How Mathilde takes control of her investments using Sharesight

Part of our Sharesight customer experience series, this blog features Mathilde K., an investor who has been tracking her portfolio with Sharesight since 2019. We talk to Mathilde about her experience as an investor, and why she likes using Sharesight to manage her investment portfolio.

When did you start investing and what made you decide to invest?

I started being an investor when I was five years old. My dad bought shares in the Massachusetts Investment Trust for all of his children and we had to sign forms in our best handwriting. I really didn’t get back into it until about 1990 when my late husband and I started our self managed super fund. It seemed to be a much better option than just turning our super money over to someone else to invest on our behalf. We understood we really didn’t know enough but we had a great investment manager who guided us and was as conservative as we were.

What kind of assets do you invest in? Do you invest globally or do you tend to stay within your home country?

I hold mainly Australian shares with some international investments in funds. I do not hold international shares outside of funds. I’m just not good enough nor do I want to spend heaps of time monitoring what my investments are doing. I like good solid boring earners who don’t need me worrying about their ups and downs. They all trend up in my portfolio over time.

How did you learn about investing?

Very cautiously. A friend who was a stock broker made suggestions, one of which was to subscribe to Your Money Weekly where we found a kindred spirit in Ian Huntley. I would read what was said about the world, economics everywhere, reviews of particular shares. I used the model portfolio as a guide for suggestions for buying and selling although I didn’t necessarily follow this advice.

Honestly, I still consider the training I got there was without parallel. It suited a novice investor because the writing was clear, the explanations simple and easy to understand. I still subscribe to Morningstar Premium and I probably understand some of what goes on in the investing world now but as my super fund is in the pension phase, I’m just keeping it simple.

Can you share one thing you wish you'd known when you started investing?

I have become a contrarian over time. It's not something I knowingly chose – it just suits my personality. I hear people moaning about a falling market and remember that, if you have been careful and prudent in your stock choices from the beginning, you rarely have any regrets.

I have a couple of things I call cuties that I just think have potential and kept the amount invested in them reasonably small and one or the other of them are the cause of Sharesight notifications to me that they have risen or fallen drastically. I just read the emails and ignore them as I still think they have potential so we will see. Resmed and CSL were two in this category in the past and I’ve never regretted having them in my portfolio. My advice – think twice before you sell the quality share in your portfolio regardless of the market.

Why Mathilde uses Sharesight to manage her investments

When Mathilde and her husband launched their veterinary business and started managing their own money, they looked for a tool that would also allow them to take better control of their financial investments.

For Mathilde, Shareight does everything she needs to manage her portfolios and it does it automatically. All she needs to do is approve the dividends as they come through and check on reporting insights to see how things are tracking.

Mathilde finds Sharesight easy to use, and recommends Sharesight for anyone who is looking to keep track of what they’re doing with their investments – from new investors to day-traders.

Watch the video to discover Mathilde’s investing journey with Sharesight.

Take control of your investment portfolio with Sharesight

If you’re not already using Sharesight, what are you waiting for? Join hundreds of thousands of investors using Sharesight to take control of their portfolio and track the performance of all their investments. Sign up today so you can:

-

Track all your investments in one place, including stocks in over 60 major global markets, mutual/managed funds, property, and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

-

Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period, multi-currency valuation, exposure and future income (upcoming dividends)

-

Easily share access to your portfolio with family members, your accountant or other financial professionals so they can see the same picture of your investments as you do

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

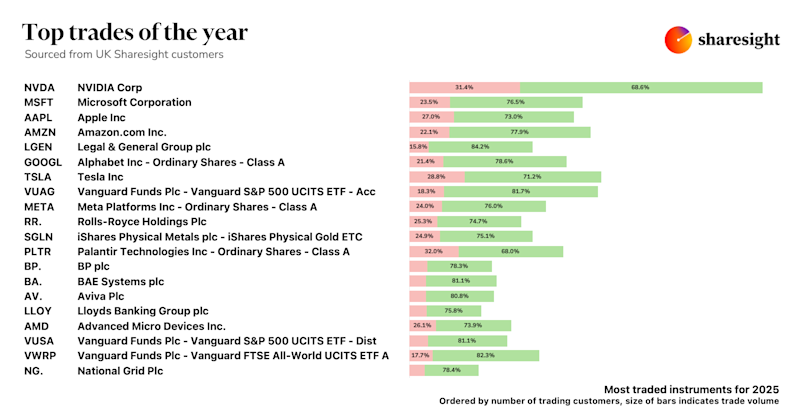

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

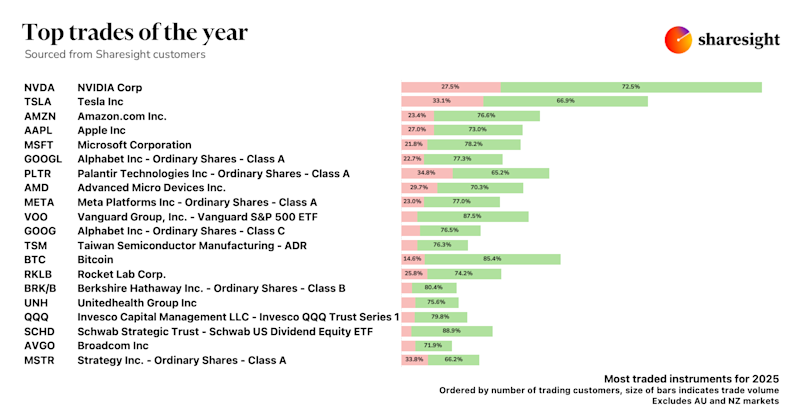

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.