- December: GSK signs US$1.7 billion deal with China’s Hansoh Pharma

Glencore (LSE: GLEN)

- May: Glencore plans to build Europe’s largest battery recycling plant in Italy

- July: Glencore reports mixed performance across metals and commodities in first-half earnings report

- September: Glencore found to have traded thousands of tonnes of Russian copper via Turkey

- November: UK investment bank downgrades Glencore rating due to low free cash flow yield

Vodafone (LSE: VOD)

- January: Vodafone reportedly planning several hundred layoffs in the UK

- May: New Vodafone CEO announces plan to cut 11,000 jobs in move to “simplify” business

- June: Vodafone and Hutchison to join forces in £15 billion merger

- December: Vodafone-Hutchinson merger still awaiting formal approval but expected to go ahead

Lloyd’s Banking Group (LSE: LLOY)

- February: Shareholders decry proposed £9.1 million CEO payout; £446 million staff bonus pot

- May: Lloyds share fall despite strong earnings results

- July: Lloyds reports weak half-year profit

- November: Over 2,500 Lloyds jobs at risk in response to cost cuts

Rio Tinto (LSE: RIO)

- February: Rio’s net cash is 36% lower compared to 2021

- June: Rio to invest US$1.1 billion in expansion of Quebec aluminium smelter

- October: Leading broker revokes Rio sell rating as iron ore outlook improves

- December: Guinea Simandou iron ore project to cost US$6.2 billion, says Rio

Track your investment portfolio with Sharesight

Get access to Sharesight20 insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

- Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

- Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis and future income

- Run tax reports including taxable income (dividends/distributions), capital gains tax (Australia and Canada), traders tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

8 ways to use Sharesight's custom groups feature

This blog explains our custom groups feature, including strategies that can help you gain deeper portfolio insights and make more informed investing decisions.

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.