Sharesight release notes - October 2019

As always, October was a busy month for the product team with a lot going on behind the scenes. This included switching to a new continuous integration solution to speed up our build times, and undergoing a full independent security audit. Here’s the release highlights for October:

New Functionality / Enhancements

-

Added ‘Return of Capital’ transaction type for fixed interest investments to support bonds and notes with an amortising principal.

-

Ongoing improvements to the trade import UI for our Saxo integration. This will eventually be rolled out to all brokers and file imports.

-

Improved Xero sync for AU trust distributions to ensure correct tax year alignment

Sharesight Usability

-

Update broker import tiles with improved datepicker.

-

Updated price chart symbols to indicate dividend currency.

-

Improved open & closed positions toggle.

Broker Transaction Import

- Added support for TD Investing (Canada) Trade Confirmation Emails.

FURTHER READING

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

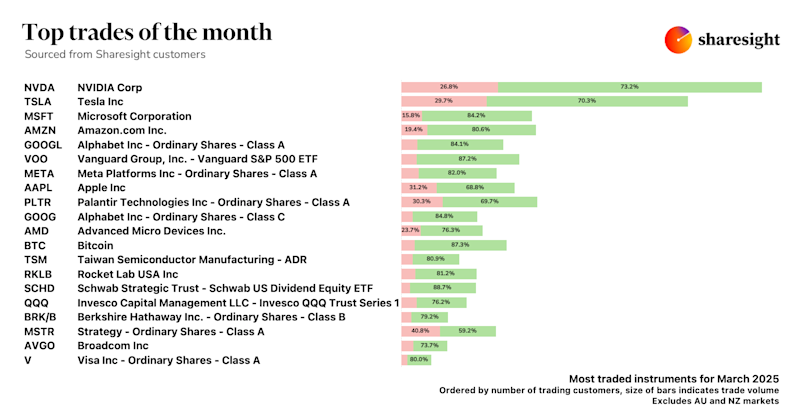

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.